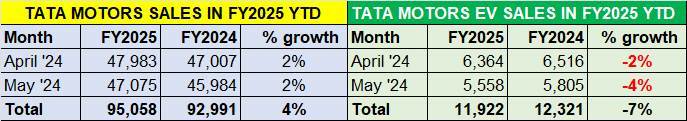

Tata Motors’ passenger vehicle division has announced wholesales of 47,075 units for May 2024. While this marks a marginal 2% year-on-year growth (May 2023: 45,984 units), the May number is down nearly 2% month on month on April 2024’s 47,983 units. What’s more, EV wholesales are down 2%– 5,558 units to the year-ago 5,805 units.

Cumulative sales for the first two months of FY2025 at 95,058 units are up 4% (April-May 2023: 92,991 units) and interestingly EV dispatches are down. While May 2024 EV sales were down 4% at 5,558 units (May 2023: 5,805 units), they are down 12.66% month on month (April 2024: 6,364 units). Combined April-May 2024 EV dispatches at 11,922 units are down 7% YoY (April-May 2023: 12,321 units).

Tata Motors, which is the third-ranked passenger vehicle OEM after Maruti Suzuki and Hyundai Motor India, is to some extent feeling the heat of the strong SUV competition from Maruti Suzuki, Mahindra & Mahindra and Hyundai Motor India.

What continues to benefit Tata Motors is that its ‘New Forever’ portfolio which spans petrol, diesel, CNG and electric powertrains, thereby considerably expanding its advantage compared to most of its rivals. In FY2024, CNG and EV sales contributed to nearly 29% of record sales of 582,915 units.

The company, which retails seven PVs — Altroz, Tigor, Tiago, Nexon, Punch, Harrier and the Safari — continues to see strong demand for its SUVs, particularly the Nexon and the Punch compact SUVs, the No. 1 and No. 3 SUVs, respectively, in India last fiscal. Sales have been slowing down for the Nexon but with a CNG variant soon to be launched, Tata Motors’ best-seller should soon be back to big numbers. Meanwhile, the Punch, whose portfolio has expanded with the rollout of CNG and EV variants, continues to punch above its weight and snare sales from rivals.

Meanwhile, Tata Motors is also planning to launch the premium Altroz Racer, its answer to the Hyundai i20 N Line,

Tata EV sales under pressure

A key factor that acts as a catalyst to Tata Motors’ growth is its first-mover advantage in India’s electric vehicle market, where it has an over 70% market share with its Nexon EV, Tigor EV and Xpres-T (for fleet buyers), Tiago EV and Punch EV.

The April and May 2024 EV dispatches are probably the first time that Tata Motors’ EV wholesales have seen a decline, indicating growing market competition. It is also likely that the company is rationalising its EV inventory at its showrooms across the country

On the retail front though, Tata Motors continues to have a 70% market share. In May 2024, as per Vahan data, the company accounted for 4,442 units of the total 6,306 ePVs retailed last month. And for the January-May 2024 period, Tata EV sales of 23,733 units comprise 68% of the total 34,659 electric cars and SUVs sold by 14 OEMs.