Even as the buzz about hydrogen as an alternative fuel to drive sales of commercial vehicles (CV), particularly long-haul trucks, gets louder, the end of June 2024 has revealed that demand for electric CVs has risen smartly in the first six months of this calendar year in India.

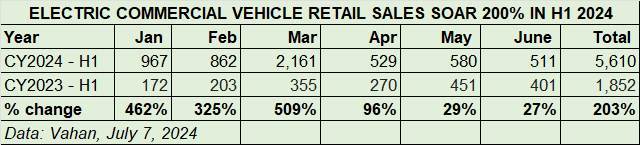

The CV sector essentially comprises light-, medium- and heavy-duty goods carriers and passenger-transporting buses. As per the latest Vahan retail sales data, the CV industry, where electric mobility makes wallet-friendly TCO sense given the much larger number of kilometres driven, compared to personal EVs, a total of 5,610 units, up 203% YoY on a low-year ago H1 2023 base of 1,852 units were sold between January and June 2024.

As the monthly sales numbers (see retail sales tata table above) shows, the FY2024-ending month of March 2024 witnessed the highest demand – 2,161 eCVs, followed by January (967 units). The average monthly sales of 935 eCVs in H1 2024 is a marked increase over the 308 units in H1 2023. The highest demand in terms of segment has been for electric buses (up 118%) and light goods carriers (408%).

Tata Motors has seen its eCV market share jump from 38% in H1 2023 to 62% in January-June 2024. Demand for electric buses and last-mile delivery goods carriers is benefiting all players.

Tata Motors has seen its eCV market share jump from 38% in H1 2023 to 62% in January-June 2024. Demand for electric buses and last-mile delivery goods carriers is benefiting all players.

Tata Motors’ eCV market share increases to 62%

In terms of OEM sales which constitutes combined sales tally of goods carriers and passenger-transporting buses, Tata Motors is the strong market leader with 3,503 units, up 400% YoY (H1 2023: 700 eCVs), which makes for 62% market share and a marked increase from the 38% share it had in H1 2023.

On May 9, Tata Motors expanded its e-cargo mobility portfolio with the launch of the new Ace EV 1000 small mini-truck which offers a higher rated payload of one tonne and a certified range of 161km on a single charge. Targeted at last-mile mobility providers, the newest variant of the Ace EV aims to address evolving needs of sectors like FMCG, beverages, paints and lubricants, and dairy. While product-wise sales data is not available, suffice it to say the Ace EV 1000 has contributed to the company’s strong H1 2024 numbers. In June, integrated electric mobility solutions provider Magenta Mobility deployed 100 units of the Ace EV including 60 Ace EVs and 40 Ace EV 1000s.

JBM Auto takes second position with 384 units, up 374%, and has a current market of 9% which is more than double its 4% share in H1 2023. The company sees demand come from state and city municipal transport corporations.

ALSO READ: EV sales at 842,000 units in H1 2024 grow 16% but June numbers lowest in 12 months

Electric car and SUV sales drive past 40,000 units in H1 2024, up 21%

Electric 2W sales in first-half 2024 cross 525,000 units, already 61% of record 2023

Electric 3-wheeler sales rise 27% in first-half 2024 to 314,000 units