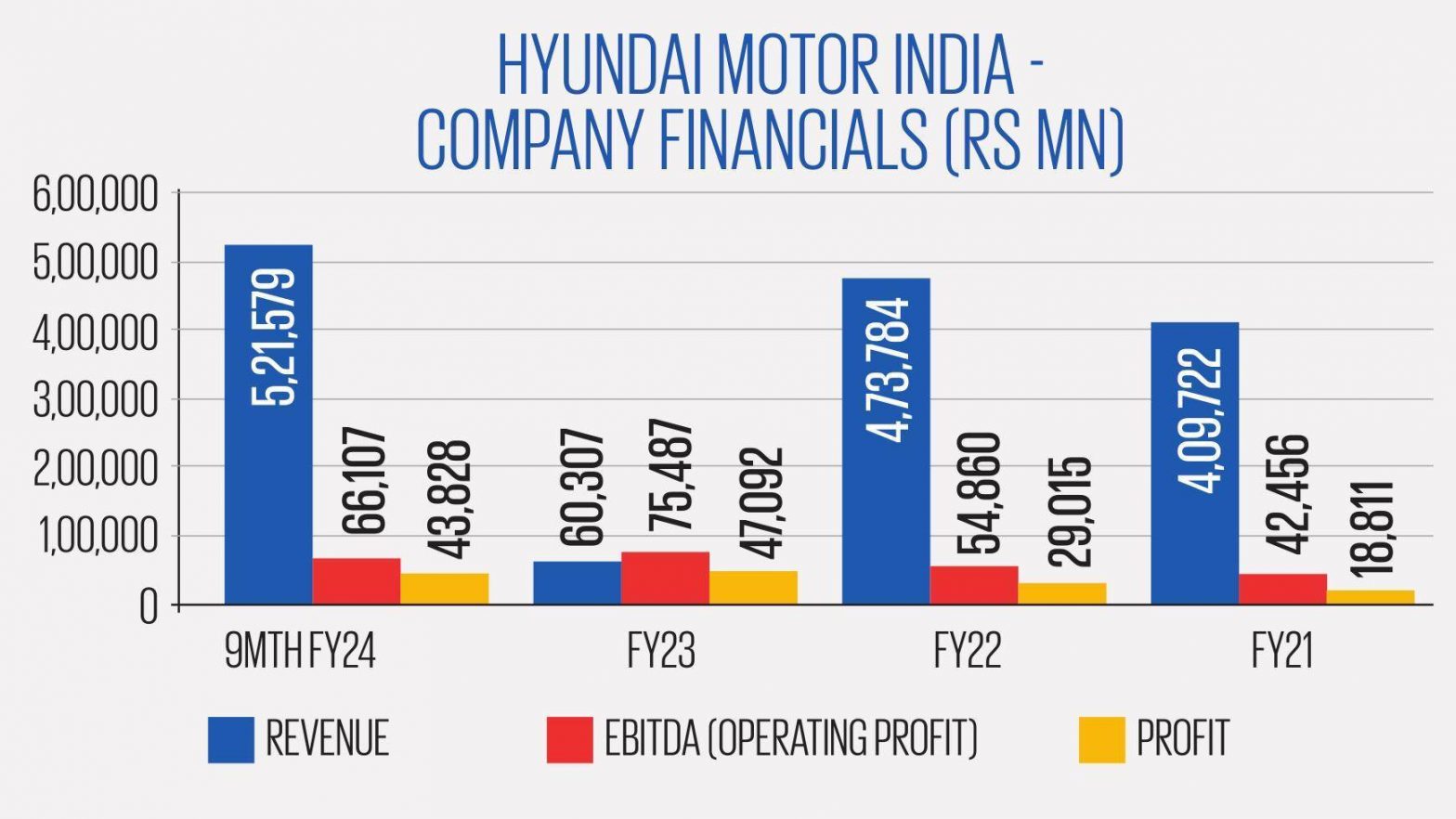

In many ways, Hyundai Motor India is sitting pretty. Despite being a distant No.2 to market leader Maruti Suzuki in market share, its profit margins and sales mix are the envy of the industry. The company gets half its volumes from vehicles priced above Rs 10 lakh, its plants regularly run at 95% utilisation, and has profit margins considerably higher than that of its main rivals.

But in an industry undergoing rapid technological shifts, sitting still is not something any player can afford. After successfully building up a profitable and premium auto business in India, the Korean company is now turning its attention to the next stage of its evolution.

Raising funds for growth, reclaiming lost market share, increasing R&D, plugging the gaps in the product portfolio and getting into the fast-growing EV market — these are some of the things on the carmakers’ to-do list for the next five years. And it is starting with the first one first — with what may well turn out to be the biggest IPO India has ever seen.

