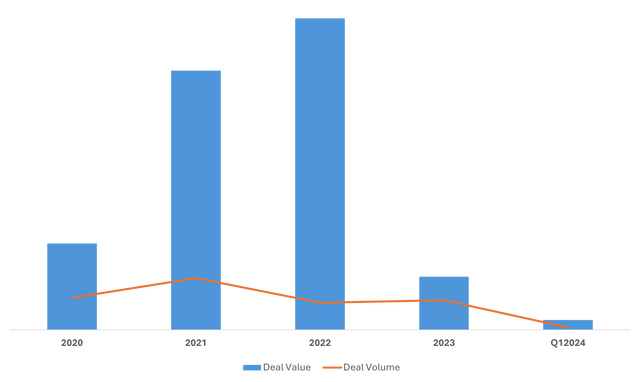

Private funding for food technology (foodtech) startups in Southeast Asia dropped to an at least four-year low of $21.6 million in 2023 as investors lost their appetite for the sector amid a broader slowdown, reveals a new report.

The 83% year-on-year decline in foodtech investments surpassed the 51% decline in total funding for the regional startup ecosystem last year, according to DealStreetAsia – DATA VANTAGE’s State of Foodtech in SE Asia 2024.

The number of foodtech deals stood at 12 last year, one more than the previous year. The sector hit a deal volume peak in 2021 with 21 transactions, while funding proceeds rose to their highest, $126.2 million, in 2022.

Foodtech funding in Southeast Asia

The report, which tracked funding in the sector from January 2020 through March 2024, found a year-on-year pick-up in deal volume (1 transaction) and value ($4 million) in the first quarter of this year. However, the Q1 proceeds marked a 72% decline sequentially, a deviation from the funding trend observed in the last four years.

The drop in foodtech funding in the region mirrors a global slowdown in the sector. According to Dealroom data, investments in foodtech globally plunged consecutively in 2022 and 2023 to $28 billion and $13 billion, respectively. At its peak, the sector had garnered investments worth $49 billion in 2021.

Southeast Asia’s foodtech market is several years behind the advanced markets of North America and Europe, noted Gautam Godhwani, managing partner at alternative proteins-focused venture capital firm Good Startup.

“As a result, the aggregate funding available, particularly relative to the size and diversity of the population of Southeast Asia, is relatively small. This has been a hurdle to innovation and production of high-quality products catering to local tastes and preferences. As funding rises and products improve, we will see this market thrive,” he added.

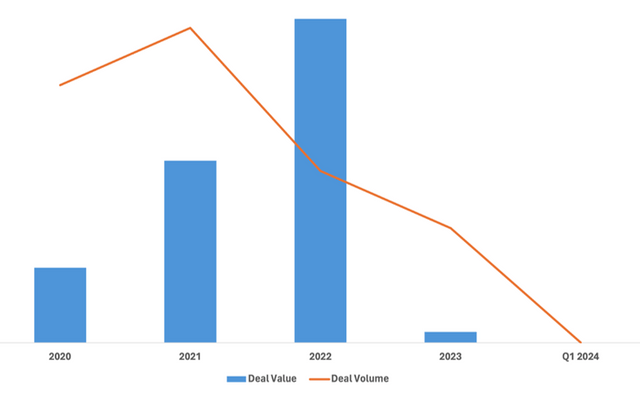

Alternative proteins lose sheen as funding dries up

Alternative proteins, which include plant-based meat and lab-grown or cell-based meat, dominate the foodtech landscape in Southeast Asia. However, the report found that private funding declined sharply after 2022 in this segment.

Funding in alternative protein startups in Southeast Asia

Annabelle Chiong, SGInnovate’s deputy director of venture investing, contended that the hype cycle in foodtech before 2023 was driven by alternative proteins, “which either have not achieved price parity or widespread adoption, or both.”

“There has since been a recalibration of expectations and valuations for foodtech among investors, which is reflected in the funding drop,” she added.

Plant-based meat accounted for 71% of all the private capital raised by alternative protein startups in Southeast Asia from January 2020 through March 2024. Deals in the sub-segment halved to two in 2023, while deal value was undisclosed.

Health food, industrial foodtech defy funding downtrend

The only segments under foodtech to witness growth in deal value and volume last year were health food and industrial foodtech. They also raised the most funding after alternative proteins in 2023.

Investments in the health food category, which includes companies focused on fighting diabetes, such as Alchemy Foodtech, jumped 20x from the previous year, while the number of deals doubled. Industrial foodtech startups, which include the likes of enzyme engineering firm Allozymes, inked three deals to raise $7.4 million in 2023. They had drawn a blank on both fronts in 2022.

Singapore leads the foodtech race

From January 2020 to Q1 2024, a staggering 96% of foodtech funding in Southeast Asia went to startups based in Singapore, which raised $280.2 million. Indonesia, a distant second, bagged $10.2 million, while the Philippines came in third with a mere $1.3 million.

Singapore’s dominance in the regional foodtech landscape is also evident from the fact that all the ten most funded Southeast Asian foodtech companies are headquartered in the city-state.

The country’s lead stems from its pioneering role in the foodtech space worldwide. In 2020, it made history by becoming the first to allow the commercial sale of cultivated meat. In 2022, it granted the world’s first commercial approval to a protein derived from gaseous feedstocks. It continued its streak of world-first regulatory approvals in 2023 by permitting GOOD Meat to use serum-free media for cultivated meat.

Under its 30 by 30 programme, the city-state has set a goal to build its agrifood capability to sustainably meet 30% of its nutritional needs by 2030.

“Singapore has positioned herself well for foodtech from both technical and regulatory standpoints due to the availability of tech talent, a trusted IP regime and a forward-looking regulatory stance,” said Heritas Capital chief executive officer Chik Wai Chiew.

“All these advantages offset Singapore’s small market, which remains insignificant even if its 30 by 30 plan is on track (and it seems not).”

The State of Foodtech in SE Asia 2024 report offers data and insights on:

- Foodtech funding from January 2020 through Q1 2024

- Quarterly fundraising trends

- Funding data for various foodtech segments

- Top fundraisers in Southeast Asia

- Investor and entrepreneur perspectives

Unlock the report for only $299 or upgrade to a Premium Plus subscription for greater savings and enjoy full access to up to 36 research reports a year, all for just $1200 ($100/month). Still not sure? Opt for a one-month trial.