The Indian passenger car segment seems to be tilting towards becoming a ‘buyer’s market’ with popular SUVs like the Maruti Suzuki Brezza and Grand Vitara, and Honda Elevate receiving lucrative discounts. On the other hand, the Mahindra XUV700, and Tata’s Harrier and Safari have received considerable price cuts.

Dealers are reporting a massive inventory situation of around 65-67 days, which is over double that of the normal levels. This makes it amply clear that manufacturers are swinging into action, and offering schemes that lure buyers into showrooms, despite the festive season being a couple of months away.

With slowing growth and rising inventory, major brands like Tata Motors and Mahindra & Mahindra (M&M) have got into a price war to woo buyers with their respective flagship SUVs. While the Harrier and Safari received a price cut that ranges from Rs 50,000 to Rs 70,000, depending on the model, Mahindra rolled out a ‘temporary price reduction’ on the XUV700 as an indirect response.

Safari prices are down by up to Rs 70,000 this month.

The XUV700 has received price cuts of around Rs 2 lakh, depending on the variant. However, in a stock exchange filing, Mahindra said, “The announced price cut of XUV700 is a continuation of our business strategy execution that was articulated in our February 14, 2024 analyst meeting where we clearly outlined that we have to bring the average price point down to drive growth.” Mahindra is expecting to grow in the mid-teens in the current financial year.

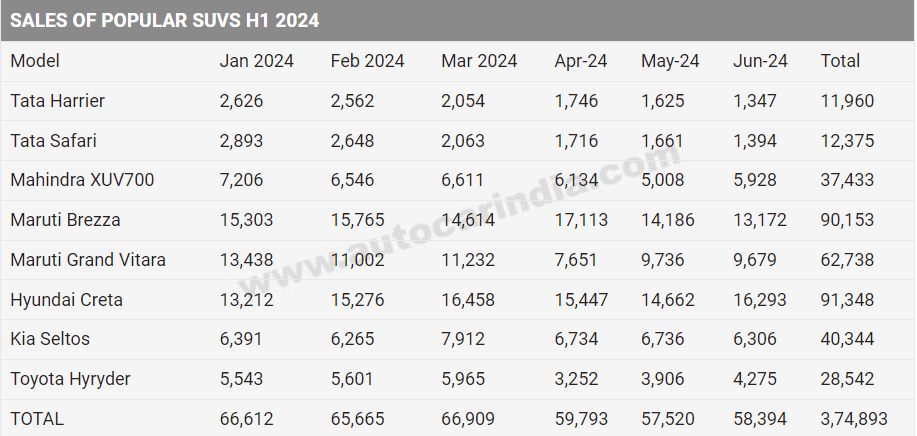

Despite multiple offers and finance schemes over the last few months, the response hasn’t been positive. Sales of the Harrier and Safari have registered a downward trend: from over 2,500 units units in January 2024 to around 1,300 units in June. There is no respite for Mahindra either as its XUV700 sales have declined from around 7,200 units in January to 5,900 units last month. So, despite the manufacturers calling these price cuts ‘temporary’, we expect the SUVs to continue to be available at these prices for an elongated period.

Due to the slowing demand for the XUV700, production of the SUV has also gone down to 6,000-7,000 units from the planned 10,000 units a month, say sources.

Maruti, Hyundai models attract huge discounts

The story does not end with Tata and Mahindra; Maruti Suzuki, the country’s largest carmaker, has been offering multiple discounts on its Arena and Nexa outlets since January 2024. While the brand introduced a Dream series line-up of cars last month, Maruti says it has gathered around 21,000 bookings for the limited-edition Dream range, so it has extended that scheme till the end of July. The Dream Edition line-up consists of entry-level models, including the Alto K10, S Presso and Celerio – all three start at Rs 4.5 lakh (ex-showroom) and get more equipment. These entry-level Marutis have been struggling as the market is visibly shifting towards more premium and better-equipped cars.

