The outlook for Zacks Automotive – Foreignindustry is currently dim, as vehicle sales growth in major markets like China, Europe and Japan is expected to slow down due to weaker demand stemming from economic pressure. China’s exports are likely to be impacted by US and EU tariffs on its electric vehicles. Despite a rate cut by the European Central Bank, vehicle sales growth in Europe is anticipated to moderate. However, the industry’s valuation is favorable as it is trading at a discount compared to the S&P 500 and the broader automotive sector. Key industry players such as BYD Co Ltd BYDDY and Honda HMC present attractive investment opportunities.

Industry Overview

Companies in the Zacks Automotive – Foreign industry are involved in designing, manufacturing and selling vehicles, components as well as production systems. The foreign automotive industry is highly dependent on business cycles and economic conditions. China, Japan, Germany and India are some of the key foreign automotive manufacturing countries. The widespread usage of technology is resulting in a fundamental restructuring of the market. Stricter emission and fuel-economy targets and ramp-up of charging infrastructure, as well as supportive government policies, are boosting sales of green vehicles. With almost all firms intensifying their electrification game, competition is getting tougher with each passing day. Foreign automakers are now actively engaged in the R&D of electric and autonomous vehicles, fuel efficiency, along with low-emission technologies.

Key Investing Themes

China’s Auto Sales Growth to Decelerate: According to the China Association of Automobile Manufacturers, vehicle sales in China grew 10.6% year over year, reaching 6.72 million units in the first quarter of 2024. However, maintaining this growth rate seems unlikely as consumer sentiment remains weak due to the prolonged stress in the property market. Last month, overall car sales dropped 2.2%, following a 5.8% decline in April. Weak demand amid a sputtering economic recovery is a significant factor. The S&P Global forecasts 2024 light vehicle sales in China to rise a mere 2-4% in 2024. Moreover, China is facing potential tariffs on its electric vehicles from both the United States and the European Union. The EU recently imposed up to 38% additional tariffs on Chinese EVs. In a more aggressive move, the U.S. government quadrupled tariffs on China-made EVs to 100% to counter what it considers unfair pricing practices by Chinese manufacturers and to protect American jobs.

Challenges in Japan’s Car Market: Annual vehicle sales in Japan were above 4 million units until 2019, but since then, they have not surpassed this mark. In 2023, total passenger car sales in Japan reached 3.99 million vehicles, up 15.6% year over year and signaling a promising turnaround following four consecutive years of contraction. But last year’s momentum is not likely to persist this year. New vehicle sales in the country from January to May 2024 declined 14.8% amid economic weakness and sluggish demand. According to S&P Global, light vehicle sales in Japan are projected to be down 4% to up 2% year over year in 2024. Contributing to the challenges, a weaker yen against the U.S. dollar has increased the cost of importing raw materials and components, which are often priced in dollars, leading to inflationary pressure. Additionally, the recent car testing scandal in Japan is likely to impact the near-term prospects of the country’s auto market.

EU Auto Market Dynamics: Europe’s vehicle sales grew by around 7% in the first quarter of 2024, driven by robust passenger car sales in Russia, Turkey and Western Europe. The five largest Western European markets — Germany, France, Italy, Spain, and the UK — posted an average increase of 6.8%. Experts attribute this to the backlog of orders from 2023, suggesting that annual sales growth in 2024 will moderate. After a 13.9% increase in Western Europe last year, vehicle sales are expected to grow 4.5% in 2024, according to MarkLines. Despite geopolitical uncertainties, the European Central Bank’s first rate cut in five years and easing supply chain issues may support growth. However, automakers’ efforts to reduce fixed costs by cutting production could limit output. Additionally, potential Chinese retaliation over tariff issues poses a risk, particularly for German automakers like Volkswagen, Mercedes and BMW, which have significant sales in China.

India’s Car Sales Growth Trajectory: In 2023, India retained its position as the world’s third-largest automotive market, ahead of Japan for the second consecutive year. The country’s passenger vehicle market reached a significant milestone, surpassing 4 million units for the first time. New vehicle sales grew by 8.2% in the first three months of 2024. Factors such as a growing population, economic growth, government fiscal stimulus, rising motorization and the introduction of new models are expected to continue driving sales this year. SUVs dominate India’s automotive market, with sales exceeding 200,000 units for the fifth consecutive month in May. Rising consumer incomes and easy financing options with lower EMIs (equated monthly installments) have bolstered SUV sales. While SUVs are expected to continue increasing their market share, the growth in two-wheeler sales will also contribute to overall sales over time.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Automotive – Foreign industry within the broader Zacks Auto-Tires-Trucks sector currently carries a Zacks Industry Rank #167, which places it in the bottom 33% of around 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates dull near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are losing confidence about this group’s earnings growth potential. Over the past year, the industry’s earnings estimates for 2024 have moved 11.5% south.

