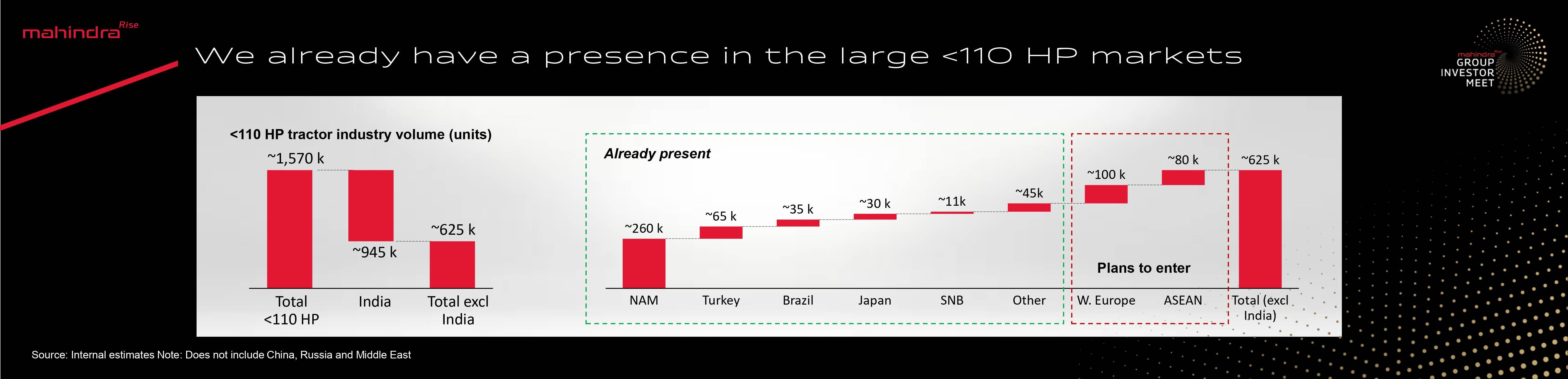

Mahindra & Mahindra Ltd, the world’s largest tractor maker by volume, plans to expand its operations internationally by entering Western Europe and ASEAN (The Association of Southeast Asian Nations), as it looks to solidify its global position.

Mahindra Tractors is expected to debut in ASEAN, starting with Thailand this year, followed by Western Europe next year. The company aims to double its international business in the next three years.

M&M is the largest tractor maker globally with a large consumer base in India. It sold 364,526 tractors in India during FY24 and exported 13,860 units. Besides India, the company has a manufacturing and assembly presence in North America, Brazil, Mexico, Finland, Turkey, and Japan, via its subsidiaries.

