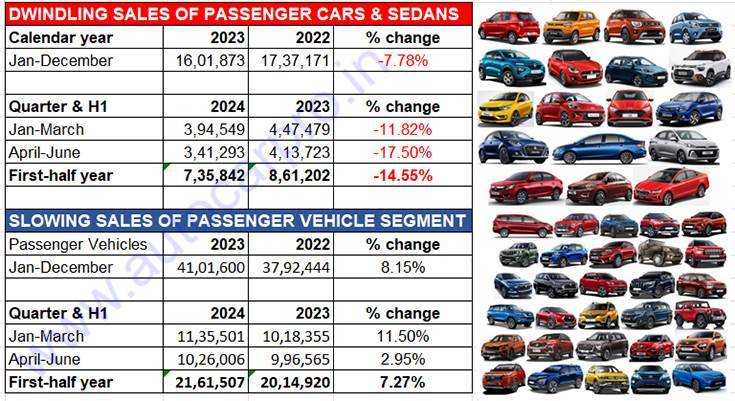

After hitting a heady 4.10 million units in calendar year 2023 (up 8.1%) and 4.21 million units in FY2024 (up 8.44%), mainly thanks to the surging demand for SUVs and MPVs, demand is slowing down for the overall passenger vehicle segment, which comprises cars, SUVs and vans, in CY2024.

As per the latest wholesales data released by apex industry body SIAM, a total of 341,293 passenger cars were sold in for Q1 FY2025 (April-June 2024), down 17.50% on Q1 2024 (413,723 units). This figure is 53,256 units lesser than the 394,549 cars dispatched in the last quarter of FY2024 (January-March 2024), which itself was 11.80% down on year-ago sales. What this means is that halfway into CY2024, passenger car sales at 735,842 units are down 17% YoY (H1 2023: 861,202 units) and are 46% of the 1.60 million cars sold in CY2023.

Six months into CY2024, passenger car and sedan sales at 735,842 units are down 17% YoY and are 46% of the 1.60 million cars sold in CY2023.

Six months into CY2024, passenger car and sedan sales at 735,842 units are down 17% YoY and are 46% of the 1.60 million cars sold in CY2023.

Clearly, India PV Inc has a problem on its hands when it comes to sales of cars and sedans, more so in the face of the rapid consumer shift to utility vehicles. In CY2023, UVs accounted for an overwhelming 57% share of the overall PV market, up from 50% in CY2022. In the first six months of CY2024, 1.34 million UVs have been dispatched to showrooms across India, up 25% YoY (H1 CY2023: 10,81,320 units), and account for 62% of total PV sales.

At present, India Auto Inc has 24 passenger cars and sedans on sale – 14 hatchbacks and 10 sedans. The slackened demand for passenger cars and sedans means that they have dragged growth down for the overall PV sector which at 2.16 million units in H1 2024 is at 7%. And, with every OEM worth its wheels pushing much-in-demand popular SUVs to dealers, overall PV inventory levels are at a record high of 62-67 days.

The Q1 FY2025 wholesales numbers are quite a revelation. Of the nine car and sedan OEMs in the fray, only one – Toyota Kirloskar Motor – has seen growth in the April-June 2024 quarter. Maruti Suzuki India, with 222,193 units, is down 13% YoY. The Alto-SPresso combine has sold 30,816 units – this is 9,584 units less than a year ago and down 24%. The six-pack of the Baleno, Swift, Wagon R, Dzire, Celerio and Ignis sold 189,208 units, down 10% YoY (Q1 FY2024: 210,825). The premium Ciaz sedan too is down by 42% to 2,169 units versus 3,753 units a year ago.

Hyundai Motor India’s car sales at 48,710 units are down 25% YoY (Q1 FY2024: 64,661 units). Combined sales of the Aura sedan, and the Grand 10 and i20 hatchbacks at 44,334 units are down 16% YoY (Q1 FY2024: 52,972). The recently launched sixth-gen Verna sedan too is feeling the heat of slowing sales – the 4,376 units in April-June 2024 are down by a massive 62% (Q1 FY2024: 11,689)

Tata Motors, which has three models in the fray in the form of the Altroz and Tiago hatchbacks and Tigor sedan, sold 37,578 units in Q1 FY2025 – that’s 13,648 fewer cars than Q1 FY2024’s 51,226 units and a 27% YoY decline.

Toyota Kirloskar Motor is the sole carmaker in India to record YoY growth in the first quarter of the ongoing fiscal, albeit on a smaller base compared to the previous three OEMs. Its cumulative three-month sales of 13,459 units are up 6% YoY (Q1 FY2024: 12,688 units). The company sold 13,015 Glanzas, up 6%, and 444 Camrys, up 14% YoY.

Honda Cars India, which has seen its overall PV numbers perk up in the past year with the launch of the Elevate midsize SUV, has witnessed a sharp 43% YoY decline in Q1 FY2025 to 8,542 units vs 15,053 units a year ago. The Amaze sold 5,805 units, down 4%; the City’s tally was 2,737 units, down 44 percent.

The next three OEMs are all single-product companies in this segment. Volkswagen India dispatched 4,449 Virtus sedans to its dealers across the country, 475 fewer than it did a year ago which translates into a decline of 10 percent. Skoda Auto India, with 4,039 Slavia sedans, registered a YoY decline of 20 percent. Renault India, with 2,323 Kwids, posted a YoY fall of 28 percent. JSW MG Motor India, which had sold 1,914 units of the Comet EV in Q1 FY2024, did not sell a single unit in Q1 FY2025, a period in which it also did not produce a single unit of this zero-emission vehicle as per SIAM data.

Amid the sea of red ink, only Toyota Kirloskar Motor is in positive territory, albeit on a much smaller year-ago base compared to Maruti, Hyundai or Tata.

Amid the sea of red ink, only Toyota Kirloskar Motor is in positive territory, albeit on a much smaller year-ago base compared to Maruti, Hyundai or Tata.

CARMAKERS ROLL OUT DISCOUNTS AND DEALS APLENTY

Earlier this month, FADA president Manish Raj Singhania flagged his concern about the car and SUV industry’s inventory levels, which have reached an all-time high – ranging from 62 to 67 days. He said, “Despite improved product availability and substantial discounts aimed at stimulating demand, market sentiment remains subdued due to extreme heat resulting in 15% less walk-ins and delayed monsoons. Dealer feedback highlights challenges such as low customer inquiries and postponed purchase decisions. With the festive season still some time away, it is crucial for passenger vehicle OEMs to exercise caution. Effective inventory management strategies are essential to mitigate financial strain from high interest costs. FADA strongly urges PV OEMs to implement prudent inventory control and engage proactively with the market.”

In an effort to reduce the current high inventory level, particularly slow-moving-off-the-shelf hatchbacks and sedans, some carmakers are offering handsome discounts and schemes, despite the festive season being at least three months away. It’s a big positive for the passenger vehicle buyer and a good time to buy a new car, sedan or an SUV.