Hyundai Motor India is very much in the news these days, what with the company readying to tap the booming Indian equity market for its IPO or its share of Hyundai’s global sales surpassing the 15% mark for the first time. Like its peers and main rivals like Maruti Suzuki, Tata Motors, Mahindra & Mahindra and Toyota Kirloskar Motor, Hyundai Motor India has been a beneficiary of the wave of consumer demand for SUVs.

A deep dive into the Korean car and SUV manufacturer’s wholesales data for the past nine fiscal years reveals just how much demand for grown for the company’s SUVs, and in turn the SUV share of Hyundai’s overall passenger vehicle sales.

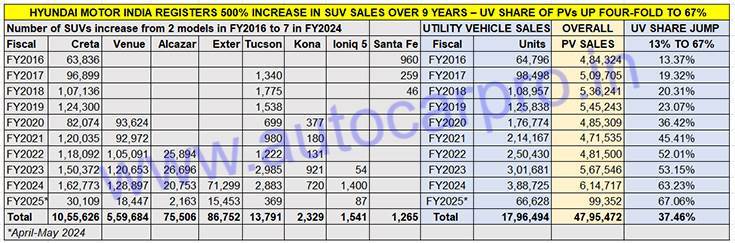

From two products – Creta and Santa Fe – and total SUV sales of 64,796 units in FY2016, Hyundai Motor India has seen its SUV stable expand to seven models (Creta, Venue, Alcazar, Exter, Tucson, Kona and Ioniq 5) and sale of 388,725 units in FY2024. That’s a massive 500% increase over nine years, a period which has the SUV share of Hyundai Motor India’s passenger vehicle (PV) sales jump 373% from 13.37% in FY2016 to 63.23% in FY2024, and by 400% to 67% if one factors in the latest dispatches in the first two months of FY2025 (see data table below).

From two products and total SUV sales of 64,796 units in FY2016, Hyundai Motor India’s SUV stable has expanded to seven models and SUV sales jump to 388,725 units in FY2024.

From two products and total SUV sales of 64,796 units in FY2016, Hyundai Motor India’s SUV stable has expanded to seven models and SUV sales jump to 388,725 units in FY2024.

The period from FY2016 to April-May 2024 – 110 months – has seen cumulative Hyundai SUV wholesales at 1.79 million units, accounting for 37.46% of the total 4.79 million overall passenger vehicle sales achieved by the Korean automaker in India.

Let’s take a closer look at each of the seven SUV models that Hyundai retails in India and how they have performed in the ultra-competitive marketplace.

CRETA SELLS 1.05 MILLION UNITS AND COUNTING

CRETA SELLS 1.05 MILLION UNITS AND COUNTING

The Hyundai Creta, launched in July 2015, is the first Hyundai SUV to have crossed a million sales in India, news which Autocar Professional broke on February 18, 2024. Not only is the Creta India’s longstanding No. 1 midsize SUV but it continues to be the biggest contributor to Hyundai’s SUV numbers. The Creta clocked its best 12-month sales in FY2024 (162,773 units), helping power Hyundai to its best-ever fiscal year PV sales of 614,717 units and accounted for 42% of SUV sales and 26% of PV sales.

The Creta got a booster shot on January 16 this year with the launch of the MY2024 facelifted Creta, which has helped further accelerate demand for the model. FY2025 has opened strongly for the Creta with combined sales of 30,109 units in April-May 2024. The electric avatar of the Creta is planned for launch at the end of FY2025.

![]() VENUE: SMALL CAN ALSO BE BIG

VENUE: SMALL CAN ALSO BE BIG

The second best-selling SUV for Hyundai in India is its first-ever compact SUV – the Venue. Launched just when the pandemic kicked in around early 2020, the Venue has gone on to cross the half-a-million sales milestone, 55 months after launch. Till end-May 2024, the Venue has sold a total of 559,684 units and has contributed to 40% of the company’s SUV sales since FY2020 (13,98,405 units).

The Hyundai Venue’s best 12-month performance was in FY2024 with 128,897 units, growing 7% on FY2023’s 120,653 units albeit slower growth to FY2023’s 15% YoY increase (FY2022: 105,091 units).

