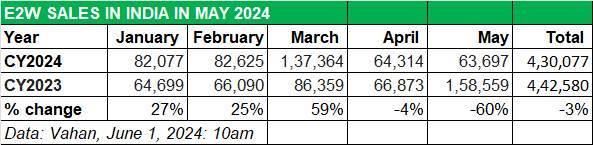

A combination of growth-impacting factors played spoilsport with the market performance of the electric two-wheeler industry in May 2024. After six straight months of over 75,000-unit sales and best-ever monthly sales of 137,000 units in FY2024-ending March, May 2024 more or less replicated the poor sales of April 2024.

While retail sales in April 2024 (64,314 units) were down 4% YoY, May 2024’s 63,697 units are down 0.95% on April. However, May 2024’s sales do not warrant a year-on-year comparison because May 2023 was when e-scooter and bike buyers rushed to buy EVs ahead of the slashed-by-25% FAME subsidy which kicked in from June 2023. As a result, May 2023 saw e-two-wheeler retails surpass the 100,000-unit milestone for the first time (105,564 units), which meant the month was also the best-one yet for India EV Inc (May 2023 EV retails: 158,459 units).

May, like April, usually in India, is a month of slow sales what them being the first two months of the new fiscal year. Sales momentum tends to gradually pick up, fall a bit in the monsoon months and then rev up again in the festive season around September-October. This year around, April and May have been the key months in the election season which has, to some extent, impacted monthly numbers. Add to this the now-reduced subsidy, which has already seen most of the leading e-two-wheeler OEMs increase prices of their products. While Ola has not effected any change, TVS, Bajaj Auto, Ather Energy and Hero MotoCorp have all revised their product prices upwards, marking an increase from Rs 4,000 through to Rs 16,000. This can dampen demand albeit the wallet-friendly long-term USP of an EV beats that of a fossil-fuelled counterpart on two or more wheels.

May 2024, like April, was a month of hectic election-related activity across the country. This mega democratic exercise somewhat impacted market sentiment, delaying customer conversions and stalling purchase decisions.

Ola tops with 24,400 units, TVS, Bajaj, Ather register month-on-month growth

Ola Electric remains the ‘Maruti Suzuki’ or the ‘Honda’ of the electric two-wheeler industry with its huge and seemingly unassailable lead over its rivals. In May 2024, Ola retailed 24,400 units, which is the highest amongst all OEMs but is its lowest monthly sales in the first five months of CY2024. Nevertheless, even with this figure, Ola has a 38% share of the market in May 2024 and 40% for the January-May 2024 period which has seen total retail sales of 430,077 e-two-wheelers across India.

TVS Motor Co, the firm No. 2 player, recorded retail sales of 11,737 units last month, improving 51% on its April 2024 sales of 7,742 units. This gives it an 18.42% market share for the month while the cumulative January-May 2024 sales at 76,101 units gives the company an 18% market share in the year to date.

On May 13, two years after the iQube got its first refresh, TVS launched more variants, both at the lower and upper end of the spectrum. The iQube line-up now starts with a base variant with a 2.2kWh battery, 75km real-world range, charging time of 2 hours from 0-80 percent with a 950W charger and a slightly smaller than the rest 30-litre underseat storage area. This base variant is now the most affordable iQube at Rs 94,999. There is also a larger variant with a 3.4kWh battery (essentially the base model previously). Both these models get a 5 inch TFT display with tow and theft alerts and turn-by-turn navigation.

The iQube ST line-up has expanded to include variants with two capacities – 3.4kWh and 5.1kWh. The iQube ST 3.4 variant has a claimed real-world range of 100km and now gets a 7-inch touchscreen TFT display that comes with Alexa voice assist, digital document storage and a tyre pressure monitoring system above the basic Bluetooth functionality seen on the lower variants. The ST 3.4 is priced at Rs 155,555 and takes 2 hours 50 minutes to charge from 0 to 80 percent.

The range-topping ST 5.1 variant has the largest battery capacity of any Indian electric scooter and TVS claims a real-world range of 150km on a single charge. The iQube ST 5.1 also has a higher 82kph top speed, and the claimed charging time is 4hr 18min from 0 to 80 percent. The ST 5.1 gets all the same features as the ST 3.4, but at Rs 185,373, it’s the most expensive model in the line-up.

TVS says that customers who had pre-booked the ST variant before July 15, 2022, will be able to purchase either the 5.1 kWh or 3.4 kWh variant with an introductory loyalty bonus of Rs 10,000.

