India’s western region, particularly Maharashtra and Gujarat, has always been an important hub in the country’s automotive industry. The western region’s strategic location, robust infrastructure, skilled workforce, and conducive business environment have collectively made it a magnet for both domestic and international automotive giants. Automakers such as Tata Motors, Mahindra & Mahindra, Maruti Suzuki India, Bajaj Auto, and MG Motor India, have major operations in this area. Major component suppliers like Schaeffler, Varroc, Bosch, and Minda also have a noticeable presence here. This is what makes the western region a force to reckon with, among India’s key automotive hubs, including those in the North and South.

An estimated Rs 89,000 crore is slated to be invested by leading passenger vehicle OEMs like Maruti Suzuki India, Tata Motors, Hyundai Motor India, Mahindra & Mahindra, and MG Motor India, in the western belt, over the next three to five years to drive capacity to nearly 1.8 million units annually, to cater to both ICE and future EV products. A similar investment is likely from key Tier-I component suppliers to support the future growth and expansion plans of their OEM customers.

Korean carmaker Hyundai is likely to spend around Rs 6,000 crore in revamping the General Motors plant in Talegaon (Maharashtra). The plant will be revamped into a nearly-130,000-unit facility. JSW MG Motor India, on the other hand, will invest Rs 5,000 crore to set up its second plant in Halol (Gujarat) and augment capacity by almost 1,50,000 units annually. India’s largest carmaker Maruti Suzuki India has committed an investment of nearly Rs 16,000 crore to set up a mega 1-million-capacity plant — its second facility in Gujarat — that is likely to be commissioned by FY29.

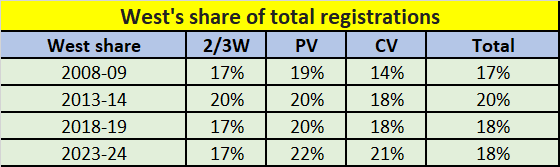

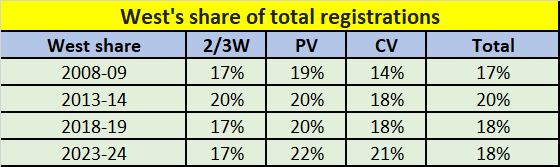

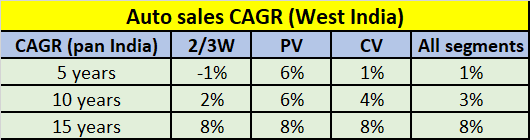

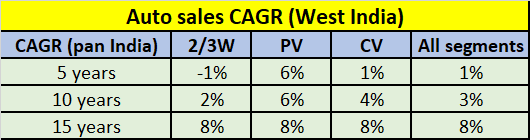

Source: ICRA, CMIE

These mega investments while target readiness to meet future demand from a growing Indian market, also come in the wake of the industry’s rapid transition towards electric mobility with EVs fast emerging as new sustainable mobility solutions.

Electrification is receiving a major push from the government that intends to drive up to 30% penetration by 2030, and is incentivising both EV manufacturing as well as demand by virtue of various subsidies.

The rise of the western region as an automotive powerhouse can be traced back to the 1950s, when after India’s independence, Maharashtra, with its capital Bombay (now Mumbai), was one of the first states to undergo rapid industrialisation. The establishment of industrial zones and the Mumbai-Pune corridor paved the way for the automotive sector’s growth. Moreover, cities like Pune, Chakan, Nashik, and Aurangabad, too, evolved as the go-to destinations for global automotive companies to set up their manufacturing bases from where they could cater to both the domestic and overseas markets.

Gujarat also followed suit with its pro-business policies, strategic port locations, and industrial parks — all attracting substantial investments from global players. Today, Tata Motors, Suzuki Motor Corporation, MG Motor India, and Honda Motorcycle & Scooter India, are some top names that are operating state-of-the-art facilities in Gujarat’s Sanand, Vithalpur, and Halol.

Factors driving investment in western India

The proximity to major ports like Mumbai, Kandla, and Mundra facilitates seamless export and import activities, enhancing the global competitiveness of automotive companies based in the region. Furthermore, the presence of well-developed industrial zones, logistics parks, and excellent road connectivity like that offered by the Mumbai-Pune expressway, provides a solid foundation for manufacturing and supply chain operations in the region.

The western belt also boasts a rich talent pool, with numerous engineering colleges and technical institutes, contributing to a steady supply of skilled professionals, and the focus on R&D and innovation, supported by

the likes of Tata Motors European Technical Centre as well as the Automotive Research Association of India (ARAI), both housed in Pune, ensures that the region remains at the cutting edge of the advancements in auto technology.

Therefore, the auto industry in West India significantly contributes to the local and national economy. Maharashtra and Gujarat together account for a sizable share — nearly 25% — of India’s automotive production and exports. The industry’s growth has a multiplier effect, stimulating ancillary industries such as steel, rubber, plastics, and electronics.

This feature was first published in Autocar Professional’s June 15, 2024 issue.