NYSE-listed Sea Ltd saw a 23% year-on-year (YoY) jump in revenue to $3.7 billion during the Jan-March quarter from $3 billion during the same period last year, according to the company’s quarterly financial report.

Its total adjusted EBITDA for the quarter, however, fell 21% to $401 million from $507.2 million in Q1 2023, although it was higher than $126.7 million in the previous quarter.

The company reported a net loss of $23 million in Q1 2024, in contrast with a positive net income of $87.3 million during Q1 2023.

“I am pleased to share that we are kicking off 2024 with a strong quarter. All our three businesses have delivered strong growth with an improved profit profile,” said Forrest Li, Sea Chairman and CEO.

“Going through this period has made us leaner, fitter, and savvier. We are now much more confident of our ability to weather headwinds well and adapt quickly to changing environments.”

Amid intensifying competition in Southeast Asia’s e-commerce landscape over the past year, Sea’s focus has shifted back to growth in 2023, following extensive cost-efficiency measures, including layoffs in the previous year.

This is reflected in the company’s performance as sales and marketing expenses nearly doubled to $769.6 million in Q1 2024 from $400.1 million in Q1 2023, while general and administrative decreased by 12.8% to $290.9 million in the quarter. Research and development expenses also decreased by 5% to $304.4 million.

“We have a clear road map for profitable growth. Our results in the first quarter have given us a strong start to 2024, and we are well on track to deliver our full-year guidance,” said Li.

As of March 31, 2024, the group had $8.6 billion in cash, cash equivalents, short-term investments, and other treasury investments. This figure encompasses the allocation of $143.9 million in cash consideration during the first quarter for the repurchase of $171.9 million aggregate principal amount of the 0.25% convertible senior notes due 2026 .

Shopee achieves record GMV, revenue growth

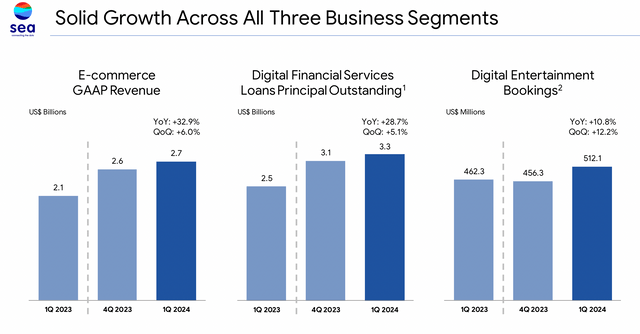

Sea’s e-commerce unit Shopee showed notable improvements across various metrics in the first quarter. GAAP revenue soared to $2.7 billion, marking a robust 32.9% year-on-year increase. Moreover, its gross merchandise value (GMV) surged to $23.6 billion, reflecting a substantial 36.3% YoY growth, while gross orders reached 2.6 billion for the quarter, up 56.8% YoY.

Li attributed these developments to Shopee’s integrated logistics capability, particularly highlighting SPX Express as “one of the fastest and most extensive logistics operators in our markets today, greatly enhancing our customer experience.”

On the other hand, Shopee reported an adjusted EBITDA loss of $21.7 million in the first quarter of 2024, a notable contrast to the positive adjusted EBITDA recorded in the first quarter of the previous year.

More cash spent on Garena

In Q1 2024, the digital entertainment unit saw an uptick in bookings, representing a 10.8% year-on-year increase to $512.1 million. Bookings represent an approximation of cash spent by users on gaming.

Its adjusted EBITDA surged by 27% YoY to $292.2 million, which accounted for 57.1% of bookings for the quarter compared to 49.8% in Q1 2023. Additionally, quarterly paying users witnessed a notable growth of 29.8% YoY, totalling 48.9 million in the quarter.

Meanwhile, the business unit observed a decline in revenue, registering $458.1 million for Q1 2024, compared to $539.7 million in the corresponding period last year.

“We are pleased to share that Garena is back to positive growth, led by Free Fire’s strong performance across markets,” said Li. He added that in its seventh year, Garena’s flagship game Free Fire continues to rank among the largest mobile games globally by user scale and remains effective in attracting new users.

Continuous growth for SeaMoney

Sea booked $499.4 million in GAAP revenue for its digital financial services business, up 21.0% YoY. Its adjusted EBITDA stood at $148.7 million, representing a 50.3% increase YoY. Revenue and operating income of this segment are primarily attributed to the consumer and SME credit business.

SeaMoney offers various fintech products including digital bank, buy now pay later (BNPL), mobile wallet, insurtech, and more.

As of March 31, 2024, consumer and SME loans principal outstanding was $3.3 billion, up 28.7% year-on-year. Non-performing loans due past 90 days was 1.4%, stable quarter-on-quarter.

Commenting on future growth of SeaMoney, Li said, “We anticipate further growth for our digital financial services business throughout the year. As we healthily grow our user base, we will be able to offer a broader set of financial services to meet our users’ needs in the future.”