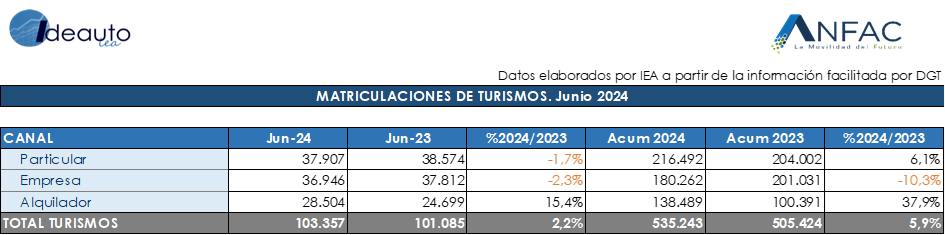

In the first semester, total sales accumulate 535,423 units, 6% more than a year ago

The market for electric and plug-in hybrid passenger cars once again registers a month of decline, with a 10% decrease in sales in June

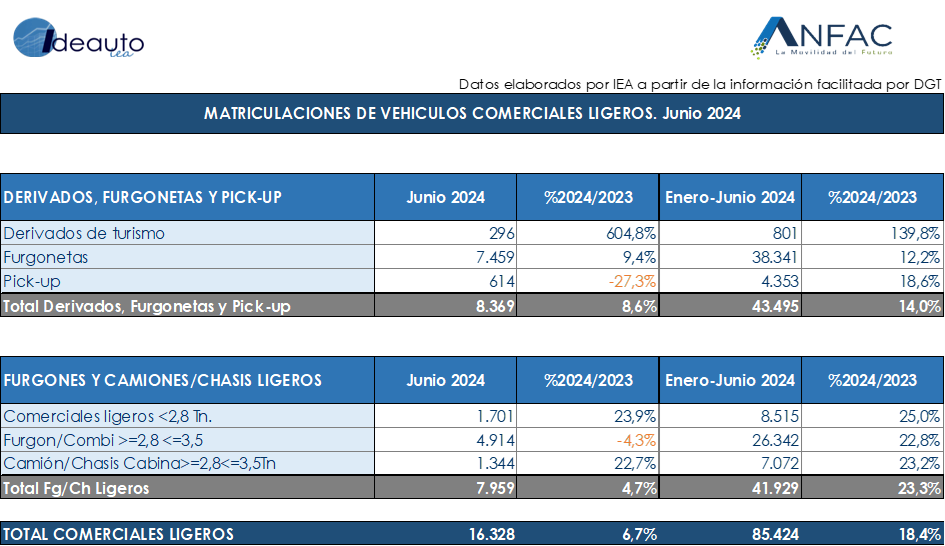

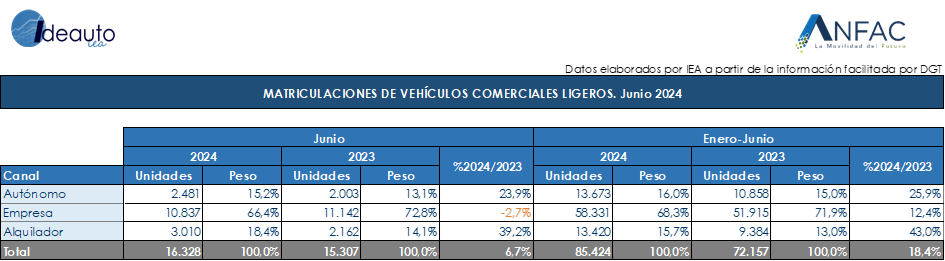

Registrations of light commercial vehicles grow by 6.7%, with 16,328 sales

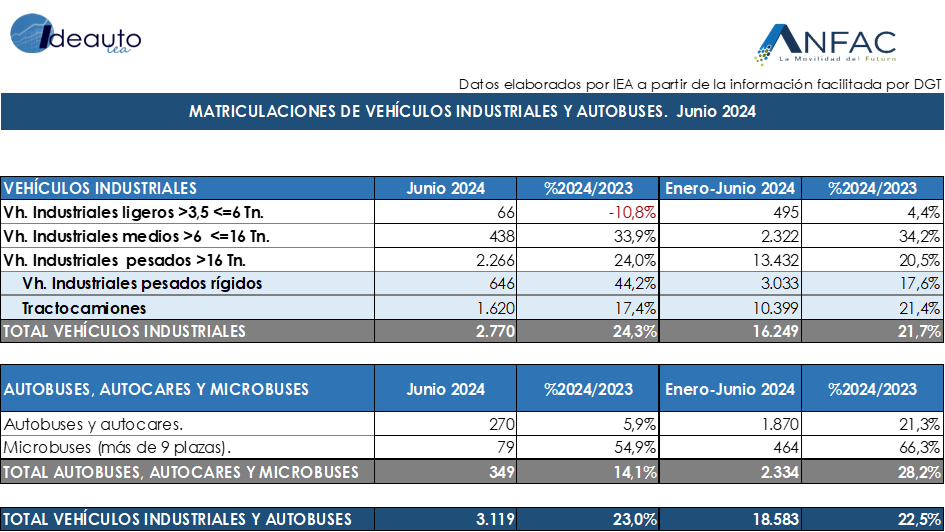

Sales of commercial vehicles, buses, coaches and minibuses increase 23% in June with 3,119 units

