Companies frequently employ stock buybacks or share repurchase programs to bolster shareholder value. These initiatives involve firms purchasing their own outstanding shares. This effectively consolidates ownership and reallocates profits among fewer shares, potentially boosting earnings per share and shareholder returns. Such buybacks are often seen as a prudent use of extra cash, especially when a company’s stock is undervalued. By resorting to share buybacks, companies signal confidence in their financial health and provide reassurance to investors.

Recently, a few auto companies — Group 1 Automotive GPI, BorgWarner, Inc. BWA and AutoNation AN — unveiled additional buyback programs. Let’s take a closer look.

Group 1: The automotive retailer reported mixed results for the first quarter of 2024 with earnings per share (EPS) missing the Zacks Consensus Estimate but revenues beating the same. While the top line grew roughly 9%, EPS declined 13% year over year.

Last week, the company boosted its buyback authorization by $161 million to $250 million. Since the beginning of the year through May 9, 2024, GPI repurchased 205,551 shares for $54 million.

In 2023, the company had bought back $172.8 million worth of shares. GPI’s commitment to increasing shareholders’ returns is praiseworthy. Apart from the buyback boost, the company hiked its 2024 annual dividend rate by 4%.In the last five years, the company has increased its dividend 13 times, with annualized dividend growth of around 13%.

The company has been benefiting from its diversified portfolio, acquisition strength and omnichannel capabilities. Year to date, Group 1 has acquired around $1 billion of annual revenues. Upon the completion of the impending Inchcape acquisition by the third quarter of 2024, total acquired revenues are expected to reach around $3.7 billion.The AcceleRide platform, its online retailing initiative, active at most of the firm’s U.S. dealerships, allows the company to enjoy higher productivity.

Group 1 currently carries a Zacks Rank #3 (Hold) and has a VGM Score of A. The Zacks Consensus Estimate for GPI’s 2024 sales implies a year-over-year uptick of nearly 11%. EPS estimates for the full year have moved north by 10 cents in the past seven days.

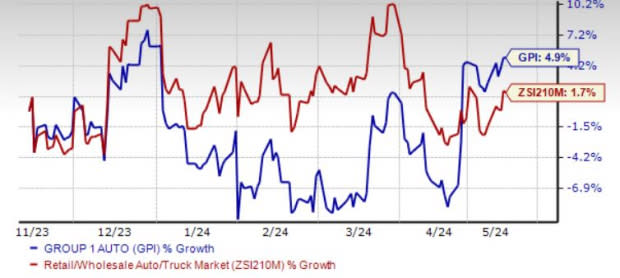

Over the past six months, shares of GPI have risen around 5%, outperforming the industry’s gain of 1.7%.

Image Source: Zacks Investment Research

BorgWarner: The automotive equipment provider delivered a beat on both its top and bottom lines in the first quarter of 2024. However, EPS and sales declined 5.5% and 14%, respectively, year over year.

Concurrent with its results, the company unveiled an additional buyback program of up to $500 million for execution over the next three years. Along with the $267 million remaining from BWA’s previous authorization, the company now has up to $767 million remaining under its authorized stock buyback program.

BorgWarner remains committed to maximizing shareholders’ value. Since 2020, BWA has repurchased approximately $733 million of stock. It returned about $623 million to shareholders in dividends since 2020 and completed the tax-free spin-off Affinion, returning around $1.7 billion of additional capital to shareholders. In total, BWA has returned roughly 3.1 billion of capital to shareholders since 2020.

Frequent business wins, strategic acquisitions, solid financials (with manageable debt and high liquidity) and its Charging Forward project are driving BWA’s prospects.

BorgWarner currently carries a Zacks Rank #3 and has a VGM Score of A. The Zacks Consensus Estimate of BWA’s 2024 and 2025 EPS implies a year-over-year uptick of nearly 7.20% and 13%, respectively. Estimates for 2024 and 2025 have moved north by 8 cents and 15 cents, respectively, in the past seven days.

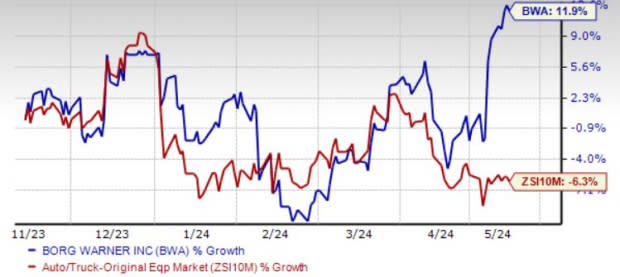

Over the past six months, shares of BWA have risen around 12%, outperforming the industry’s loss of 6.3%.

Image Source: Zacks Investment Research

AutoNation: This automotive retailer beat EPS estimates in the first quarter of 2024 but missed the same for sales. While the top line inched up 1.4% year over year, the bottom line contracted 25.7%.

To boost investors’ confidence, AN authorized an additional $1 billion shares under its repurchase program.During the first quarter of 2024, AutoNation repurchased 0.2 million shares for $39 million. From the beginning of the year through Apr 24, 2024, the company bought back 1.6 million shares for $250 million. As of Apr 24, AutoNation had $1.1 billion remaining under its share repurchase program.

AutoNation’s strong footprint, large dealer network and store expansion efforts are praiseworthy. The launch of AutoNation Express, facilitating online vehicle buying and selling, signifies a significant digitization leap. Buyouts like Priority 1 Automotive, Peacock Automotive’s 11 dealerships, CIG Financial and RepairSmith are driving the company’s prospects.

AutoNation currently carries a Zacks Rank #3 and has a VGM Score of A. The company’s growth is forecast to cool down in 2024, with the Zacks Consensus Estimate for EPS of $18.49 suggesting a 19.6% year-over-year decline on a 0.2% contraction in sales. Growth is expected to resume modestly in 2025, as consensus expectations suggest a 6% recovery in EPS on 1.27% improved sales.

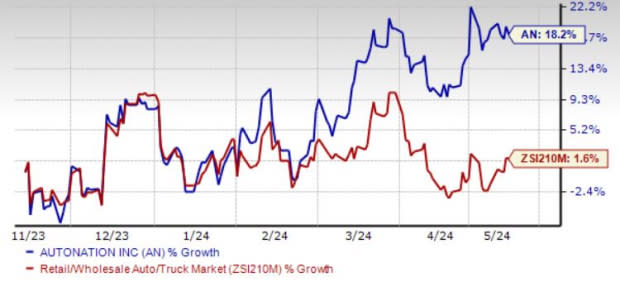

Over the past six months, shares of BWA have risen around 18%, outperforming the industry’s rise of 1.6%.

Image Source: Zacks Investment Research

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

AutoNation, Inc. (AN) : Free Stock Analysis Report

Group 1 Automotive, Inc. (GPI) : Free Stock Analysis Report