Amid a backdrop of mixed global economic signals, Hong Kong’s Hang Seng Index showed resilience with a modest gain during a holiday-shortened week. This context of cautious optimism in the market sets the stage for considering growth companies with high insider ownership, as these firms often demonstrate aligned interests between shareholders and management, potentially navigating uncertainties with strategic agility.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

iDreamSky Technology Holdings (SEHK:1119) |

20.2% |

104.1% |

|

Fenbi (SEHK:2469) |

32.7% |

43% |

|

Tian Tu Capital (SEHK:1973) |

34% |

70.5% |

|

Adicon Holdings (SEHK:9860) |

22.4% |

28.3% |

|

Zhejiang Leapmotor Technology (SEHK:9863) |

15% |

73.4% |

|

DPC Dash (SEHK:1405) |

38.2% |

90.2% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

18.7% |

79.3% |

|

Ocumension Therapeutics (SEHK:1477) |

23.1% |

93.7% |

|

Beijing Airdoc Technology (SEHK:2251) |

28.7% |

83.9% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

13.9% |

100.1% |

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★☆☆

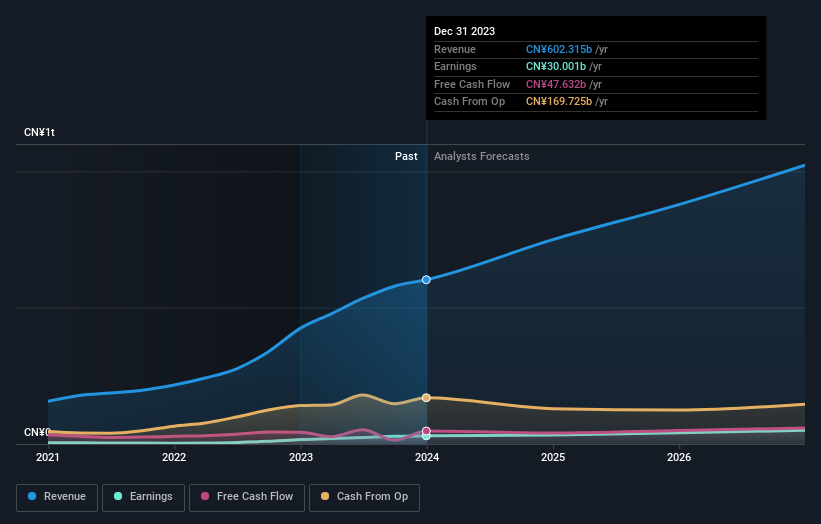

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$727.70 billion.

Operations: The company’s revenue is primarily generated from its automobile and battery sectors.

Insider Ownership: 30.1%

BYD, a growth company in Hong Kong, has shown substantial progress with a 52.7% increase in earnings over the past year and is trading at 33.1% below its estimated fair value. Its Return on Equity is expected to be robust at 22.3% in three years, outpacing the forecasted Hong Kong market growth. Revenue projections indicate a 13.7% annual increase, surpassing the local market’s 7.7%. However, insider trading data for the past three months shows neither significant buying nor selling by insiders, suggesting a stable but cautious ownership stance amidst growth.

Simply Wall St Growth Rating: ★★★★☆☆

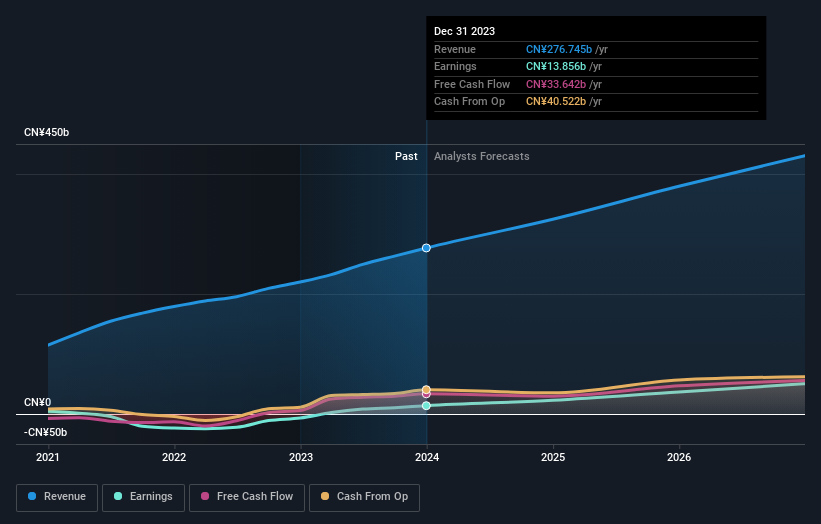

Overview: ESR Group Limited operates in logistics real estate development, leasing, and management across regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, and Europe with a market capitalization of approximately HK$47.02 billion.

Operations: The company’s revenue is derived primarily from fund management at HK$774.64 million and new economy development, contributing HK$105.48 million.

Insider Ownership: 13.1%

ESR Group is poised for notable growth with its earnings expected to increase by 26.5% annually, outstripping the Hong Kong market’s 11.3%. Despite trading at a substantial discount to its estimated fair value, concerns persist due to low forecasted Return on Equity and poor coverage of interest payments by earnings. Recent events include a potential privatization proposal valued between US$7 billion and US$8 billion, suggesting confidence from major investors despite current financial pressures and a changing board composition.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meituan is a technology retail company based in the People’s Republic of China, with a market capitalization of approximately HK$731.89 billion.

Operations: The revenue segments for this company are not specified in the provided text.

Insider Ownership: 11.4%

Meituan has demonstrated robust growth with its Q1 2024 sales rising to CNY 73.28 billion from CNY 58.62 billion year-over-year, and net income increasing to CNY 5.37 billion. The company’s earnings are projected to grow by 31.2% annually over the next three years, outperforming the Hong Kong market prediction of 11.3%. Despite this positive trajectory, there’s been significant insider selling recently, although Meituan is trading at a substantial discount to its estimated fair value. Recent activities include a US$2 billion share buyback program, underscoring strong internal confidence in its valuation.

Seize The Opportunity

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:1821 and SEHK:3690.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com