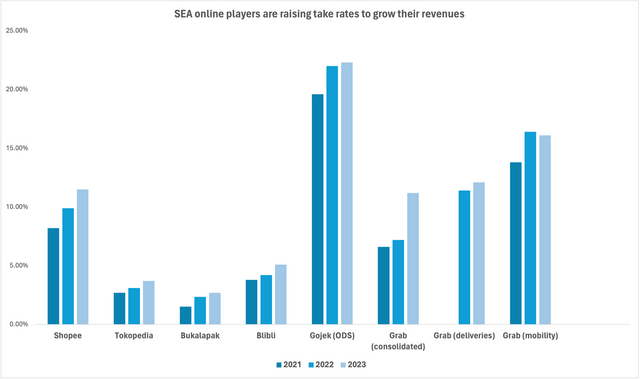

Triggered by the need to maximise profitability and real revenues since the pandemic, most online companies in Southeast Asia have gradually increased take rates, according to the report “E-commerce and Ride-Hailing: How High Can Take Rates Go ?” However, this strategy can also hurt the companies, especially in a competitive landscape.

Take rate is the fee a third-party platform or marketplace charges its merchants for facilitating their transactions on its platform. This includes commissions, service and transaction fees, and payments for services like advertising and logistics.

Source: Company Announcements

While a platform may succeed in increasing its revenue by pushing up the take rates on its platform, it could also lose users who may switch to competitor platforms. On the other hand, low take rates may lead to a drop in revenues and can thus hurt a platform’s profitability.

A consistent drop in GMV (gross merchandise value) can further put pressure on online platforms to raise take rates.

Falling GMV poses a concern

GMV growth of the Southeast Asian online platforms has slowed down post-pandemic after consumers returned to offline consumption making it their primary choice, according to the report.

This shift in consumer behaviour has put several companies in a difficult situation as they were already under pressure to earn more profits amid growing competition. GMV, a measure of business growth, is the total value of transactions or goods sold on a platform. GMV growth of companies like Tokopedia and Gojek (ODS) shrunk to -9% in FY2023.

Source: Company Announcements

E-commerce, food delivery take rates can go higher

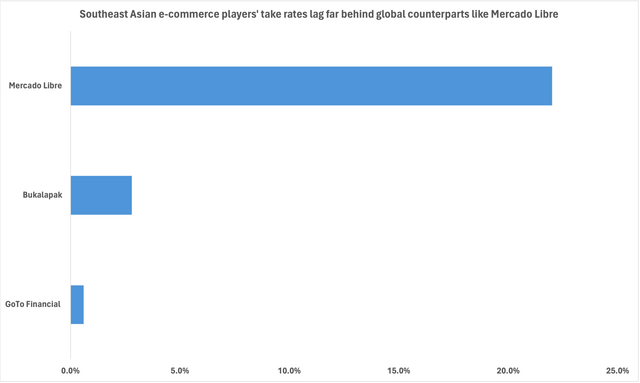

Take rates are typically different across verticals. E-commerce and food delivery platforms usually have lower take rates compared to ride-hailing and mobility platforms. Take rates of e-commerce players in Southeast Asia are quite lower than their global counterparts.

Indonesian marketplace Bukalapak’s take rate increased to 2.8% in Q1 2024 from 2.49% during the same period in the previous year but it is still far lower than the likes of Mercado Libre with a take rate of 22% in Q1 2024. The Uruguay-headquartered e-commerce and payment platform operates across 18 countries including its largest markets – Brazil, Mexico and Argentina.

Fintech has been a laggard with significantly low take rates. For example, GoTo Financial had a take rate of just 0.6% in Q1 2024. Fintech mostly includes digital payments but the focus is now shifting to high-margin lending businesses like Buy Now Pay Later (BNPL). A rise in the nascent lending business can help to push take rates higher. There is an obvious scope for the e-commerce players to increase take rates by adding subscriptions, advertising, and premium offerings. There is also room for higher take rates in food delivery, the report notes.

Source: DealStreetAsia Data Vantage

Ride-hailing and mobility is one segment where take rates are already high and almost at par with the international players. There is hardly any scope to raise take rates in these segments. A rising cause of concern for ride-hailing companies is to find a balance between increasing take rates and attracting drivers in major markets like Singapore where there is a shortage.