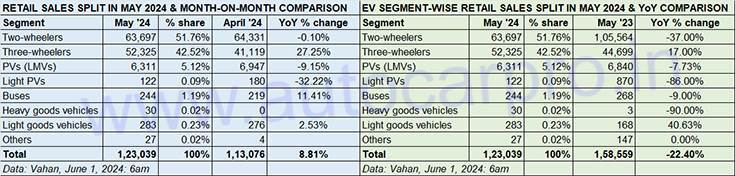

The heat is on, both in terms of the weather as well as sales of electric vehicles in India. May 2024, which saw temperatures across the country scale new highs, saw total retail sales of electric two- and three-wheelers, passenger and commercial vehicles at 123,039 units. While this number is 8.81% up on April 2024’s 113,076 units and way below those in the first three months of CY2024 (January: 144,972, February: 141,972, March: 209,539), it gives hope to the industry that despite the reduced subsidy for e-two- and three-wheelers and in turn higher prices since April 1, 2024, there are sales to be had.

May 2024’s 123,039 units are down 22% on May 2023’s 158,559 units. However, a year-on-year comparison wouldn’t be correct because May 2023 – the first month when EV sales surpassed the 150,000-unit mark – benefited substantially as e-two-wheeler buyers rushed to make their purchases before the FAME subsidy was slashed from 40% to 15% with a resultant increase in new product prices. Not surprisingly, May 2023 also saw e-scooters and bikes cross the 100,000-unit sales mark for the first time.

Twelve months later, the scenario is vastly different. The FAME II subsidy scheme, which closed on March 31, 2024, has been replaced by the Electric Mobility Promotion Scheme (EMPS). Valid for a four-month period from April 1 to July 31, 2024, EMPS has a total outlay of Rs 500 crore and aims to support the purchase of 372,000 EVs including 333,000 two-wheelers and 38,828 three-wheelers (L5 category). While e-two-wheelers get a subsidy of Rs 5,000 per kWh with a maximum limit of Rs 10,000 per unit under EMPS, e-three-wheelers can avail a subsidy of Rs 5,000 per kWh with a maximum limit twice that of two-wheelers at Rs 10,000 per unit.

Suffice it to say, July 2024 should see a similar spike in EV sales as in March 2024, with consumers likely to take the non-subsidy and increased product prices (for e2Ws and e3Ws) in their stride albeit the growth rate will reduce substantially compared to the strong double-digit growth seen consistently in CY2023.

Sales of e2Ws at 63,697 units in May 2024 were at an eight-month low. The e3W segment was the only one to register high double-digit MoM growth.

Sales of e2Ws at 63,697 units in May 2024 were at an eight-month low. The e3W segment was the only one to register high double-digit MoM growth.

Flat sales for e-two-wheelers

In May 2024, the EV industry’s overall sales numbers were somewhat dragged down by the tepid demand for two-wheelers, which are the largest volume providers This level of market performance though was expected what with the reduced subsidy for two- and three-wheelers, which together account for 94% of industry sales, as well as the fact that last month saw plenty of electoral activity in different states across India.

Electric two-wheeler OEMs sold 63,697 units in May 2024, marginally down on April 2024’s 64,331 units. It was felt that e2W retails would really feel the heat but that seems to be belied in the second month of the ongoing EMPS subsidy.

Overall EV industry sales in May 2024 would have been lower if it weren’t for the sterling performance of the e3W sector. With 52,325 units retailed in May 2024, the e-three-wheeler segment registered strong 27% month-on-month and 17% YoY growth, helping buffer the muted demand for electric two-wheelers in the wake of the reduced subsidy.

Sales of electric passenger cars and SUVs at 6,311 units in May 2024 were tepid, down 11% on April 2024’s 7,111 units and considerably below the first three months of this year: January (8,467 units), February (7,492 units), March (9,345 units).

Retail sales of both electric buses (244 units) as well as light goods vehicles (283 units) were up both month on month, which augurs well for this year.

Growth outlook

It can be expected that June 2024 will display a similar tepid demand for EVs but will see strong growth in the EMPS-ending month of July 2024. Again, there is likely to be a lull for a couple of months before the festive season kicks and demand returns to EV OEMs, particularly the two- and three-wheeler industry which are the volume drivers and the key beneficiaries of the EMPS.

It may be recollected that a similar market scenario played out in CY2023. When the FAME II subsidy was slashed from 40% to 15% starting June 1, 2023, demand jumped 42% in May 2023 to 158,454 EVs from April 2023’s 111,356 units. After that sales fell 35% month on month in June 2023 (102,640) but saw a gradual recovery in the second half of CY2023 – July (116,619), August (127,180), September (128,536), October (140,300), November (153,970) and December (141,763).

The fact of the matter is that compared to fossil fuelled vehicles or even CNG-powered mobility, the long-term wallet-friendly and value proposition of an EV remains a winning bet, both for individual users as well as fleet operators.