Amid the slowing growth of electric cars in India, Tata Motors, the country’s largest zero-emission car maker, has revised the long-term guidance for its own electric vehicle sales penetration downward to 30 percent from 50 percent forecasted earlier.

Yet, the company expects its EV penetration to be far higher than the 20 percent EV penetration expected in the market by the end of the decade.

In a presentation shared at the Investor Day 2024 on Tuesday, the automaker said it expects to drive up the penetration of electric vehicles in its portfolio to “30 percent plus by FY30”.

Last year, Shailesh Chandra, MD, Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility, had said that the company will be at 50 percent penetration by 2030.

“We are very clear that we will be 50 percent by 2030 as a company and do everything to bring all ecosystem players together to work towards that kind of target,” Chandra had said earlier.

To be sure, Niti Aayog, in 2022, guided an EV penetration of private electric four-wheelers to be 9-11 percent and penetration in shared electric four-wheelers to be 20-25 percent by the end of the decade. This is still lower than Tata Motors’ own EV sales penetration plan.

The company has predicted that the Indian passenger vehicle market will hit a 6-million-unit annual sales mark by FY30. Tata Motors will be gunning for an 18-20 percent market share, translating to 1-1.2 million annual car sales.

A 30 percent of this would easily translate to about 3-4 lakh electric car sales by the end of the decade, which is effectively more than four times its current annual sales of 73,000 units.

Tata Motors has had the early mover advantage in the electric passenger vehicle market. With a portfolio of five models, it has a market share of 73 percent in the electric car market. Electric vehicle penetration in its total car sales accounted for 13 percent in 2023-24.

Despite the introduction of the heavily updated Nexon EV and the all-new Punch EV, Tata Motors’ monthly volumes have remained around 5,500 to 7,000 units in the last couple of quarters.

FY25 has started negatively, with sales declining year over year in April and May.

With the early EV adopter’s market being satiated, the practicalities of driving range, charging network, and higher acquisition cost versus the internal combustion engine equivalent, have posed headwinds to further the adoption of electric vehicles.

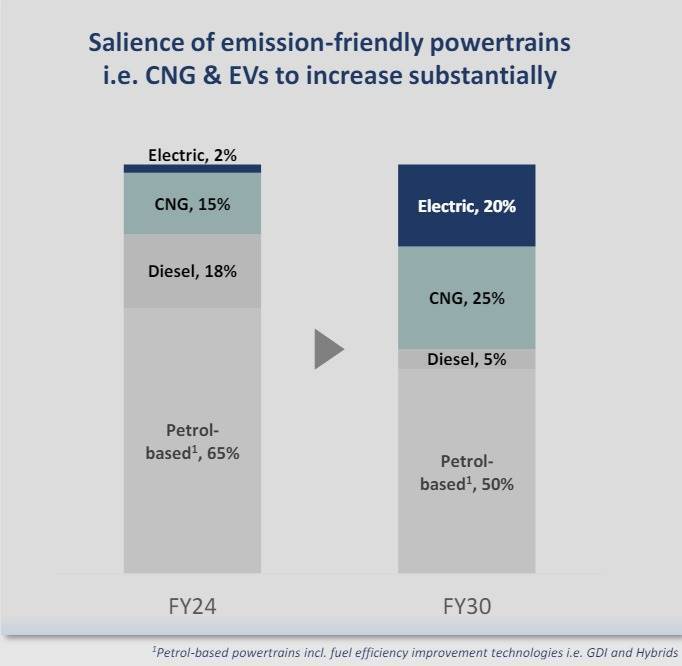

Currently, electric powertrains account for 2 percent of the passenger vehicles sold in the industry, while CNG contributes 15 percent. By the end of this decade, Tata Motors expects the share of electric powertrains in the industry growing to 20 percent, and CNG to 25 percent.

The automaker has lined up capital expenditure in the range of Rs 16,000 – 18,000 crore to be spent in its electric vehicle business from this year to FY30. The company plans to introduce a portfolio of 10 models by the end of the decade and expects the electric vehicle business to be operationally profitable from FY26.

Meanwhile, Tata Motors also plans to expand its electric vehicle-exclusive retail channel “.ev” to over 50 key cities over the next two years. In addition, the automaker will strengthen the charging infrastructure by expanding collaborations, to drive the installation and establishment of public as well as community EV chargers across India.