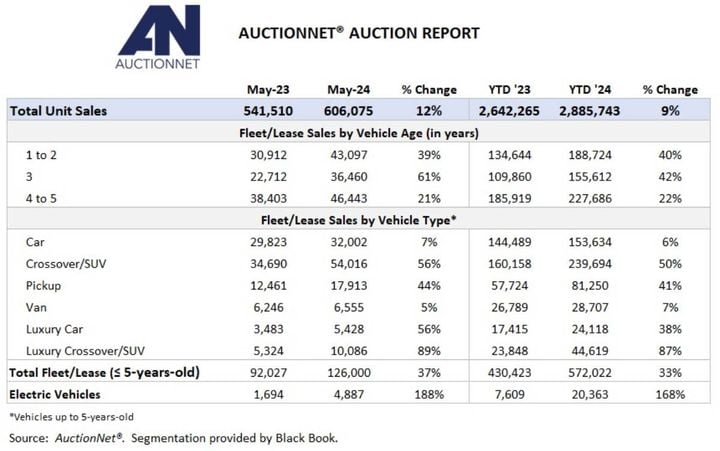

Sales during the first five months of the year reached 2.89 million units, a 9% improvement over 2023’s five-month total.

Graphic: AuctionNet

Wholesale auction sales reached just over 606,000 units in May, up 5% versus April and nearly 12% versus May 2023, according to data released June 6 from AuctionNet, according to AuctionNet figures released June 6.

Sales during the first five months of the year reached 2.89 million units, a 9% improvement over 2023’s five-month total.

Fleet/Lease Sales Increase at Healthy Clip

Both dealer and fleet/lease sales moved higher compared to April, with dealer volume rising 4% and fleet/lease volume increasing 6%.

Compared to May 2023, however, dealer volume was 1% lower last month while fleet/lease sales were up 37% (units under 5 years old). Year-to-date (YTD), dealer sales are down 3% and fleet/lease sales are up 33%.

“Beginning in late 2022 and throughout 2023, commercial fleets were able to acquire more new vehicles,” said Larry Dixon, vice president of auction data solutions for the National Auto Auction Association. “As such, there are far more used commercial vehicles being remarketed this year, especially rental from rental fleets, as fleets replace old vehicles with new ones. In addition, there was a large increase in new leases over the first half of 2021.”

Since most leases are 36 months/3 years, there has been a similar upward trend in off-lease vehicles over the first part of this year, Dixon added. “Note that new sales and leases fell off dramatically over the second half of 2021. We’ll see the same thing happen with off-lease volume this year. Also, a material rise in repossessions is driving commercial growth, such as lenders selling repossessed vehicles at auction.”

Compared to April, fleet/lease sales of 1-2-year-old vehicles jumped 19% last month, while sales of 3- and 4-to-5-year-old vehicles increased 9% and 2%, respectively. YTD, fleet/lease sales of vehicles up to 3-years-old are up 41%.

Across vehicle types, the YTD growth in mainstream car sales has been relatively modest, while light trucks and luxury vehicle sales have experienced substantial growth.

Pickup trucks and crossover SUVs dominated the top selling mainstream models at wholesale auctions in May.

Graphic: AuctionNet

EVs Surging Into Auction Channels

Fleet/lease sales of electric vehicles up to 5-years-old reached nearly 4,900 units in May, 13% more than in April and 188% higher on a prior-year basis.

Fleet/lease consignors have sold nearly 20,400 electric vehicles through AuctionNet auctions YTD, an increase of 168%.

“This trend has more to do with the fact that progressively larger numbers of new EVs were sold into commercial fleets over the past 1.5 years than before when sales were nascent and low,” Dixon said. “Basically, we’re seeing EV auction volume move higher because of the natural lag between new sales trends and subsequent used sales trends.”

While EV prices had been depressed heading into April, there have been signs of improvement over the past two months, at least for certain models.

For example, prices for high-volume 3-year-old Tesla Model Y and Model 3 prices grew by an average of 3% monthly in May, while wholesale prices overall fell by 2.7%.

Monthly AuctionNet data is derived from 265 NAAA member auctions that use AuctionNet. It is considered the most comprehensive source of wholesale auto auction sales data in the U.S.

Originally posted on Automotive Fleet