The company, which expects two-wheeler EV sales in India to reach 30% market penetration by CY2025, is targeting a big jump in the contribution of EV sales to its overall volumes over the next two years.

Bajaj Auto maintains its No. 3 ranking with 8,213 Chetaks sold. Between January and May 2024, the Pune-based company has sold 9,189 Chetaks, which gives it a 14.42% market share. Bajaj Auto, which markets the two Chetak variants – Urbane (Rs 123,319) and Premium (Rs 147,243) – continues to see strong demand. This is thanks to a ramped-up production and a growing dealer network, which is to be expanded from its existing presence in 164 cities and 200 touchpoints to around 600 showrooms in the next three to four months. Bajaj Auto is also soon to further up the ante with the launch of a new mass-market e-scooter under the Chetak brand umbrella.

Bengaluru-based smart EV OEM Ather Energy recorded sales of 6,024 units in May 2024 and a market share of 9.45 percent. Its cumulative January-May sales at 46,000 units gives it a market share of 10.69 percent in the year to date. On April 6, Ather launched the new Rizta at a starting price of Rs 109,999 (Rizta S) through to Rs 149,999 (Rizta Z). While the S version is equipped with a 2.9 kwH battery and has a 123km range, the Z variant with a 3.7 kWH battery has a 160km range. Key highlights for the family EV include the largest two-wheeler seat in India and storage space aplenty.

Hero MotoCorp takes fifth rank in May 2024 with sales of 2,453 units, up 157% on its April sales of 955 units and its best monthly performance in the year to date. However, in cumulative terms and January-May 2024 sales, Hero MotoCorp is below Greaves Electric Mobility (12,322 units).

Greaves Electric Mobility’s May 2024 sales at 1,956 units were down 22% on April’s 2,511 units. May 2024 was the first month of sales for the Greaves Electric Mobility’s new Ampere Nexus launched on April 30. Targeted at families, the Ampere Nexus has been designed and developed in-house at the Ranipet facility in Tamil Nadu. Equipped with a 3 kWH LFP battery, the Nexus has a claimed top speed of 93kph and a certified range of 136km. Sold in two variants, prices start at Rs 110,000 (ex-showroom) and go up to Rs 120,000.

Wardwizard Innovations continues to witness a spike in demand and its May retails of 1,261 units were up marginally on April’s 1,205 units but are its best monthly figures in the first five months of 2024.

Interestingly, demand for electric motorcycles is gradually picking up. The past eight-odd months have seen new players and products enter the market. Revolt Motors with 687 units in May 2024 is now in the Top 10 OEM list at ninth position. Its five-month cumulative sales at 3,035 units give it ninth position in the overall e-two-wheeler market.

Then there’s the recent entrant River Mobility which registered sales of 164 units last month.

Will sales pick up?

The new Electric Mobility Promotion Scheme (EMPS), valid for a four-month period from April 1 to July 31, 2024, has a total outlay of Rs 500 crore and aims to support the purchase of 372,000 EVs including 333,000 two-wheelers and 38,828 three-wheelers. While e-two-wheelers get a subsidy of Rs 5,000 per kWh with a maximum limit of Rs 10,000 per unit under EMPS, e-three-wheelers can avail a subsidy of Rs 5,000 per kWh with a maximum limit twice that of two-wheelers at Rs 10,000 per unit. Suffice it to say, July 2024 will see a similar spike in EV sales as in March 2024.

As to whether sales will pick up, the answer is blowing in the wind but the EMPS-ending month of July 2024 should see a sales spike, and e-two-wheeler buyers are likely to take the increased EV prices in their stride later.

It may be recollected that a similar market scenario played out in CY2023. When the FAME II subsidy was slashed from 40% to 15% starting June 1, 2023, demand jumped 42% in May 2023 to overall 158,454 EVs (across all segments) from April 2023’s 111,356 units. After that sales fell 35% month on month in June 2023 (102,640) but saw a gradual recovery – July (116,619), August (127,180), September (128,536), October (140,300), November (153,970) and December (141,763).

The fact of the matter is that compared to fossil fuelled vehicles or even CNG-powered mobility, the long-term wallet-friendly and value proposition of an EV remains a winning bet, both for individual users as well as fleet operators. And with regular rollout of new zero-emission products on two wheels, consumers have good choice of what suits their wallets.