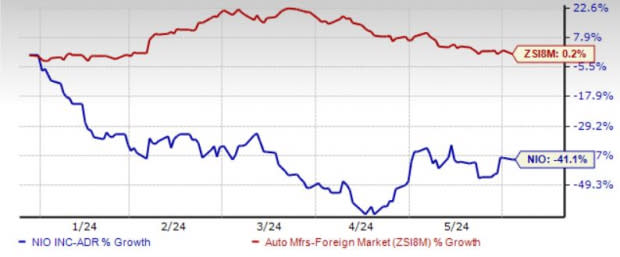

China’s electric vehicle (EV) maker NIO Inc. NIO is set to report its first-quarter 2024 results on June 6 before the opening bell. Investors are contemplating if this could be an opportune time to invest in the stock, given the massive sell-off so far this year. Shares of NIO have plunged more than 41% year to date, significantly underperforming the industry.

Image Source: Zacks Investment Research

The price drop mirrors the broader EV market challenges, including tepid demand and infrastructural concerns. From an all-time high of more than $60 a share in early 2021, the stock is now hovering at around $5 per share. Of course, the high prices back in 2020 and 2021 were largely due to the e-mobility frenzy that had stretched the valuations for nearly all EV startups.

But after witnessing such a steep fall in its stock price, does the company look fairly valued now and present a good buying opportunity? Also, as NIO queues up to unveil its first-quarter results, what should investors be watching in its report?

Key NIO Metrics to Watch

One crucial aspect that investors are already aware of is the delivery numbers. The company delivered 30,053 vehicles in the first quarter of 2024, a 3.2% decrease year over year, which is expected to impact revenues. The Zacks Consensus Estimate for sales stands at $1.48 billion, suggesting a year-over-year decline of around 5% and a significant drop from the $2.4 billion generated in the fourth quarter of 2023.

Another key metric to watch is vehicle margin. In the last reported quarter, the metric came in at 11.9%, improving 90 bps sequentially and 510 bps yearly. With management’s optimistic guidance of a 15-18% margin for the year, investors will be watching for signs of sustained improvement.

That being said, the company needs to further reduce its manufacturing costs as well as operational expenses, as it is incurring substantial losses from operations. In the fourth quarter of 2024, operating losses surged 37% year over year, albeit declining 1.6% sequentially. Maintaining a steady improvement in operating margin is crucial for NIO’s path to profitability.

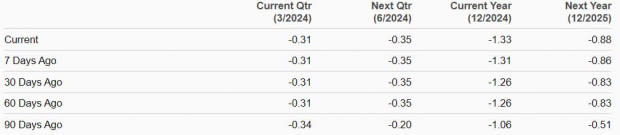

The Zacks Consensus Estimate for first-quarter 2024 loss per share is pegged at 31 cents, indicating an improvement from the year-ago reported loss of 42 cents.

Are There Enough Growth Drivers for NIO?

China’s strong push for EV adoption provides a boost for NIO. Despite a general slowdown in EV demand, NIO operates in a market where demand is holding up better than in the United States. NIO’s strong standing with the Chinese government offers an advantage. Additionally, a robust product portfolio, featuring models such as the ES6, ET5T, ES8, EC6, EL7, ET5, ET7 and EC7, bodes well for the company.

Although first-quarter 2024 deliveries were lackluster, the past two months have shown significant improvement. Last month, NIO delivered a record 20,544 vehicles, marking a 233.8% year-over-year increase. This brings the total deliveries in 2024 to 66,217 vehicles so far, a 51% year-over-year increase.

NIO’s battery swap technology, part of its Battery-as-a-Service (BaaS) strategy, sets it apart from competitors. The company has installed 2,419 power swap stations worldwide and aims to build 1,000 more in 2024. Expanding partnerships with major Chinese automotive groups is bolstering this ecosystem.

NIO’s financial position has improved following a $2.2 billion investment from Abu Dhabi’s CYVN Holdings in December. The investment bolstered NIO’s balance sheet, enabling intensified brand positioning, enhanced sales and service capabilities and significant investments in core technologies.

The recent launch of the low-cost Onvo model, the L60, priced around RMB 250,000 ($34,600), could boost sales, though the impact on manufacturing costs remains to be seen. Additionally, NIO’s acquisition of two JAC plants is expected to reduce production costs, thus enhancing efficiency and competitiveness.

Should You Buy NIO Stock Now?

Well, NIO remains unprofitable and requires continuous capital injections, posing a risk of dilution.There is a risk that any recovery in its stock could be quickly offset by new share capital issuances.

Additionally, there is intense competition in China with numerous companies and models entering the market, which is forcing players to slash prices. In this competitive market, NIO will have to put more effort into gaining buyers’ attention, and slashing prices could squeeze margins further.

Discouragingly, the expectations for loss per share have been widening for the current and next fiscal.

Image Source: Zacks Investment Research

From a valuation perspective, NIO’s price-to-sales (P/S) ratio is way lower than historical highs. Both those pricey valuations were never justified by the company’s fundamentals in the first place. NIO is currently trading at a forward sales multiple of 0.78, still higher than the industry levels. The stock does not seem very attractive at the current levels as well. It carries a Value Score of F.

Image Source: Zacks Investment Research

We think investors should be cautious and avoid rushing to buy the dips. Before considering an investment in NIO, it is crucial to await the first-quarter results for clearer signals. Investors should pay close attention to whether NIO continues to improve its vehicle margin and how well its new models are selling. Additionally, the cost savings from acquiring its manufacturing partner’s assets should be closely monitored.

NIO carries a Zacks Rank #3 (Hold) currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NIO Inc. (NIO) : Free Stock Analysis Report