In its quick commentary on the Venue, Autocar India states: “The compact SUV is more than a scaled-down Creta. It may lack a bit of presence but it’s a fine choice for urban buyers. A very likeable, user-friendly compact SUV.”

EXTER TURNS HYUNDAI’S THIRD-HIGHEST SELLING SUV IN 11 MONTHS

EXTER TURNS HYUNDAI’S THIRD-HIGHEST SELLING SUV IN 11 MONTHS

Launched on July 10, 2023, the Exter, Hyundai’s second compact SUV, is an unmitigated success. With total sales of 86,752 units in just 11 months till end-May 2024, the Exter has vaulted into the third best-selling SUV for the Korean OEM, after the market-leading Creta and the Venue.

In FY2024, the Exter sold 71,299 units and accounted for 18% of Hyundai’s total SUV sales of 388,725 units. And in April-May 2024, with 15,453 units, the youngest Hyundai SUV has contributed 23% to total UV sales after the Creta 45% share and the Venue’s 28 percent. In fact, in the first two months of FY2025, the Exter is just 2,994 units behind the Venue, its compact SUV sibling.

The entry-SUV category within the sub-four-metre-SUV segment is witnessing strong demand and the Exter’s aggressive pricing strategy has paid off. It is estimated that between 20,000-22,000 entry SUVs are sold each month and Hyundai aims to tap the potential here.

ALCAZAR: THREE YEARS OLD & OVER 75,000 SALES IN INDIA

The Alcazar, Hyundai Motor India’s flagship, turned three years old in the Indian market on June 18, 2024. The three-row, feature-laden Alcazar midsize SUV is based on the company’s best-selling product, the Creta and packs the strengths of India’s No. 1 midsize SUV along with the flexibility of six or seven seats.

Since launch, the Hyundai Alcazar has sold 75,506 units in the domestic market. FY2023 was the Alcazar’s best fiscal year yet – 26,696 units (up 3.1% YoY). However, the next fiscal (FY2024) saw domestic market sales reduce by 22% to 20,753 units. Wholesales in the first two months of FY2025 at 2,163 units are down 52% YoY (April-May 2023: 4,480 units).

At launch, the Alcazar was Hyundai Motor India’s fifth SUV after the Creta, Venue, Tucson and Kona. Since then, Hyundai’s SUV portfolio has expanded to seven with the addition of the Ioniq 5 EV and Exter compact SUV.

TUCSON: 13,791 UNITS SOLD SINCE NOVEMBER 2016

Launched on November 14, 2016, the Tucson was the third Hyundai SUV to go on sale in India and plugged the gap between the Creta and the more upmarket Santa Fe. The third-generation Tucson marked the comeback of the model in India, following the discontinuation of the first-gen Tucson after a short stint.

On August 10, 2022, Hyundai Motor India launched the fourth-generation Tucson aiming to sell 5,000 units a year. The new Tucson, which is high on space, comfort, tech and features, was the first Hyundai and the only SUV in its segment in India at the time to be equipped with ADAS technology.

Altogether since launch 91 months or seven-and-a-half years ago, the premium executive SUV has sold a total of 13,791 units in India, with its best fiscal year performance coming in FY2023: 2,985 units.

KONA AND IONIQ 5 EVs: 3,870 units sold in India

KONA AND IONIQ 5 EVs: 3,870 units sold in India

Hyundai Motor India retails two EVs in India: the Kona Electric and the Ioniq 5. The Kona was the first all-electric Hyundai model launched in India on July 9, 2019. The well-equipped, smartly laid out zero-emission SUV can deliver up to 300km on a single charge in the real world and takes just 57 minutes to juice up with a DC fast-charger.

The Ioniq 5, launched on January 11, 2023 at the Auto Expo, has a lot going in terms of winning credentials. In CY2022, it had won the World Design of the Year and World Electric Car of the Year awards, along with the 2022 World Car of the Year award. And, it was not long before it also won top honours as the 2024 Autocar Car of the Year as well as bagged the EV of the Year accolade.

In a span of 17 months since its India launch, the Ioniq 5 has sold a total of 1,541 units including 1,400 units in FY2024.

