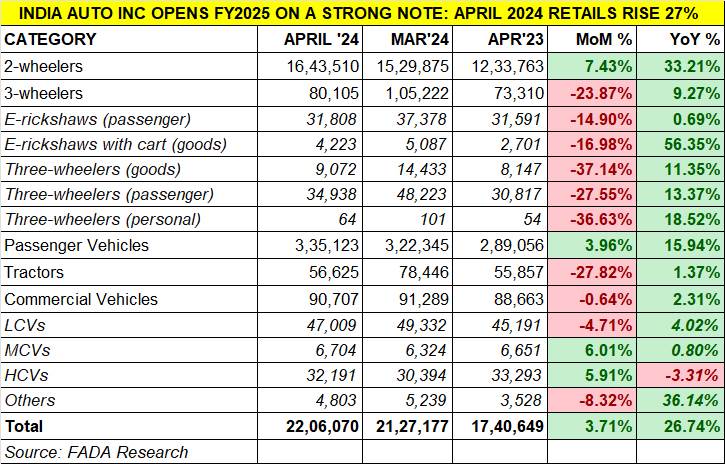

India Auto Inc has had a good start to the new fiscal year 2025. The Federation of Automobile Dealers Associations (FADA) today released April 2024 vehicle retail sales numbers for India Auto Inc. At 2.20 million units, April 2024 retails constitute a 3.71% increase on March 2024’s 2.12 million units and a handsome 27% year-on-year increase (April 2023: 1.74 million units).

The key growth drivers for sales last month are the favourable market sentiment driven by stable fuel prices, positive monsoon outlook by the IMD, festive demand and the marriage season. A fair number of new product launches across the two-wheeler and passenger vehicle segments also helped rev up overall industry demand.

TWO-WHEELERS: 16,43,510 units, up 33% YoY, up 7.43% MoM

What augurs well for India Auto Inc is that all segments have witnessed real-world growth: two-wheeler sales have risen by 33% to 1.64 million units, up 7.43% month on month (MoM) and by a strong 33% YoY. That clearly is the result of some sales firepower from the market leader Hero MotoCorp, which sold all of 511,599 bikes and scooters, up 24% (April 2023: 411,206 units). Honda Motorcycle & Scooter India did well too – 394,147 units and a handsome 61% growth on year-ago sales of 411,206 units. The difference between the No. 1 and No. 2 OEMs is a yawning 100,393 units in April 2024.

TVS Motor Co, the firm No. 4, sold 280,204 scooters, motorcycles and mopeds, increasing its YoY sales by 34% (April 2023: 208,818 units).

It’s a similar 34% growth for Bajaj Auto which sold 195,842 two-wheelers compared to 146,538 units in April 2023.

Suzuki Motorcycles India, with 77,898 units, recorded 26% growth while Royal Enfield sold 72,056 motorcycles to achieve 16% growth. Meanwhile, India Yamaha Motor, with 55,956 units, saw 47% growth.

From amongst the pure EV players, Ola Electric continues its strong run and sold 33,963 e-scooters in April 2024, up 54% YoY. In April 2024, as per Vahan, Ola had a never-before market share of the Indian e-two-wheeler market which saw dampened sales as a result of the reduced subsidy.

According to FADA president Manish Raj Singhania, “The two-wheeler segment saw notable growth due to improved supply and the increasing demand for 125cc models. Positive market sentiments, bolstered by stable fuel prices, a favourable monsoon outlook, festive demand and the marriage season, contributed to this rise. New model launches also helped drive growth, despite some delays in supply.”

THREE-WHEELERS: 80,105 units, up 9.27% YoY, down -24% MoM

Demand for three-wheelers rose by 9% to 80,105 units last month but down 24% on March 2024’s 105,222. Market leader Bajaj Auto sold a total of 29,932 units, up 13% (April 2023: 26,584 units) which sees it increase its market share to 37 percent. The Pune-based auto major, which entered the electric three-wheeler market 11 months ago, is seeing a good contribution from its EV sales. As per Vahan, Bajaj Auto sold 1,280 units of the Bajaj RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0, which gives it fifth rank in the e-three-wheeler market. EVs contributed to 4% of Bajaj Auto’s sales last month.

Piaggio Vehicles, with 5,886 units, saw demand decline 4% (April 2023: 6,134 units) and sees its market share drop to 7.35% from 8.37% a year ago. Mahindra & Mahindra’s retail sales were also down in April 2024: the 3,813 units are 9.68% down on April 2023’s 4,222 units, with market share reducing to 4.76% from 5.76% in April 2023.

