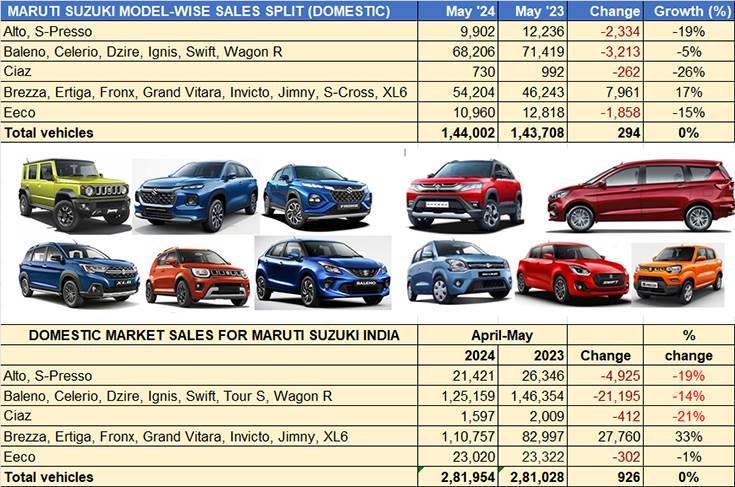

Passenger vehicle market leader Maruti Suzuki India has reported flat sales in May 2024. At 144,002 units dispatched in May 2024, the year-on-year increase was just 294 vehicles or zero percent growth. This performance comes on the back a similar showing in April 2024: 137,952 units (April 2023: 137,320 units).

As it has been for quite some time now, sustained demand for most of its SUVs and MPVs have saved the blushes for the company. Utility vehicle sales of 54,204 units, up 17% YoY (May 2023: 46,243 units) and accounted for 38% of the company’s overall passenger vehicle sales.

This number though is 4.15% down on April 2024’s UV sales of 56,553 units comprising the seven-model utility vehicle portfolio of the Brezza, Ertiga, Fronx, Grand Vitara, Invicto, Jimny and XL6. In the process, as they did in FY2024, they have helped buffer the sustained decline in consumer demand for entry-level hatchbacks as well as sedans.

Combined sales of the Alto and S-Presso at 9,902 units are down 19% YoY and 14% month on month (April 2024: 11,519 units). Thus, in a move to rev up demand for its budget cars, the company has today slashed prices of the Alto, S-Presso and Celerio to Rs 499,000. At present, their average prices are upwards of Rs 600,000 to Rs 700,000.

Similarly, there is a decline in demand for the seven-model hatchback range of the Baleno, Wagon R, Swift, Celerio, Dzire, Tour S and Ignis albeit the rate of decline is slowing likely to the revival of demand from rural India. This lot sold 68,206 units in May 2024, down 5% YoY but up 20% on April 2024’s 56,953 units. While the sole premium Ciaz sedan’s sales were down 26% to 730 units, the Eeco van has also felt the heat of slowing sales with 10,960 units, down 15 percent.