Hyundai Motor Company is expected to raise a whopping Rs 25,000 crore from the Indian equity market over the coming days, and use the money to raise its game in the world’s third biggest passenger vehicle market.

A Rare Success

Hyundai Motor’s is a rare case in India. In a market littered with the shattered dreams of American and European carmakers, the Korean brand stands tall as a compelling saga of success, complete with blockbuster models and gushing profits.

The South Korean automaker entered India in 1996. Its first model, the Santro hatchback launched two years later, became an instant hit in a market where reputations usually take decades to be built. Santro’s tall boy design and advanced features earned Hyundai a place in the hearts of aspiring Indian buyers and made it the largest selling carmaker in India after Maruti Suzuki — a spot it has never let go since.

Part of Hyundai’s success is due to the fact that unlike other foreign brands like Ford, Opel, and Honda which chose not to take market leader Maruti Suzuki head on, Hyundai went in all guns blazing at its bread-and-butter segment — the small car.

Also unlike others – who generally brought in global models tweaked for India – Hyundai built the Santro with India in mind and shipped it to international markets. This not only helped the brand resonate better with Indian buyers, but also ensured faster break-even and high-capacity utilisation.

“Hyundai has been one of the very few non-Indian automakers that have succeeded [in India],” says Felipe Munoz, Global Automotive Analyst at Jato Dynamics. “General Motors failed, Ford failed, Stellantis is almost failing, and Volkswagen is struggling. Remarkably, the Koreans made it.” Indeed, right from its first model, Hyundai has had a “secret sauce” for success that it has relied upon again and again over the past two-and-a-half decades: Go with an attractive, well designed product loaded with first-in-class features, and wow the buyer.

From the Santro to hot hatchback i20 in late 2000, from the fluidic Verna to the stately Creta, the company has relied upon this mantra to offer stand-out designs with features and technology one normally associates with much more expensive models. Some of the segment-first features introduced by the company include the CRDI engine, power steering, and connected car technology. Hyundai is also credited with introducing features like daytime running lights, air purifiers, dash cams, and panoramic sunroofs to the mid-size SUV segment. This ability to understand the market and constantly raise the bar ensured that Hyundai remains ahead of everyone except the market leader since its debut.

At the same time, it is not just well-made products that underlie Hyundai’s success in India. The company has also invested in its partner networks, such as dealers and vendors, ensuring that they keep pace with its own plans.

In fact, of late, the company has started contacting component makers with plans to increase localisation. The company’s distribution network, despite its size, is among the most profitable in India. In fact, it has maintained dealer inventories at 30 days after Covid, ensuring the dealers’ profitability, even as many of its competitors have started pushing more and more stocks towards the dealers.

Another factor that has contributed to Hyundai’s speed and agility has been the strong commitment from its HQ to India as a critical market, enabling it to react swiftly to competitive pressures.

All this means that Hyundai has remained a strong challenger to Maruti Suzuki in the mass market, and a preferred alternative to Honda for the upgraders, over the years. The Gurgaon headquartered unit has cumulatively sold over 12 million units and has elevated India as the South Korean company’s third-largest market after Korea and the US, and the company itself as the third largest PV maker in the world based on volumes.

Clouds Gathering

However, it is not all rainbows and unicorns. While the first two decades of the 21st century saw Hyundai grow and establish itself as the undisputed No. 2 in India’s PV market, the last five years have seen major disruptions in the market.

On the one hand, a clutch of foreign brands — hungry for market share — have arrived with models that are as stylish, advanced and value-for-money as any from Hyundai, and on the other hand, homegrown brands such as Tata and Mahindra & Mahindra seem to have finally got their act together after struggling for decades. Resurgent Tata Motors and Mahindra & Mahindra have helped themselves to chunks of Hyundai’s market share in the PV segment.

The pressure is not just from below. Alarmed by the steady erosion of its market share, leader Maruti Suzuki has unleashed a series of new models since the lockdown, particularly in the SUV segment.

Hyundai, in other words, has been sandwiched between a market leader desperate to win back lost market share, and hungry challengers snapping at its heels from below. This means that, for the first time in over two decades, Hyundai’s No.2 position has come under threat.

The company’s volume market share has shrunk to just around 15%, while that of Tata Motors has shot up to 14% from 12% in a little over two years. The No. 4 player, Mahindra and Mahindra, too has seen a steady increase in its market share in recent years to 9%. Meanwhile, Maruti Suzuki is eager to expand its 42% number.

What should worry Hyundai Motor India is the steady decline in its share. The company saw its share fall to 14.6% in FY23 from 15.7% in FY22, while its biggest challenger Tata Motors has been riding high on the success of models such as Nexon, Punch and Thar. In fact, the difference between Tata Motors and Hyundai has narrowed to just 25,000-30,000 units over the last two years.

