Despite numerous delays and mounting competition from Ford, Stellantis, and the Chinese, the GM board decided to take $6 billion and pump its share price instead of investing in the company’s future.

A few short weeks after labor negotiations led to a six-week UAW strike at GM plants, GM board members approved a $10 billion accelerated stock buyback plan. This week, the board kicked off that initiative with a $6 billion purchase and raising its shareholders’ stock dividend by 33 percent (to 12 cents per share) in the first quarter … a move that, to this writer, seems like a blatantly cynical cash-grab and shockingly shortsighted dereliction of the board’s fiduciary duty to the well-being of the company.

Stellantis is serious

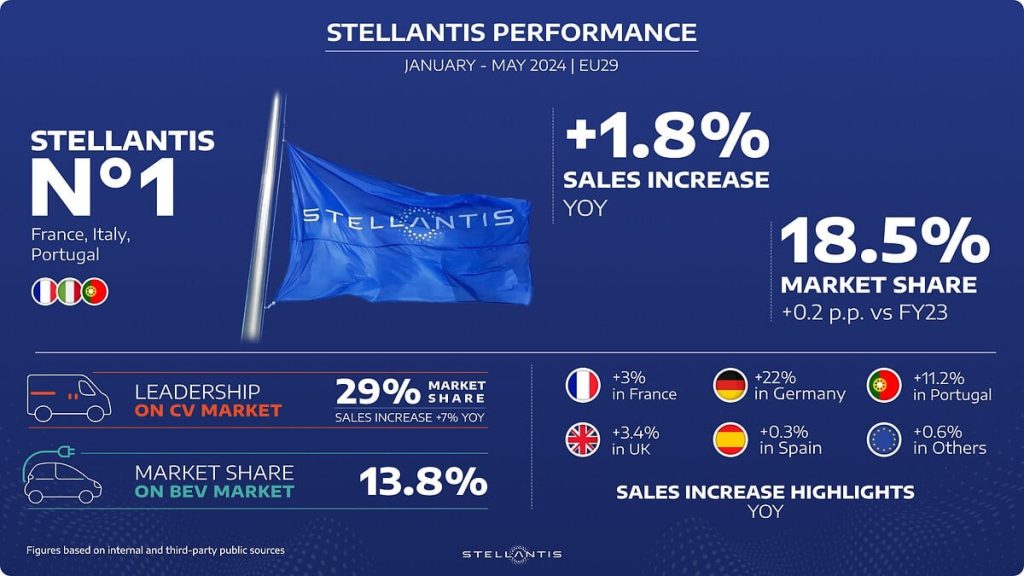

Stellantis may have been slow to the electric party back in 2020 and 2021, when it seemed like you couldn’t go two weeks without some OEM or other announcing plans to go “fully electric” by 2035. But the Carlos Tavares-led company seems like it’s rising to the challenge – in a big way.

“While the BEV market may be experiencing a slowdown, Stellantis remains undeterred, capturing a 13.8% share in the EU29 region,” writes Max McDee. “The company’s electric vehicles are leading the charge in France, where sales soared by 56% to reach a 37.9% market share.”

In Germany, the world’s number two producer of electric vehicles, Stellantis is on a charge. The company’s sales there are up 22% over the year before, and it remains a market leader in Italy on the strength of its Fiat, Alfa Romeo, and well-received new Lancia offerings.

To make matters worse for GM, Stellantis seems to have rediscovered the fact that Jeep is a young, fun brand, and the company announced plans today to launch an “affordable,” $25,000, all-electric Jeep Renegade somewhat sooner than later.

And Stellantis isn’t even a strong example! GM’s arch-rival Ford is securing some top new product talent, as well. The blue oval is ramping up its efforts to produce an affordable EV and get it to market as quickly as possible, and its compact Maverick hybrid truck and E-Transit electric van are dominating their respective markets

If you look at import brands, Hyundai and Kia are closing the gap with Tesla, experiencing double-digit growth in the EV market without Stellantis’ advantage of having started in the single digits. Hyundai, along with Tesla, have driven down the price of 300-mile, fast-charging EVs to well below the $47,218 average new car transaction price.

At the same time, Kia’s design team is going from strength to strength with cars like recently updated EV6, American-made, seven-passenger EV9, and upcoming EV3 compact all looking like real winners for the Korean brand.

It’s not just legacy brands

Upstart carmakers like Rivian, with its compact R3 (above) are also coming to eat GM’s lunch with fresh, innovative products that compete directly with GM’s bread-and-butter offerings like the Chevy Silverado (Rivian R1T), Tahoe (R1S), and the Blazer/Equinox (R2), which are still getting crushed in the marketplace by Tesla’s super best-selling Model Y.

And that’s saying nothing of the Chinese.

China is a problem for GM

Once upon a time, GM could depend on China to at least buy some Buicks here and there – but the domestic Chinese manufacturers have stepped up their game significantly in the past decade, to the point that it’s no longer clear whether or not Buick will still be a desirable brand in the world’s largest auto market in five-to-ten years’ time (or in the US, for that matter).

Meanwhile, GM’s big talk about its Ultium platform bringing costs down with the economies of massive scale seem to have stalled, with the company producing far fewer mainstream EVs like the Silverado and Blazer than you get the feeling they’d have liked.

What’s obviously needed for GM to survive the next big evolution of the auto market as it transition to electric fuel is more product. Better product. Cheaper product. And, while we’re at it, more significant investment in its workforce, so that they can not only help develop that next generation of GM EVs, but be able to afford to buy them, as well – something that the latest UAW deal tried to address, even as it failed to secure pensions for employees hired after the ’07/08 bailout.

Instead, GM is getting a stock buyback. As a GM fan, I hope they reconsider.

FTC: We use income earning auto affiliate links. More.