Before we present a couple of stocks that investors can still buy, let’s look at the industry’s recent stock market performance and current valuation.

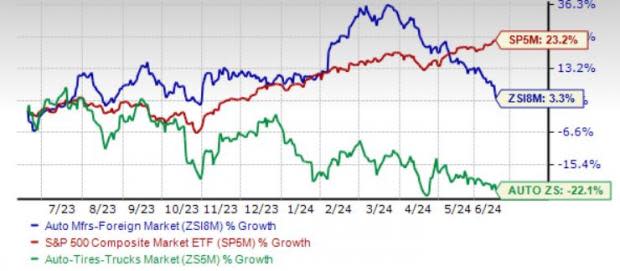

Industry Tops S&P 500 But Lags Sector

The Zacks Automotive – Foreign industry has outperformed the Auto, Tires and Truck sector but lagged the Zacks S&P 500 composite over the past year. The industry has moved up 3.3% compared with the S&P 500’s growth of roughly 23%. Meanwhile, the sector has contracted 22.1% over the same timeframe.

One-Year Price Performance

Industry’s Current Valuation

Since automotive companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio.

Based on trailing 12-month enterprise value to EBITDA (EV/EBITDA), the industry is currently trading at 8.02X compared with the S&P 500’s 19.65X and the sector’s 14.38X.

Over the past five years, the industry has traded as high as 12.55X, as low as 6.76X and at a median of 9.26X, as the chart below shows.

EV/EBITDA Ratio (Past Five Years)

2 Stocks to Buy

BYD: China-based BYD is a prominent player in automobile research, manufacturing and distribution. It also produces secondary rechargeable batteries and mobile phone components. With a vertically integrated structure encompassing mines, battery production and chip manufacturing, BYD holds a competitive edge. The company has a robust international presence across Asia, Europe and Latin America, making significant inroads in markets such as Japan, India, Malaysia, Australia, Singapore, Israel and Europe.

BYD’s diverse electric vehicle lineup, including models like Seagull, Denza, and Yangwang, has garnered global acclaim. The company recently introduced its fifth-generation DM (dual mode) hybrid technology for plug-in hybrid electric vehicles, underscoring its innovation in the EV sector. Committed to cost-reduction across its production processes, BYD reported year-over-year revenue and profit growth of nearly 4% and 11%, respectively, in the first quarter of 2024. The company expects its sales volume to increase by over 20% in 2024.

BYD currently has a Zacks Rank #2 (Buy) and a Value Score of B. The consensus mark for 2024 and 2025 revenues and earnings implies year-over-year growth of 60% and 15%, respectively. The Zacks Consensus Estimate for 2024 and 2025 earnings per share has been upwardly revised by 4 cents and 8 cents over the past 60 days to $3.02 and $3.68, respectively.

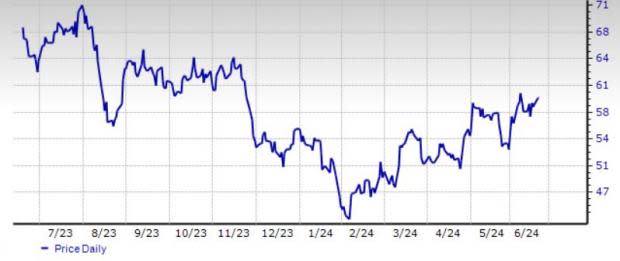

Price : BYDDY

Honda: Based in Japan, it is one of the prominent manufacturers of automobiles and the largest producer of motorcycles in the world. Honda’s hybrid-focused strategy is thriving. It projects fiscal 2025 sales volumes from the Motorcycle and Automobile segments to be 13.06 million units and 2.97 million units, implying year-over-year growth of 7% and 4%, respectively. HMC’s electrification push is also praiseworthy. Honda 0 Series — the flagship series of Honda EVs — will be launched in North America in 2026 and then globally, with seven models by 2030. The company aims to produce 2 million EVs annually by 2030 and is making efforts to lower overall production costs by 35%.

Honda plans to establish a comprehensive, vertically integrated EV supply chain, focusing on reducing battery costs by over 20% in North America by 2030. It aims to lower overall production costs by 35% and secure batteries for the production of 2 million EVs annually by the end of the decade. Encouragingly, it also remains committed to increasing shareholders’ returns via dividends and stock buybacks.

HMC currently has a Zacks Rank #2 and a VGM Score of B. The consensus mark for fiscal 2025 and 2026 revenues implies year-over-year growth of 1% and 1.3%, respectively. The Zacks Consensus Estimate for fiscal 2025 earnings per share has been upwardly revised by 9 cents to $4.50. The consensus mark for fiscal 2026 EPS is pegged at $4.66, marking a 3.7% year-over-year uptick.

Price & Consensus: HMC

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report