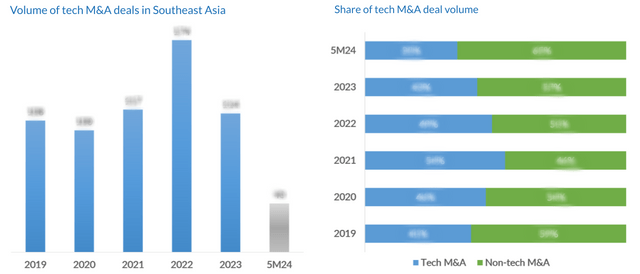

Following peak activity in 2022, Southeast Asia witnessed a notable decline in mergers and acquisitions (M&As) of tech companies in 2023. Deal volumes plummeted by over a third as global economic challenges prompted investors to become more selective, according to DealStreetAsia’s latest report SE Asia Tech M&A Review 2024.

The first five months of 2024 point to a further decline, with quarterly deal activities dropping below the five-year average of 30 transactions since Q4 of last year.

Among the six largest Southeast Asian markets, Indonesia saw the steepest decline (51% year-on-year) in tech M&A deal volume in 2023, corresponding to a more than 60% annual drop in venture capital funding for two consecutive years. The outlook for the region’s largest economy in 2024 also looks weak, given a 69% decrease in M&A deal volume in the first five months of this year.

Singapore, usually the region’s leader in tech M&A activity, experienced a 33% YoY contraction in deal volume in 2023. However, its performance in early 2024 has been relatively stable compared with the same period of last year.

Malaysia, which had a steady flow of deals from 2020 to 2022, saw a 38% YoY drop in deal volume in 2023. Vietnam was the only market in the region with positive momentum last year.

Alpha JWC co-founder and general partner Jefrey Joe said his company has adapted its M&A strategy to focus more on strategic mergers given the VC funding slowdown and shifts in tech company valuations.

“Companies are increasingly merging to craft a more compelling, end-to-end growth narrative as part of their strategic fundraising efforts. We prioritise M&A opportunities that allow companies to gain scale, making them more attractive to investors,” said Joe.

Weakness is largely in domestic M&A activity

The decline in tech M&As in Southeast Asia in 2023 was largely due to a sharp drop in domestic activities. Domestic acquisitions plummeted by nearly half, a much steeper decline than the 22% drop in foreign acquisitions (i.e when the acquirer is not headquartered in the same country as the target).

Domestic acquisitions comprised just 35% of total tech M&As in 2023, the lowest share since at least 2018. Singapore, which led foreign acquisitions in 2022 with 32 deals, saw an 84% decrease to just five deals in 2023.

Domestic acquisitions in Singapore also fell significantly, dropping 63% year-on-year. As a result, foreign acquisitions drove 74% of tech M&A activities in the city-state in 2023, up from 52% in 2022.

Companies based in the US were the top foreign acquirers in the region in 2023, completing 18 deals, compared with 16 the previous year.

Source: DATA VANTAGE

Source: DATA VANTAGE

“The appetite of foreign investors for tech companies in Southeast Asia has witnessed significant fluctuations in recent years, closely tied to global economic conditions and regional market dynamics,” said Adrian Li, founder and managing partner, AC Ventures.

Li noted that certain sectors, such as digital financial services, continue to attract substantial interest, indicating a sustained investor appetite in specific tech sub-sectors, despite a slowdown in large-scale deals.

Top sectors under pressure

Fintech and e-commerce, which were among the top verticals of 2022, experienced over 50% fall in deal volume in 2023, per DealStreetAsia’s report. However, a reset in startup valuations is expected to sustain a reasonable number of deals in these verticals, according to the report.

Traditional financial services saw a 59% YoY decline in M&A deal volume to seven. This pushed the sector to fifth place, down from third place in 2022, when expansion into banking, multifinance, and securities trading had resulted in a flurry of deals.

Fintech and Software & IT sealed the most number of tech M&A deals in 2023.

Source: DATA VANTAGE

The restructuring of the global supply chain, prompted by US-China decoupling, is anticipated to create acquisition opportunities in Vietnam, Thailand, and Malaysia, as well as in Singapore’s financial services sector.

Companies and investors are increasingly looking to Southeast Asia as a neutral ground for tech investments, driven by the desire to mitigate risks associated with US-China trade disputes and regulatory crackdowns, said Terence Quek and Favian Tan, M&A specialists at Rajah & Tann Singapore LLP.

“As a result, Southeast Asia has become an attractive alternative for tech M&A activities, benefiting from companies looking to relocate their supply chains, as well as diversification strategies of both Western and Chinese investors and entrepreneurs,” Quek and Tan said in a joint response to DealStreetAsia.

Insiders express optimism

All industry insiders interviewed by DealStreetAsia for the report agree that a recovery in tech M&A activities in the next 12-24 months is to be expected.

Joe believes that the tech M&A market cycle is nearing its bottom, predicting a resurgence as funds seek strategic investments. “With venture funds, including ours, needing to deploy capital, we anticipate a resurgence in M&As as funds look to invest strategically,” he said, adding that the shift towards more realistic valuations and terms is creating a conducive environment for deals to occur.

Quek and Tan said recovery is already happening: “In terms of deal activity, there has been a significant increase in the number of tech M&A transactions in Singapore and in the region in 2024 year-to-date, compared to the slowdown witnessed in 2023 in the face of headwinds created by crypto and tech winter.”

Both highlighted that emerging technologies and business verticals such as climate tech and AI are poised to grow in the next 12-24 months.

“We anticipate significant investments in technologies that enable businesses to achieve environmental goals while enhancing operational efficiencies. Another area of keen interest is the integration of AI across Southeast Asian businesses,” said Li.

The SE Asia Tech M&A Review 2024 report covers M&A transactions involving homegrown tech companies in Southeast Asia. It captures:

- The volume of tech M&A deals in Southeast Asia since 2019

- Tech M&As broken down by country in the last five years

- Top tech M&A deals in SE Asia in the last five years

- Outlook for 2024

- Interviews with experts

The report is available exclusively to DealStreetAsia – DATA VANTAGE subscribers. Subscribe/upgrade your subscription now to access our entire set of reports.