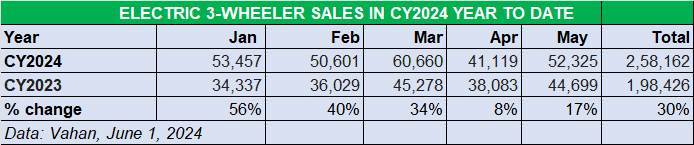

Despite a sweltering month which saw temperatures soar to record levels of over 48deg C in various parts of India, the electric three-wheeler industry has maintained its cool in May 2024. Sales had fallen to a 10-month low of 41,119 units in April 2024 (up 8% YoY) but have bounced back in May 2024 with 52,325 units, up 27% (May 2023: 44,699 units).

Last month’s improved numbers are thanks to strong demand for passenger carrying e-rickshaws and three-wheelers: the combined 44,776 units are a 13% improvement over year-ago sales (May 2023: 39,470 units). Demand for goods-transporting e-rickshaws was up by 70% at 5,309 units (May 2023: 3,125 units) while goods carrier demand rose by a more muted 5% to 2,210 units (see data table below).

Like the e-two-wheeler industry, e-three-wheeler OEMs have been impacted by the now-reduced subsidy which has a number of OEMs increase product prices. While this can somewhat dampen demand, the wallet-friendly long-term USP of an EV remains a draw in the electric three-wheeler segment, which has seen the fastest transition to e-mobility amongst all vehicle segments.

The new Electric Mobility Promotion Scheme (EMPS), valid for a four-month period from April 1 to July 31, 2024, has a total outlay of Rs 500 crore and aims to support the purchase of 372,000 EVs including 333,000 two-wheelers and 38,828 three-wheelers (L5 category).

This e-three-wheeler sub-segment, which sells passenger-transporting e-rickshaws and cargo-carrying three-wheelers, continues to witness strong double-digit growth thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

Compared to fossil fuel or CNG-powered models, the long-term wallet-friendly proposition of electric three-wheelers is drawing both single-user buyers (autorickshaw drivers) as well as fleet operators. The retail sales data table above indicates the growth trajectory for the ongoing fiscal year.

Mahindra maintains leadership, Bajaj Auto moves into fourth position

Of the 485 players in this vehicle category, nine OEMs registered four-figure sales or over 1,000 units each – four more than in April 2024. These nine OEMs together accounted for 20,437units in May 2024 or 39% of total e-three-wheeler retails. Let’s take a closer look at some company-wise market performances.

Having opened FY2025 with sales of 3,141 units in April 2024, Mahindra Last Mile Mobility (MLMM), the market leader in FY2024 with 60,542 units, maintained its tempo in May 2024 with 4,534 units. This gives it a market share of 9% in May 2024 while its cumulative January-May 2024 retails at 24,855 units give it a market share of 10% in the year to date (258,162 units sold) and position it comfortably ahead of the competition. MLMM, whose portfolio includes the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Super and e-Alfa Cargo catering to multiple mobility operations, continues to gain from the launch of two new products – the Treo Plus and e-Alfa Super passenger and cargo variants. To ensure sustained supplies to meet growing demand for its portfolio, MLMM has tripled its production capacity, leveraging its manufacturing plants in Bengaluru, Haridwar, and Zaheerabad.

YC Electric Vehicles, which sold 3,779 units in May, continues to witness sustained demand for its five products – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations. Low initial cost, from Rs 125,000 to 170,000 for passenger EVs, and Rs 130,000 to Rs 165,000, is what is driving demand for YC EV. Saera Electric Auto with 2,474 units is ranked third, maintaining its position.

while expanding volume, market share and network presence on the electric front. Received PLI certificates for all five of our electric 3-wheeler models Rakesh Sharma: Our EV 3-wheelers have been very well accepted and are now available in 60 cities, giving us a market share of 30% in such addressed markets.

Bajaj Auto, with 2,357 units, is ranked fourth in May with a market share of 4.50%, moving up one rank from April 2024 albeit in cumulative five-month sales it is No. 5. Its cumulative January-May 2024 sales at 9,949 units give it a 3.85% market share. A creditable performance for the company which entered the market a year ago.

The Pune-based auto major, which is the IC engine three-wheeler market leader and a recent entry into the e-three-wheeler industry in June 2023, has two products on sale – the Bajaj RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0.

The company’s sales spike is reflected in its rate of growth. In CY2023 (six months since market entry in June 2023), Bajaj Auto was ranked 28th. In FY2024, in just 10 months after its EV rollout, Bajaj grabbed a 2% market share and was ranked No. 13. With growing demand for both its products, ramped-up production and an expanded EV sales network, expect the Pune-based auto major to be making the headlines regularly, as well as keeping the top OEMs worried.

Dilli Electric Auto with 1,610 units is ranked fifth in May 2024 but cumulative sales-wise it is fourth in the ladder board.

Piaggio Vehicles, which sold 1,377 units in May, is the sixth-placed OEM. Its cumulative January-May 2024 sales are 9,514 units. The company is benefiting from its new models and aggressive network expansion. The Apé E-City FX Max passenger model (with 145km range) and Apé E-Xtra FX Max cargo carrier (115km range) are fully assembled by an all-women team at its Baramati factory in Maharashtra. Piaggio is already gearing up for a subsidy-free EV market – on May 1, it launched a battery subscription model for its Apé Elektrik three-wheeler in 30 cities across India in an effort to simplify ownership and eliminate upfront battery costs.

There were five OEMs with sales between 900 to 1,000 units last month. They comprise Hotage Corporation (993 units), Champion Poly Plast (993 units), SKS Trade India (959 units), Atul Auto (940 units) and JS Auto (906 units).

The e-three-wheeler industry’s strong market performance in May 2024 has helped buffer the flat sales of the e2W segment and in turn helped the overall EV industry register sales of over 123,000 units, up 9% year on year.