Sovereign wealth fund Indonesia Investment Authority (INA) more than doubled its investments in 2023 despite political and economic uncertainties throughout the year, according to its annual report.

The report noted that INA and its co-investors disbursed $1.9 billion in 2023—up 152.6% year-on-year. In 2023, INA made six investments, with a total of nine projects, across the health, infrastructure, digital infrastructure, geothermal, and logistics sectors.

The new investments resulted in an increase of 37.7 trillion rupiah ($2.3 billion) in INA’s total assets under management (AUM), bringing its total AUM to 147.6 trillion by the end of 2023.

In a previous conversation with DealStreetAsia, INA Deputy CEO Arief Budiman had said the fund was targeting investments worth $1 billion last year in energy, infrastructure, digital, and healthcare space.

“Indonesia encountered not only global challenges but also domestic challenges in 2023, as it was a preparatory year for the presidential and legislative elections,” said Ridha DM Wirakusumah, CEO of INA. “Political and economic uncertainties have a significant impact on investors’ deal appetite, subsequently impacting investment decisions and the implementation of investment projects,” said Wirakusumah.

Indonesia held one of the world’s biggest one-day general elections on February 14, 2024. Defence Minister Prabowo Subianto and his vice-presidential running mate Gibran Rakabuming Raka won a majority of votes.

Indonesia also faced headwinds due to the global economic slowdown, heightened geopolitical tensions, inflation risks, and the pressing issue of climate change. However, its gross domestic product (GDP) grew 5.05% in 2023.

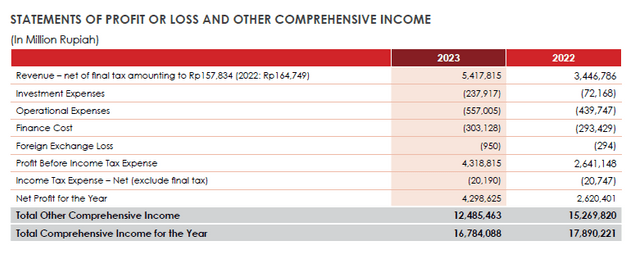

INA booked 4.3 trillion rupiah ($260 million) in net profit in 2023, up 64% compared with the previous year, according to the report.

The fund made 5.4 trillion rupiah in total revenue which came from interest income from investment portfolios and treasury assets, dividend income from in-kind shares, and unrealised gains from mark-to-market investment valuations.

INA’s total assets reached 116.9 trillion rupiah at the end of 2023, up 17% compared with 99.8 trillion rupiah in the same period a year earlier. The increase, according to the report, was largely due to the significant growth of investment in equity instruments, loans, and other receivables.