The story does not end with Tata and Mahindra; Maruti Suzuki, the country’s largest carmaker, has been offering multiple discounts on its Arena and Nexa outlets since January 2024. While the brand introduced a Dream series line-up of cars last month, Maruti says it has gathered around 21,000 bookings for the limited-edition Dream range, so it has extended that scheme till the end of July. The Dream Edition line-up consists of entry-level models, including the Alto K10, S Presso and Celerio – all three start at Rs 4.5 lakh (ex-showroom) and get more equipment. These entry-level Marutis have been struggling as the market is visibly shifting towards more premium and better-equipped cars.

The brand has also introduced the Brezza Urbano Edition as the SUV has also seen a notable drop in sales from around 17,000 units in April to 13,000 units in June. This edition gets more accessories at a discounted rate, thus claiming to give the consumer more value for their money.

All three Dream Series models are priced at Rs 4.5 lakh (ex-showroom).

Even the latest-gen Swift hatchback that was launched in May has not been able to ride on the success of its predecessor. While dealer-level discounts of around Rs 10,000 were already being offered unofficially in June, Maruti has now officially announced discounts of up to Rs 15,000 in July.

Hyundai continues to see strong sales for its bestselling Creta SUV, but models like the Alcazar and Exter are seeing demand drop. The brand recently introduced the Exter Knight edition and has been offering discounts in the range of Rs 10,000 to Rs 20,000 on the standard Exter for the last few months.

The Alcazar, too, is offered with discounts of up to Rs 80,000, depending on the variant and dealer. Hyundai despatched over 1,800 units of the Alcazar in January, which had dropped to a mere 800 units in June. One of the reasons for the lower numbers of the Alcazar is that the launch of the facelift is just around the corner and the current model is in its run-out phase.

The Venue compact SUV gets discounts of up to Rs 55,000 this month as sales have seen a slight dip for this model, too. Apart from the SUV line-up, hatchbacks like the Grand i10 Nios and the i20 can be purchased with offers and benefits of up to Rs 50,000.

Up to Rs 50,000 in discounts are available on the i20 this month.

Brands like Volkswagen and Honda have been offering close to six-figure discounts on their models. Volkswagen and Skoda are offering discounts and benefits of over Rs 1.5 lakh on most of their India 2.0 line-up, which includes the Slavia, Virtus, Kushaq and the Taigun.

The Honda Elevate, on the other hand, has been available with benefits of around Rs 70,000 for a few months. Sales of the Elevate have also seen a downward trend from around 4,500 units in January to a mere 2,100 units in June. Even the City sedan get benefits of around Rs 1 lakh at most locations with the City hybrid seeing higher discounts. Thanks to the waiver of road tax announced in the state of UP, the City e:HEV is much more affordable in that state.

What experts say

A ground-level check with dealers of these brands reveals a significant decline in customer footfalls, and piling up of unsold inventory. Partho Banerjee, senior executive officer, Marketing and Sales, Maruti Suzuki, said, “The soaring temperatures witnessed in several parts of the country over the last few months, accompanied with the national elections that culminated in June, kept buyers away from visiting showrooms.” The carmaker acknowledged that its 38-day inventory level is slightly above the normal range.

As a result, waiting periods are on the decline, with most popular models available within two to three weeks – ones in huge demand continue to have long waiting periods. High-demand SUVs like the XUV700, the Scorpio N, Harrier, Safari, Brezza and even MPVs like the Ertiga are readily available at most locations, depending on dealer inventory.

With the ‘pent-up demand’ generated due to the infamous chip shortage during the COVID-19 pandemic having tapered off over the last few months, and with raw materials being easily available to automakers, there is again a demand-supply mismatch that seems to have emerged in the market. And, with the entry-level segment continuing to reel under an affordability challenge, manufacturers can now only pray that the rains improve the situation in the monsoon, even as they roll out some hefty offers. “With monsoon forecast being above normal, and good projections for the Kharif crop, we are bullish about the momentum going forward,” said Banerjee.