HOW THE UV SHARE OF HYUNDAI’S RIVALS STACKS UP SINCE FY2016

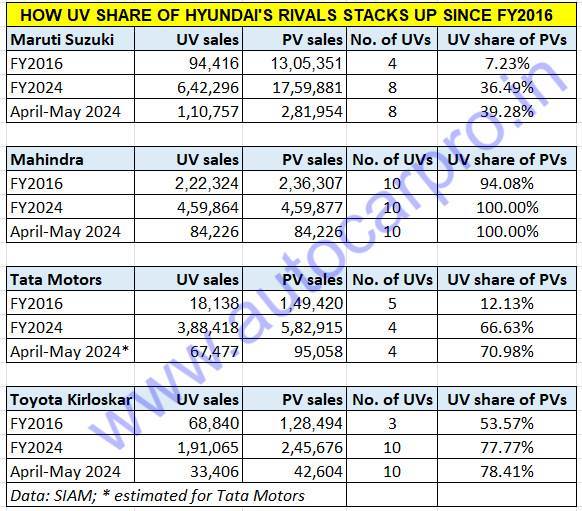

When it comes to SUV share of passenger vehicle sales, let’s also take a quick look at how Hyundai’s main rivals have fared in the same timeframe. A quick and comparative look at Hyundai Motor India’s four key rivals – Maruti Suzuki India, Mahindra & Mahindra, Tata Motors and Toyota Kirloskar Motor – reveals a similar trend when it comes to the increased share of utility vehicle sales to their overall passenger vehicle dispatches. This is also reflected in the increased number of UV models on offer.

Maruti Suzuki India, which is currently the UV market leader, was the No. 2 after Mahindra & Mahindra, with Toyota ranked third and Tata Motors fourth. In FY2016, Maruti Suzuki sold a total of 94,416 UVs which accounted for a 7% share of its total PV sales of 1.30 million units. Nine fiscals on, that UV number increased nearly six-fold to 642,296 units and a 36% share of Maruti Suzuki’s record PV sales of 1.75 million units. In FY2025’s first two months, the UV share has further increased to 39 percent.

That’s not all. The growth is also reflected in the number of UV models on offer – from 4 (Gypsy, Vitara Brezza, Ertiga, S-Cross) in FY2016 to 8 (Brezza, Ertiga, Fronx, Grand Vitara, Ignis, Invicto, Jimny, XL6) in FY2024.

Mahindra & Mahindra, which has always had an SUV-laden portfolio and far higher than its PV counterparts, had sold 222,324 SUVs in FY2016. At the time it had around 10 SUVs (Bolero, Bolero Plus, Quanto, Thar, KUV100, TUV300, Scorpio, XUV500, Xylo and Rexton) and two PVs (Vibe and Verito). Nine years down the line, in FY2024, M&M more than doubled FY2016’s sales at 459,864 units and currently retails 10 models (Bolero, Bolero Neo, Bolero Neo+, Marazzo, Scorpio N, Scorpio Classic, Thar, XUV3XO, XUV400, XUV700).

Tata Motors, which has seen a huge turnaround in its fortunes in the past four-odd years, has seen the SUV share of its PV sales jump from 12% to 71% in end-May 2024. In FY2016, with five models (Sumo, Sumo Grande, Safari, Aria, Xenon). Tata had sold 18,138 UVs accounting for 12.13% of total PV sales of 149,420 units. In FY2024, the company, which has a four-model SUV line-up comprising the Nexon, Punch, Harrier and Safari, dispatched 388,418 SUVs, which comprised 67% of its record PV sales of 582,915 units. And in April-May 2024, the SUV share of PV sales has further risen to 71 percent.

A resurgent Toyota Kirloskar Motor too has seen its UV share of PV sales rise strongly. In FY2016, the company dispatched a total of 68,840 UVs comprising three models (Innova, Fortuner, Prado) accounting for a 53% share of PV sales of 128,494 units. In FY2024, TKM sold 191,065 UVs which accounted for a 78% share of total and record PV sales of 245,676 units. And the UV portfolio has expanded substantially to 8 models – Innova Crysta, Innova Hycross, Fortuner, Hilux, Land Cruiser, Rumion, Urban Cruiser Hyryder, Taisor and Vellfire.