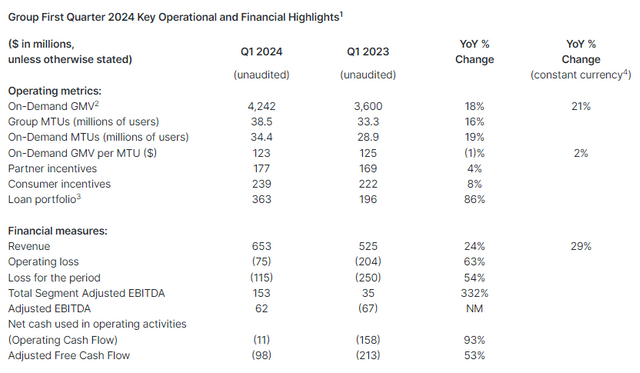

Southeast Asian super app Grab Holdings Ltd recorded a 24% increase in its revenue in the first three months of 2024, backed by growing on-demand gross merchandise value (GMV), and lower operating loss after booking its first quarterly profit in Oct-Dec 2023.

In its statement, the Nasdaq-listed company said its revenue grew 24% year-on-year to $653 million in the Jan-Mar 2024 quarter. Its operating loss improved by 63% year-on-year to $75 million. Meanwhile, Grab’s loss for the period improved by 54% to $115 million.

Grab’s Group-adjusted EBITDA reached $62 million for the first quarter of 2024 compared to a negative $67 million for the same period a year earlier.

“Our focus on product-led growth is bearing fruit, with on-demand GMV scaling to new highs in spite of the seasonal impact we usually see in the first quarter of the year. Our push on affordability and reliability is pulling more people onto our platform and driving up order frequency. We also continue to see our partner earnings trending up,” Anthony Tan, group chief executive officer and co-founder of Grab, said in the statement.

“We continue to strengthen our category position and we will leverage this scale and our technological edge to serve our users and partners better,” Tan said.

Its revenue breakup in the first quarter shows Grab earned $350 million from its deliveries segment, $247 million from its mobility segment, $55 million from its financial services, and $1 million from others.

Grab maintained its full-year 2024 revenue guidance at $2.70-2.75 billion and raised its group-adjusted EBITDA forecast to $250-270 million (against $180-200 million earlier).

Jeffrey Bahar, chief operating officer at YAMADA Consulting & Spire, said “Grab is likely to have strong positive performance in mobility and deliveries, successfully driven by its strategic initiatives such as transit fees, surcharges, cancellation fees and advertising fees.”

“As we drive growth across our business, we remain focused on continued improvements in profitability as demonstrated by our ninth consecutive quarter of Group Adjusted EBITDA expansion while improving shareholder returns and managing our balance sheet,” Peter Oey, chief financial officer at Grab, said.

Grab’s cash liquidity stood at $5.3 billion at the end of the first quarter of 2024, compared to $6 billion at the end of the previous quarter. The company said a substantial part of the cash outflow was on account of full repayment of the outstanding principal and accrued interest of its Term Loan B of $497 million, and the repurchase of 30 million shares for an aggregate principal amount of $96.6 million.

The company’s net cash liquidity was $5 billion at the end of the first quarter compared to $5.2 billion at the end of the prior quarter.

Grab closed 2023 positively by booking its first quarterly profit in Oct-Dec 2023. The company booked a profit of $11 million during the period, a swing from a $391 million net loss a year earlier.

The turnaround was mainly attributed to improved group-adjusted EBITDA, adjustments in fair value investments, and reduced expenses related to share-based compensation. The profit was also on account of the reversal of unnecessary accounting accrual.

In 2023, Grab recorded a 65% revenue growth to $2.36 billion, beating its guidance of $2.31 billion-$2.33 billion. The company also managed to reduce its loss significantly to $485 million.

Before Grab’s earnings report, Indonesia-listed tech firm GoTo reported an improved performance in the first quarter of 2024 with a lower group adjusted EBITDA loss and significantly higher revenue on the back of user growth; the rise of buy now, pay later (BNPL) in e-commerce; and accelerated integration and payment adoption linked with TikTok.

“Y&S foresees Grab, as well as Gojek, will maintain its dominance in transportation and food deliveries. It will be critical to strengthen its local B2B/merchant partnerships and explore other new revenue models to counter competition from other service providers like Anteraja, Lalamove, SiCepat, and Paxel to name a few,” Bahar of YAMADA Consulting & Spire said.