While incremental volumes from Exter helped Hyundai Motor India retain its number two position in FY24, Tata Motors is set to unleash the Curvv later this year, which could tilt the scales again. Tata plans to follow it up with Sierra SUV in FY26. It seems very likely that Tata Motors could dislodge Hyundai from its No. 2 position either this year or the next.

Meanwhile, the commentary and roadmaps are unlikely to offer any solace. Maruti Suzuki has announced its intention to win back its previous market share of 50%, while Tata Motors has set a target of 20% for the next 5-6 years. Others, such as Mahindra & Mahindra and Kia, too have aggressive ambitions backed by robust launch pipelines. Someone, in other words, has got to give.

“Competitive intensity has certainly increased from local players like M&M and Tata Motors, and new players like MG. If Tata Motors’ upcoming model Currv succeeds, the company could overtake Hyundai’s sales,” pointed out Raghunandhan, Director (Research) at Nuvama Institutional Equities.

Hence, not only does Hyundai need to defend its market share in its traditional areas of strength — hatchbacks and SUVs, it has become imperative for the company to urgently establish its foothold in new areas such as electric vehicles. The company has done a good job of reinforcing its strength in the premium portfolio and building a profitable business over the five years, but needs to compete aggressively and win back market share in the next five.

S&P Global Mobility’s Associate Director Gaurav Vangaal says Hyundai needs electric powertrains and new products in its portfolio to fend off its rivals.

He points out that, for the first time in history, Tata Motors and Mahindra & Mahindra seem to have surprised the competition with their agility and speed by introducing globally competitive products. Hyundai, he says, needs to enter new segments and bridge the gaps in its portfolio. Indeed, the company has stayed out of the sizeable MPV or MUV market, which is dominated by Toyota Innova and Maruti Suzuki Ertiga. It has also slashed exposure to the small car segment. Even its entry into electric vehicles and premium C and D segments has been tentative and largely dependent on CBU and CKD.

The Comeback Plan

It is in these circumstances that the Korean company has decided to go for an IPO for its Indian subsidiary.

“The IPO proceeds will help Hyundai to fund investments in upcoming projects and stay competitive,” Vangaal says. “Mahindra and Tata Motors are well capitalised due to private equity infusion. So, the money raised from the sale of shares will help Hyundai bridge its portfolio gap and cater to the emerging EV market.”

The company is believed to be planning to invest Rs 32,000 crore, or $4 billion, over the coming eight years, a large chunk of it in the EV segment.

Among other things, this is expected to help the company raise its annual output to one million units by 2027-2028, a 40-50% growth in less than four years from 2023.

On the products side, Hyundai Motor India intends to add half a dozen new products or nameplates to its portfolio over the next four years, including four locally manufactured electric vehicles.

In addition, it will enter the luxury car market with Genesis in 2025-26, for which a team has been formed. The three years from 2026 to 2028 will also see the company enter new segments, such as entry EVs, crossover SUVs, and premium SUVs.

Hyundai also has plans to update its Alcazar in the second half of 2024. The next-gen Venue, codenamed QU2i, will be its first model from the Talegaon plant, and production is scheduled to start in October 2025.

Following them, on the internal combustion engine side, will be two major models. The first will be a crossover based on i20 architecture, codenamed Bc4i, that will hit the road in 2026. This is likely the same model that is sold as Bayon globally, and will take on the Maruti Suzuki Fronx.

It will be followed, in 2027, by a top-of-the-line SUV, internally known as Ni1i, to challenge the Mahindra XUV 700. The Ni1i is likely to be a long-wheelbase Tucson sold by the company in China. The top-of-the-line SUV will be produced at the Talegaon factory, whereas the crossover will be made at its existing Sriperumbudur plant on the outskirts of Chennai.

To cater to the growing demand for internal combustion engines and export markets, Hyundai also bought a car manufacturing plant in Talegaon, Maharashtra, from USbased General Motors, which had exited India a few years back. The automaker paid Rs 787.2 crore to General Motors for this plant, which is now under redevelopment. Hyundai India expects to start production at the Talegaon plant in the second half of the financial year 2026.

Once the Talegaon facility is partly operational, Hyundai India’s total production capacity will increase to 9,94,000 units per year from the current 8,24,000 units yearly. The total capacity will increase to 10,74,000 units once the plant is fully operational. While acquiring the plant in early 2024, Hyundai India said the company would invest Rs 6,000 crore in the Talegaon facility.

EV Play

Key to the fight back plan will be EVs, a segment that is dominated by key rival Tata Motors and one that Hyundai Motor India has largely ignored. Though Hyundai has introduced two electric cars—Kona and Ioniq 5—in India by importing them as completely built units, the carmaker is yet to enter the mass electric vehicle market in the country.