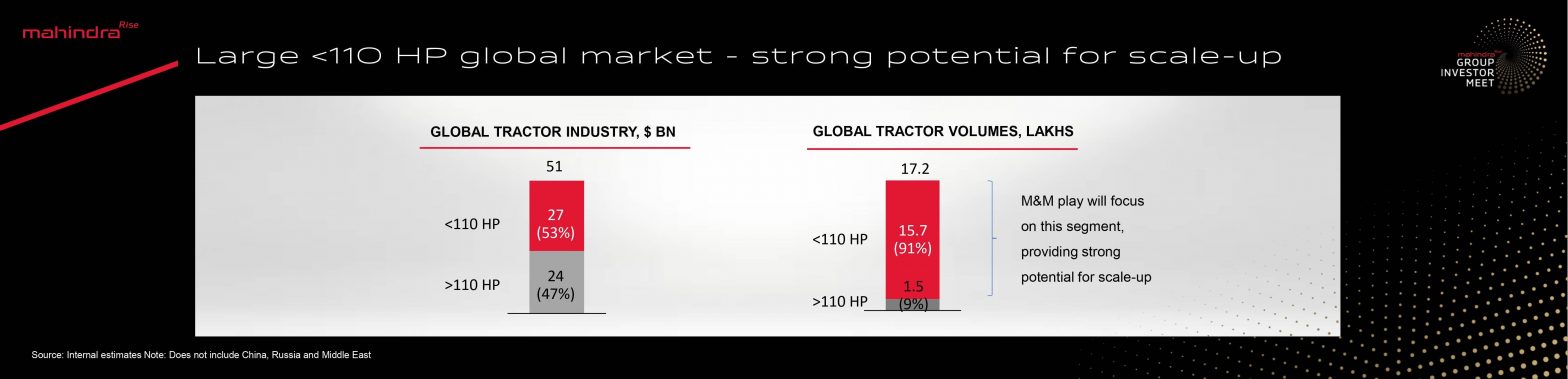

In the international market, M&M sees a huge potential to scale up in the tractor segment with less than 110 horsepower (HP). Tractors below 110 HP account for 91 percent of overall global tractor volumes.

“M&M play will focus on this segment, providing strong potential for scale-up,” the company said in the presentation. The company noted that it already has a strong presence in the less than 110 horsepower segments.

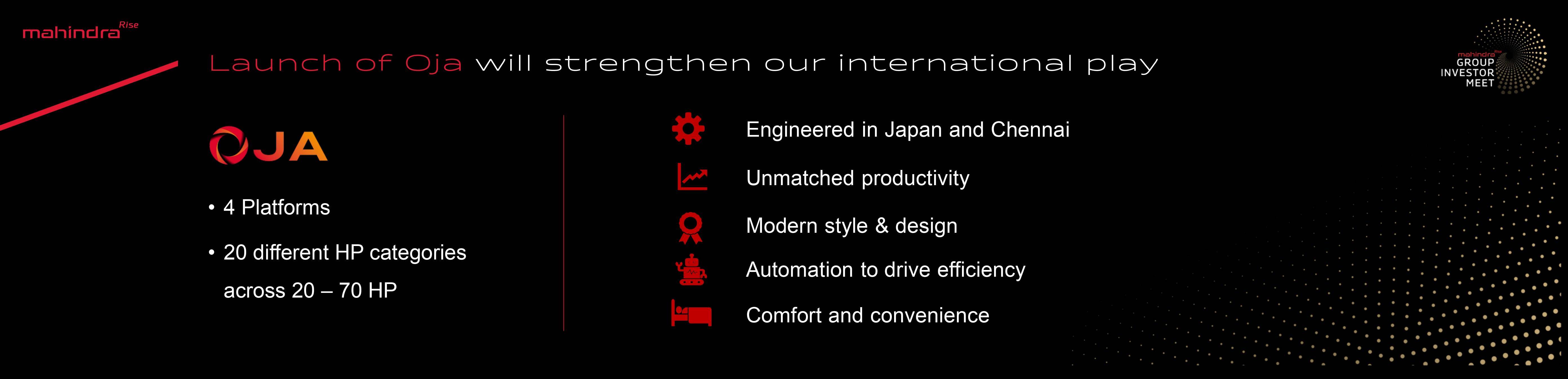

The company looks to capitalise on the recently launched Oja tractor range for international markets. Oja, developed with Japan-based Mitsubishi Mahindra Agriculture Machinery, comes in four platforms – ranging from sub-compact, compact, small utility and large utility tractors, with 20 different HP categories ranging from 20HP to 70HP.

The company will debut in ASEAN and Europe with Oja tractors. It will also leverage its strong product portfolio, on-ground channel experience, and its India scale and synergies to expand the international business.

Meanwhile, in India, M&M sees a significant headroom for growth. The company has a market share of around 41.6 percent in the domestic tractor market with Mahindra and Swaraj brands.

The shift from traditional crops towards high-value crops, higher cropping intensity, changing farmer aspirations and increasing labour costs are the major factors expected to drive the demand for tractors in India going forward.

Autocar Professional has already reported that M&M plans to invest Rs 5,000 crore over the next three years to build market share and retain its bottom line in the competitive Indian tractor market. It will spend about Rs 1,000 crore annually on building products, adding capacity, and maintaining plants, while Rs 600 crore has been set aside to meet future emission norms of TREM V.

Hemant Sikka, president of M&M’s farm equipment sector, has said the tractor market in India will grow at a CAGR of over 6% in the mid-to-long term.