EV OEMs YC Electric Vehicles (2,938 units) and Saera Electric Auto (1,966 units) are next on the ladder board, both seeing YoY sales increases.

PASSENGER VEHICLES: 335,123 units, up 16% YoY, up 4% MoM

Fired up with sustained demand for SUVs, which now account for 50% of the market, passenger vehicle sales in April 2024 recorded 16% YoY growth at 335,123 units. Demand was supported by enhanced model availability and favourable market sentiments, particularly around festive events like Navratri and Gudi Padwa.

Fired up with sustained demand for SUVs, which now account for 50% of the market, passenger vehicle sales in April 2024 recorded 16% YoY growth at 335,123 units. Demand was supported by enhanced model availability and favourable market sentiments, particularly around festive events like Navratri and Gudi Padwa.

Maruti Suzuki India sold 136,915 units, up 23% on April 2023’s 111,004 units, as a result of robust demand for its SUVs and MPVs. This performance sees its April 2024 market share at 41% versus 38% a year ago.

All the players with strong SUV portfolios have done well in the marketplace. Hyundai Motor India (48,050 PVs, up 12%), Tata Motors (45,930 units, up 9%), Mahindra & Mahindra (36,775 units, up 19%), Kia India (19,114 units, up 12%) and Toyota Kirloskar Motor (18,999 units, up 31%).

However, according to the FADA president, “Despite strong bookings and customer flow, high competition, excess supply and discounting presented challenges for sustained growth. Additionally, the lack of new models in some portfolios impacted market traction.”

COMMERCIAL VEHICLES: 90,707 units, up 2.31% YoY, down 0.64% MoM

The commercial vehicle segment witnessed modest 2% YoY growth at 90,707 units but a 0.6% MoM decline, indicating varied market conditions. While the sector benefited from positive momentum in bulk and corporate deals and school bus demand, the ongoing election season has dampened sentiment, with customers delaying expansion plans. Other sales inhibitors were limited finance options and regional challenges such as water scarcity, states FADA.

The commercial vehicle segment witnessed modest 2% YoY growth at 90,707 units but a 0.6% MoM decline, indicating varied market conditions. While the sector benefited from positive momentum in bulk and corporate deals and school bus demand, the ongoing election season has dampened sentiment, with customers delaying expansion plans. Other sales inhibitors were limited finance options and regional challenges such as water scarcity, states FADA.

Market leader Tata Motors saw its April 2024 sales of 32,194 units decline 4.71% on the year-ago sales of 33,787 units. Its overall CV market share has also dipped to 35% from 38% in April 2023. Mahindra & Mahindra, with 20,620 units, saw a 21% YoY increase (April 2023: 17,000 units), as a result of strong demand for its pickup trucks. Ashok Leyland’s sales at 16,423 units were down 2% YoY (April 2023: 16,777 units).

Commenting on the industry retail sales in April 2024, FADA president Manish Raj Singhania said: “In April 2024, the Indian Auto Retail sector achieved a robust 27% YoY growth. The two-wheeler (2W), three-wheeler (3W), passenger vehicle (PV), tractor (Trac) and commercial vehicle (CV) segments grew by 33%, 9%, 16%, 1%, and 2%, respectively. While some attribute this growth to the shift in Navratri to April instead of March last year, the overall increase was significant. Comparing combined March and April 2024 with the same period last year shows a 14% YoY growth for the entire industry.”

FADA’S NEAR-TERM OUTLOOK

According to FADA, the industry outlook for May 2024 is shaped by a number of positive indicators. Improved vehicle supply and strategic planning in the two-wheeler segment have led to rising customer bookings and better market sentiment, driven by favourable crop yields. In the PV segment, new model launches and favourable monsoon forecasts are set to stimulate customer interest, while bulk deals in the CV segment should bolster demand in sectors like iron ore, steel, and cement. The appeal of new electric models and sustained demand for conventional vehicles are likely to provide further momentum.

Nevertheless, some challenges remain. The election uncertainty continues to affect market sentiment, delaying customer conversions and stalling purchasing decisions. Financial constraints, extreme temperatures, and overcapacity in the CV segment could slow growth, while heavy discounting in the PV segment could impact profitability. Seasonal factors such as no marriage dates and a lack of major festive events may also influence demand.

While India Auto Inc remains cautiously optimistic about its near-term outlook, given some of the challenges to near-term growth, it will need to closely monitor demand and supply. But, all in all, April 2024 retail numbers have kicked off FY2025 on a good note.