Madrid, July 1, 2024. The passenger car market managed to grow in June, but with only an increase of 2.2% and a total of 103,357 units sold. Sales manage to exceed the previous year’s figures due, mainly, to the push from rental companies in June, due to the fleet supply for the summer period. The decline in sales to individuals is observed with concern, especially in a month like June that is usually marked by a rebound in sales to this channel, when people want to take their new car on vacation. One of the reasons for this stagnation in family purchases is the uncertainty that citizens have about which car to buy.

Regarding the total for the year, the first semester adds 535,243 units, which is 5.9% more than in 2023. Despite the slight rebound this month, market forecasts indicate that 2024 will close above one million units.

For its part, the electrified market maintains the path of the previous month and suffers a new setback. In the sixth month, sales are 9.9% lower than a year ago, with 10,735 sales of pure electric and plug-in hybrids. This figure represents 10.4% of the total market, 1.4 percentage points lower than June 2023. In the total for the year, the market slows down its growth, with a slight increase of 0.6%, with 55,883 units and the 10.44% of the total market, a figure that is below that registered in 2023, which was 11%

The average CO2 emissions of passenger cars sold in June remain at 117.1 grams of CO2 per kilometer traveled, 0.02% lower than the average emissions of new passenger cars sold in the same month of 2023. In total of the year, an average of 117.7 grams of CO2 per kilometer traveled is recorded, 0.63% lower.

Regarding sales by channels, only the rental channel achieved an improvement, with an increase of 15.4%. For their part, both sales aimed at individuals and those made by companies suffered slight falls in June, with 1.7% and 2.3% less, respectively.

LIGHT COMMERCIAL VEHICLES

Registrations of light commercial vehicles achieved an increase of 6.7%, with 16,328 units in June. In the first six months of the year, a total of 85,424 new registrations were accumulated, which is 18.4% more than the same period of the previous year. Regarding sales by channels, with the exception of those aimed at companies, with a decrease of 2.7%, they managed to increase. The self-employed channel increased by 23.9%, with 2,481 sales and renters grew by 39.2%, to 3,010 units.

INDUSTRIAL AND BUSES

In June, registrations of commercial vehicles, buses, coaches and minibuses increased their sales significantly by 23%. During the month, the upward trend continues and 3,119 new units are registered. In the total for the year, there are 18,583 units, with an increase of 22.5%. By type of vehicle, both industrial vehicles and buses and coaches managed to grow, with an improvement of 24.3% and 14.1%, respectively, in the month. Where industrial companies register 2,770 new units and buses and coaches register 349 new registrations.

Félix García, director of communication and marketing at ANFAC, explained that “the passenger car market continues to stagnate during the month of June. The holiday period has not worked as we expected and we only grew slightly above 2%. Rise that has been saved on the last day of the month. If we stay with the positive fact, it is that we continue on the path to achieving the desired one million new passenger cars sold in one year. Something that has not happened since 2019. If we stay with the negative, we see that in June individuals and companies have slowed down their pace of purchasing new cars. On the electrified side, the extension of MOVES until the end of the year is welcome so as not to paralyze sales of this type of vehicles, which are in negative volume figures in the last two months compared to 2023. On the contrary, hybrid passenger cars “Conventional vehicles continue their upward path, which indicates that citizens and companies increasingly want to buy more sustainable vehicles.”

Raúl Morales, communication director of FACONAUTO, indicated that “the registrations for the month of June seem to confirm that the market has found its rhythm at about 100,000 registrations, which for the sector is a significant figure that at least the market is doing reasonably well. It could go much better if we managed to activate the sale of electrified vehicles that fell again last month. That is why it is so important to be ambitious in supporting the electrified vehicle in the short and long term through direct aid or through tax incentives. What is crucial is to think that 48% of citizens are delaying their purchasing decision due to the uncertainty they feel. We must do everything possible to reduce this percentage through reassuring messages regarding the electrified vehicle, but also regarding the deadlines and the rest of the technologies. A secure client will surely allow us to have a much more agile market and much more prepared for the challenge of decarbonization, which in the end is the objective that we all seek.

GANVAM’s communications director, Tania Puche, pointed out that “the market stagnates in June. Traditionally, it is usually a good month from a commercial point of view and it is true that it has allowed us to overcome the psychological barrier of 100,000 registered units and close the semester with over half a million registrations. However, we are still more than 20% below pre-pandemic levels at a time when individual purchases and the renewal of corporate fleets are not driving the market. It is the registrations of the rental companies that save the furniture to respond to a summer tourist campaign that is expected to be a record. If we really want to transform Spanish mobility, consolidate long-term demand and achieve the decarbonization objectives, the Administration must support, implement direct aid and undertake a comprehensive tax reform that truly promotes the renewal of the park.”