As global markets exhibit mixed signals with some regions showing economic cooling and others modest gains, the Hong Kong market remains a focal point for investors seeking growth opportunities. High insider ownership in companies is often viewed as a positive signal, suggesting that those with the deepest knowledge of the company are betting on its success, which could be particularly reassuring in the current unpredictable economic climate.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

iDreamSky Technology Holdings (SEHK:1119) |

20.2% |

104.1% |

|

Fenbi (SEHK:2469) |

32.7% |

43% |

|

Tian Tu Capital (SEHK:1973) |

34% |

70.5% |

|

Adicon Holdings (SEHK:9860) |

22.4% |

28.3% |

|

Zhejiang Leapmotor Technology (SEHK:9863) |

15% |

73.4% |

|

DPC Dash (SEHK:1405) |

38.2% |

90.2% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

18.7% |

79.3% |

|

Ocumension Therapeutics (SEHK:1477) |

23.1% |

93.7% |

|

Beijing Airdoc Technology (SEHK:2251) |

28.7% |

83.9% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

13.9% |

100.1% |

Here’s a peek at a few of the choices from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$727.70 billion.

Operations: The company generates revenue from its automobile and battery sectors across various regions including China, Hong Kong, Macau, Taiwan, and internationally.

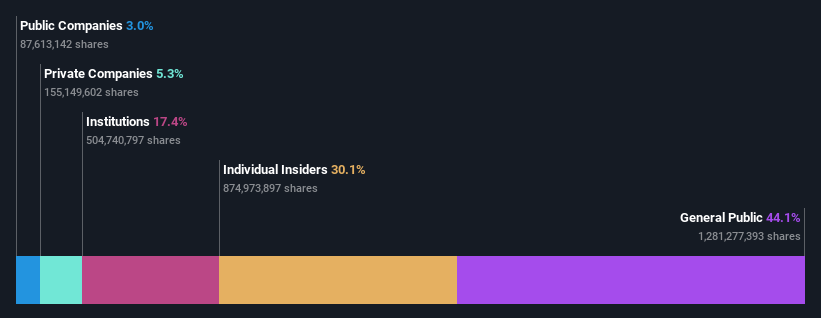

Insider Ownership: 30.1%

Earnings Growth Forecast: 14.8% p.a.

BYD, a notable player in the electric vehicle market, has demonstrated robust year-over-year growth in production and sales volumes as of June 2024. Recent expansions include launching the BYD SHARK pickup in Mexico, showcasing innovative hybrid technology aimed at redefining global standards for plug-in hybrids. Despite trading 33.1% below its estimated fair value and showing slower revenue growth compared to some market expectations (13.7% annually), BYD’s earnings have increased by 52.7% over the past year with forecasts suggesting continued annual earnings growth of 14.76%. This performance is complemented by a high forecast return on equity of 22.3%, indicating strong profitability relative to shareholder equity expected within three years.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ESR Group Limited operates in logistics real estate development, leasing, and management across regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, and Europe with a market capitalization of approximately HK$47.02 billion.

Operations: The company’s revenue is primarily derived from fund management, generating HK$774.64 million, and new economy development, contributing HK$105.48 million.

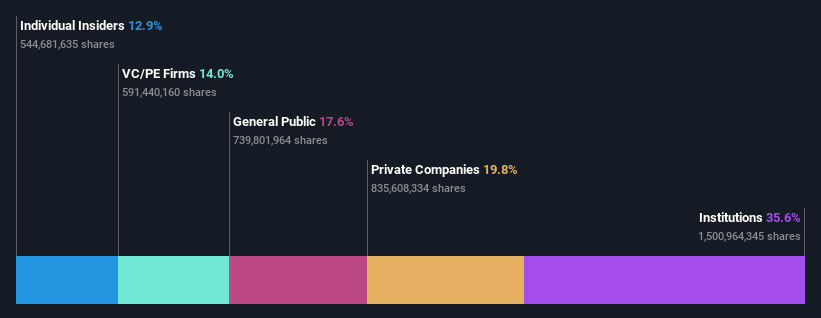

Insider Ownership: 13.1%

Earnings Growth Forecast: 26.5% p.a.

ESR Group, a logistics and real estate firm, is under the spotlight with its earnings forecast to grow 26.47% annually, outpacing the Hong Kong market’s 11.3%. Despite trading at a substantial 40% below its fair value and having lower profit margins than last year (23.9%), it maintains higher revenue growth forecasts (9.6%) compared to the market (7.7%). Recent board changes and potential privatization talks suggest significant strategic shifts, reflecting both opportunities and uncertainties for the company.

Simply Wall St Growth Rating: ★★★★★☆

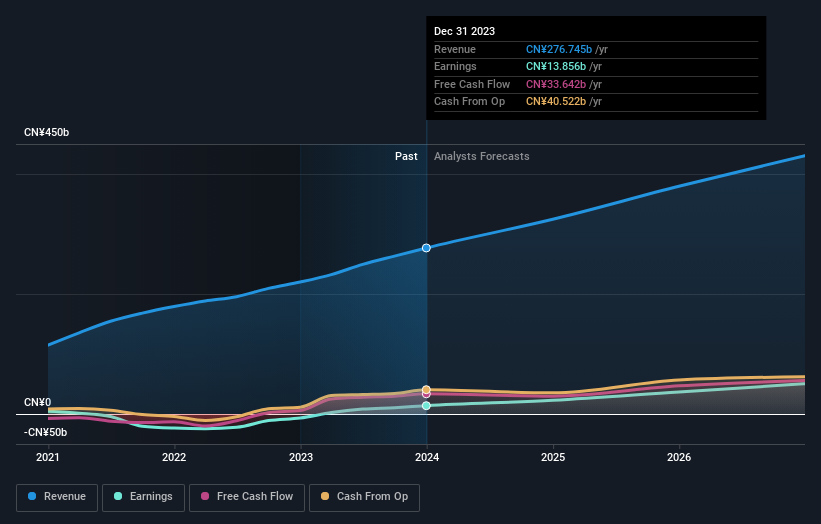

Overview: Meituan is a technology retail company based in the People’s Republic of China, with a market capitalization of approximately HK$731.89 billion.

Operations: The company generates revenue primarily through technology retail operations in China.

Insider Ownership: 11.4%

Earnings Growth Forecast: 31.2% p.a.

Meituan, a dynamic growth company in Hong Kong, is forecasted to experience robust earnings growth at 31.22% annually, significantly outpacing the market average. Despite recent insider selling, Meituan’s commitment to shareholder value is evident from its recent US$2 billion share buyback initiative. While the firm trades at 65.8% below estimated fair value and faces impacts from one-off items on earnings quality, its substantial revenue increase of 12.7% per year highlights strong operational performance and market confidence.

Summing It All Up

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:1821 and SEHK:3690.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com