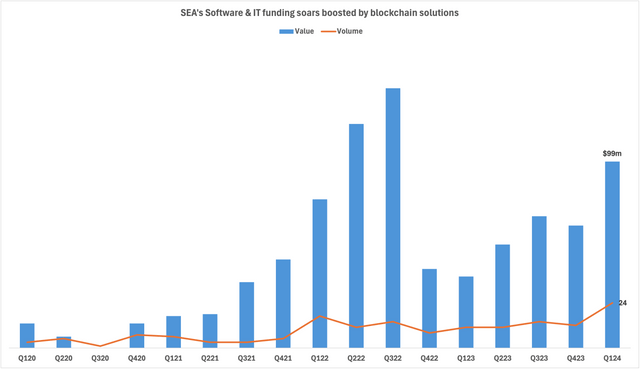

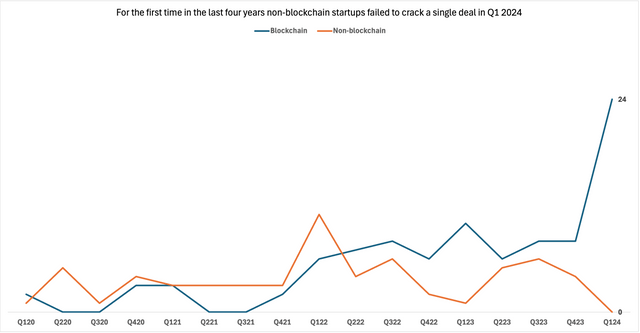

Demand for startups in Southeast Asia’s Software & IT vertical soared in the first quarter of 2024 but the interest was fuelled entirely by blockchain startups. Q1 2024 was the first quarter in the last four years when non-blockchain startups couldn’t clinch a single deal from private equity (PE) or venture capital (VC) investors.

Software & IT ranked second, behind the fintech vertical, in terms of the number of deals sealed (24) and funds raised ($99 million) from PE-VC investors in Jan-March 2024, according to the SE Asia Deal Review: Q1 2024 report.

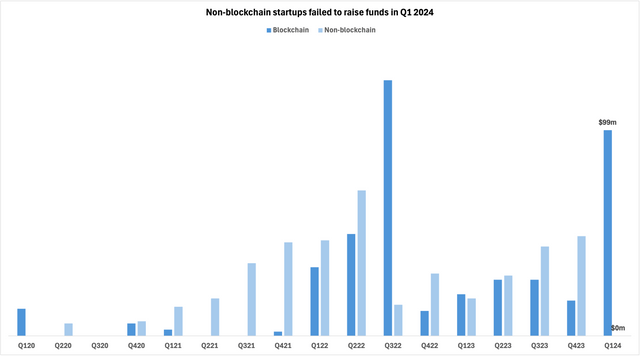

The $99 million was raised entirely by blockchain startups and marked a 482% jump from the $17 million they raised in the previous quarter. It also marked a 395% year-on-year jump in blockchain funding.

Q1 2024 was also only the fourth instance between Q1 2020 and Q1 2024 when the deal value of blockchain funding was more than that of non-blockchain funding.

At $123 million, Q3 2022 witnessed the highest quarterly investments into blockchain startups in the region in the last four years, while Q2 2022 recorded the highest fundraising ($70 million) by non-blockchain startups in at least four years.

In terms of deal volume, non-blockchain startups dominated Software & IT funding in Southeast Asia between Q2 2020 and Q1 2022.

During this period, blockchain startups failed to crack a single deal in four out of eight quarters. However, the picture changed after Q1 2022 when blockchain startups started to attract more deals than non-blockchain ones.

Top three deals account for over half of Software & IT funding

Singapore-based Layer 2 startup Morph, which raised a $20 million seed round, sealed the highest deal in Q1 2024 in SE Asia’s Software & IT sector.

It was followed by Singapore-based Layer 1 blockchain company peaq’s $15 million Series A round and Singapore-based rollup solution provider AltLayer’s $14.4 million Series A round. The top three deals accounted for more than half of the Software & IT funding during the period. Seed funding dominated the funding charts as six out of the top 10 deals in Q1 were seed rounds.

Top 10 Software & IT deals in SE Asia in Q1 2024

| Firm | Sector | Value | Funding Type |

|---|---|---|---|

| Morph | Blockchain solutions | $20m | Seed |

| peaq | Blockchain solutions | $15m | Series A |

| AltLayer | Blockchain solutions | $14.4m | Series A |

| UXLINK | Blockchain solutions | $9m | Seed |

| Initia Labs | Blockchain solutions | $7.5m | Seed |

| Pontem Network | Blockchain solutions | $6m | Venture-Unclassified |

| OxScope | Blockchain solutions | $5m | Pre-Series A |

| BitLayer | Blockchain solutions | $5m | Seed |

| LightLink | Blockchain solutions | $4.5m | Seed |

| Startale labs | Blockchain solutions | $3.5m | Seed |

Singapore garners lion’s share of blockchain funding

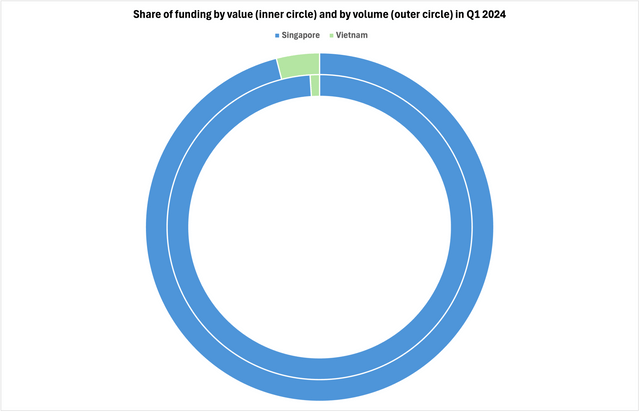

Within Southeast Asia, Singapore was the most preferred destination for blockchain funding in Q1 2024. The city-state accounted for 99% of the total value of investments into blockchain startups and 96% of the total deal volume in the three months. Besides Singapore, Vietnam was the only country in the region where there was dealmaking in this space.