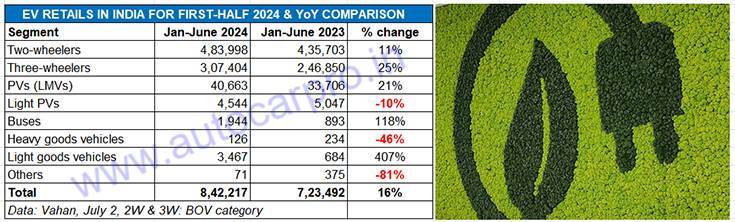

Here’s the good news first. Cumulative retail sales of electric vehicles across the two- and three-wheeler, passenger vehicle and commercial vehicle segments in the first six months of CY2024, at 842,217 units are up 16% YoY (January-June 2023: 723,492 units). The not-so-good news is that June 2024 numbers, at 108,742 units, although 6% up on June 2023, are the lowest monthly sales since a year ago.

EV sales opened 2024 with strong numbers but since March have felt the heat of slowing demand amid a reduced subsidy and higher EV prices.

EV sales opened 2024 with strong numbers but since March have felt the heat of slowing demand amid a reduced subsidy and higher EV prices.

As per the comprehensive retail sales data on the government of India’s Vahan website, the 842,217 EVs sold in H1 2024 account for 6.69% of the total 12.58 million (1,25,86,934 units) vehicles sold across all segments and petrol, diesel, CNG, LPG and electric powered vehicles. This is a marginal increase compared to the 6.34% EV penetration level in H1 2023 – 723,492 EVs to 11.40 million automobiles (1,14,02,262 units).

At halfway stage in CY2024, EV sales are 55% of CY2023’s record sales of 15,32,308 units, up 49% on CY2022’s 10,25,020 units, which was the first time India EV Inc crossed the million-units milestone. However, what’s clear is that at 16% YoY growth for the January-June 2024 period, growth clearly is slowing down albeit on a larger base.

Month on month, EV retails in June have fallen by 12% with the two- and three-wheeler as well as the electric car and SUV segments seeing a decline.

Month on month, EV retails in June have fallen by 12% with the two- and three-wheeler as well as the electric car and SUV segments seeing a decline.

Sales in the largest volume segments – electric two- and three-wheelers – have been impacted by the withdrawal of the FAME II subsidy scheme on March 31, 2024 (which itself was reduced in June 2023) which has led to OEMs raising vehicle prices.

Two- and 3-wheelers account for 94% of EV sales

These two segments (791,3402 units) together account for an overwhelming 94% of total EV sales in India – while e-two-wheelers have the major share of 57.46%, e-three-wheelers have contributed to 36.49% of the sales in H1 2024. While electric cars and SUVs, with 40,663 units, account for a 4.82% share, electric buses, heavy and light goods carriers at 5,537 units account for a 0.65% share.

In mid-March 2024, FAME II was replaced by the Electric Mobility Promotion Scheme (EMPS). Valid for a four-month period from April 1 to July 31, 2024, EMPS has a total outlay of Rs 500 crore and aims to support the purchase of 372,000 EVs including 333,000 two-wheelers and 38,828 three-wheelers (L5 category). While e-two-wheelers get a subsidy of Rs 5,000 per kWh with a maximum limit of Rs 10,000 per unit under EMPS, e-three-wheelers can avail a subsidy of Rs 5,000 per kWh with a maximum limit twice that of two-wheelers at Rs 10,000 per unit.

The Indian automotive industry is banking on the government extending the EV subsidy to sustain demand as well as enable the transition to electric mobility. Industry captains remain hopeful that the government will extend the EV subsidy scheme. On June 11, FADA president Manish Raj Singhania said. “The automotive industry is eagerly looking forward to the announcement of FAME 3 by the newly formed government. We believe that the introduction of new subsidies and incentives under FAME 3 will provide the necessary boost to EV sales and help increase their market share significantly.”

ALSO READ:

Electric car and SUV sales drive past 40,000 units in H1 2024, up 21%

Electric 3-wheeler sales rise 27% in first-half 2024 to 314,000 units