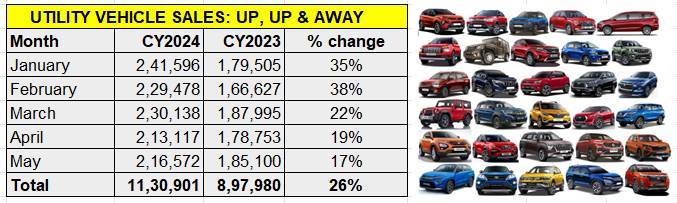

After the 189,917 units it sold in December 2023, the utility vehicle (UV) industry in India has registered monthly sales of over 200,000 units for the fifth month in a row in May 2024. As per SIAM wholesales data and also company numbers, the UV segment, which comprises SUVs and MPVs, dispatched a total of 216,572 units in May 2024, up 17% year on year (May 2023: 185,100 units).

There’s more news on the UV number-crunching front: cumulative five-month sales at 1.13 million units constitute a handsome 26% YoY increase (January-May 2023: 897,980 units). And, the 11,30,901 UVs sold between January and May 2024 are already 48% of the record 2.35 million UVs sold in CY2023, which were up 22% on CY2022’s 1.92 million UVs.

Cumulative UV sales of 1.13 million units in the first 5 months of CY2024 are a 26% YoY increase and already 48% of CY2023’s record 2.35 million UVs.

Of the 16 OEMs in the fray, five stand out in volume terms and between them make up for 202,740 units or 93% of the UVs dispatched to dealer showrooms in May 2024. Let’s take a look at how the top UV manufacturers fared in May 2024.

Maruti Suzuki tops the UV charts with 54,204 units but its market share remains unchanged at 25%. Mahindra & Mahindra, with 43,218 UVs (10,335 units more than in May 2023), sees its market share grow to 20% from 18%.

Maruti Suzuki tops the UV charts with 54,204 units but its market share remains unchanged at 25%. Mahindra & Mahindra, with 43,218 UVs (10,335 units more than in May 2023), sees its market share grow to 20% from 18%.

Market leader Maruti Suzuki India with 54,204 units, up 17% and 7.961 units more than in May 2023, remains on top but its UV market share gains are flat at 25.02% for May 2024 versus 24.98% in May 2023. The Vitara Brezza compact SUV (14,186 units) was its best-seller, followed by the Ertiga MPV (13,893 units), Fronx (12,681 units), and the Grand Vitara (9,736 units). May 2024 saw the Fronx cross the 150,000 unit sales mark in just 14 months after launch and cumulative sales currently stand at 161,702 units.

The star performance in May 2024 comes from Mahindra & Mahindra (M&M), which has achieved strong market share gains – 19.95% versus 17.76% in May 2023. With a portfolio laden with SUVs, the company reported domestic market wholesales of 43,218 units.

M&M’s 43,218 units in May 2024 are the highest yet in the year to date, and just 490 units below the 43,708 units in the festive month of October 2023.

M&M’s 43,218 units in May 2024 are the highest yet in the year to date, and just 490 units below the 43,708 units in the festive month of October 2023.

M&M’s May 2024 numbers constitute strong 31% YoY growth (May 2023: 32,883 units) and marks the fifth month in a row that M&M has surpassed the 40,000-unit dispatches mark (see data table below). May 2024’s dispatches are also its highest yet in the calendar year to date, and just 490 units below M&M’s best-ever monthly wholesales of 43,708 units in October 2023.

Tata Motors, with an estimated 33,689 units last month (up 14%), has pipped Hyundai Motor India to the No. 3 rank. Increased competition in the UV market has seen a marginal drop in the OEM’s market share to 15.55% from 16% a year ago. The battle between the compact SUV siblings Nexon and Punch has tilted in favour of the Punch from the beginning of this year. In May 2024, the Punch was the best-selling Tata product with 18,949 units to the Nexon’s 11,457 units.

Hyundai Motor India dispatched a total of 32,840 UVs last month, up 18% YoY (May 2023: 27,728 units). Hyundai retails 11 models in India SUV — two hatchbacks (Grand i10 Nios, i20), two sedans (Aura, Verna) and seven SUVs (Creta, Venue, Alcazar, Exter, and Tucson along with the all-electric Ioniq 5 and Kona) The Creta, whose facelifted version was launched in January, is the company’s No. 1 model by far – the 14,662 units sold in May are much above the Venue (9,327 units). As in April, SUVs accounted for 67% of Hyundai’s total passenger vehicle sales of 49,151 units in May 2024.

Kia India, with 19,500 UVs dispatched in May, takes fifth position amongst the 16 OEMs. This is a 4% increase over year-ago sales of 18,766 units. The new Sonet compact SUV, equipped with plenty of features and also ADAS and launched in January 2024, has emerged as Kia India’s highest-selling model in May with 7,433 units, followed by the Seltos midsize SUV (6,736 units) and the Carens MPV (5,316 units).

The Sonet has outsold the Seltos since January 2024.

The Sonet has outsold the Seltos since January 2024.

Interestingly, data analytics reveal that the Sonet has outsold the Seltos, which is Kia India’s first model launched in August 2019, for five straight months from January 2024. The Sonet’s cumulative January-May 2024 sales at 44,716 units are 31% more than the Seltos’ 34,038 units in the same period.

Toyota Kirloskar Motor continues to fire on all cylinders. In May 2024, the Japanese car, SUV and MPV manufacturer dispatched 23,979 passenger vehicles, which marks strong 26% YoY growth (May 2023: 19,079 units). Of this, UVs – at 19,289 units, up 37% YoY – accounted for 80% of total PV wholesales. The recently launched Urban Cruiser Taisor has opened its sales account with 2,180 units. Combined sales of the Urban Cruiser Hyryder and Rumion MPV were 5,825 units, as per SIAM data.

While the monsoon months could dampen demand marginally for SUVs and MPVs, there is little doubt that the UV segment will continue to sustain its double-digit growth, even on a high year-ago base. The market continues to expand with new models and there are more, like the Tata Curvv, expected later this year.