“A new EV race is starting to happen in India, and Tata and Mahindra are working on it. It is time for the leaders to wake up and start bringing EVs, especially considering the positive outlook for the Indian economy in the coming years. This IPO is mostly about getting money and funding EVs exclusively for India,” said Jato Dynamics’ Munoz.

Hyundai India wants to build a diverse electric vehicle portfolio as the adoption of electric vehicles picks up in the country’s passenger vehicle segment. For this, it has signed an agreement with the Tamil Nadu government to invest Rs 20,000 crore in the state between 2023 and 2032, predominantly to build up EV capacities. The company plans to develop its Chennai plant as an electric and sport utility vehicle production hub.

The automaker will also set up a battery packing assembly unit and install charging stations along major highways and in key cities.Hyundai has developed a dedicated electric vehicle platform, E-GMP, and adapted platforms for battery electric vehicles in India.

“We are following a transition strategy, starting with the launch of high-end, premium EVs. We plan to transition towards the mass markets as the EV market and ecosystem sales increase in India. In line with this, we aim to launch four EV models in the future, including Creta EV, in the last quarter of fiscal 2025,” the company said.

The company’s DRHP states that an EV version of the Creta will be launched in Jan-Mar 2025. Sources indicate that a subcompact SUV, codenamed HE—EV, is scheduled for the festive season 2026. The HE EV will challenge Tata Motors Punch EV.

Alternatively, the company is studying the possibility of launching EVs based on its next gen Grand i10 platform — codenamed Ai4 and Venue based EV. The plans are yet to be finalised. The company is building a localised EV supply chain by focusing more on securing local production capabilities for key parts such as cells, battery packs, power electronics, and drivetrains. This could help the company improve the price competitiveness of its EV portfolio.

The company has also leased a portion of land within its Chennai Plant to Mobis, which assembles battery systems for electric vehicles. Hyundai has also partnered with battery maker Exide Industries to equip its future electric vehicles in the Indian market with locally produced LFP batteries. “The focus on high localisation levels in electric vehicles, along with the introduction of an electric vehicle-specific platform, is expected to help reduce costs and improve price competitiveness (for Hyundai),” Emkay Research said.

Hyundai India has strategically decided to reduce its exposure in the small car segment while staying away from hybrid vehicles. If market forces were to move in favour of both these directions, it would pose a challenge to the South Korean car maker to get back in the race. To be sure, the company has already started working on a hybrid alternative for India in HQ. If the country approves the speculative lower tax on hybrids, the car maker may introduce hybrid alternatives.

Though Hyundai India did not mention its stand on hybrid cars, the company noted in its DRHP that the South Korean parent company’s diversified xEV portfolio, which includes battery EVs, hybrid EVs, plug-in hybrid EVs, mild hybrid EVs, and fuel cell EVs, will be a “key enabler” for EV strategy in India.

Side Benefits

Besides providing funds for its next phase of growth, the IPO of Hyundai Motor India is also expected to yield other benefits. For example, the company has, over the years, been under the government’s radar for not doing enough for the local value chain and for relying on duty-free imports; the IPO will give Hyundai a greater stake on the ground. A listing in India is expected to make the company “more Indian” by giving it more shareholders and independent directors from the country. In addition, more of the company’s R&D efforts are likely to come from India than earlier.

One of the key stakeholders in the know said the company will likely double its R&D workforce in India with a local test track and regional validation center that will enable it to deliver products quickly tailored to local market needs. The additional engineering set-up is planned for Zaheerabad, Andhra Pradesh, and the announcement is likely to be made soon.

The fresh investment will also help Hyundai bridge the product gaps and compete more intensely in the marketplace. Market experts also see the IPO as an attempt to boost Hyundai India’s image in the domestic market, which is the world’s third-largest and fastest-growing passenger car market.

“It is like Hyundai is sending a message to India and confirming its commitment to the Indian car market. In my opinion, this IPO is more like a political statement reconfirming its commitment to the Indian future, where it should be positioned in the Indian automotive industry,” said Felipe Munoz of JATO Dynamics.

Experts say a local listing will mean more stakes on the ground with empowered Indian management, further aiding speed and agility. However the Indian management bandwidth is thin and they will have to be spruced up significantly — to manage a listed organisation, say people in the know.

A highly profitable operation with a solid manufacturing base, a proven SUV portfolio, and almost $2.5 or 3 billion in funds raised through an IPO will put the company in the fast lane in the market, where it has often seen Tata Motors in its rearview mirror in recent years.

This feature was first published in Autocar Professional’s July 1, 2024 issue.