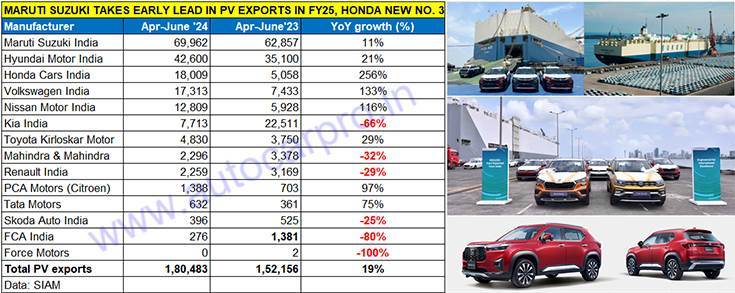

Maruti Suzuki, India’s No. 1 car and SUV exporter for the past three fiscals (FY2024, FY2023 and FY2022) has taken an early lead in overseas shipments of made-in-India passenger vehicles. As per export data released by industry body SIAM, a total of 180,483 units were exported in April-June 2024, up 19% YoY (Q1 FY2024: 152,156 units).

Honda, which is back in the SUV game with the Elevate, has received a huge boost with exports of the made-in-India WR-V (the rebadged Elevate SUV).

Honda, which is back in the SUV game with the Elevate, has received a huge boost with exports of the made-in-India WR-V (the rebadged Elevate SUV).

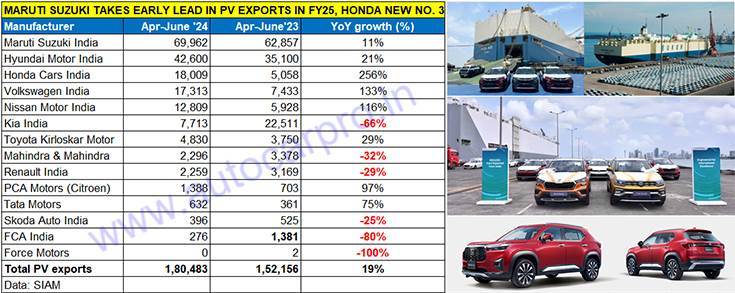

Maruti Suzuki India, with 69,962 units and 11% growth, has opened FY2025 on a strong note and is 27,362 units ahead of Hyundai Motor India in the first quarter of FY2025. The company, which exports to nearly 100 countries and sees Africa, Latin America, Asia and the Middle East are its key markets, currently exports 17 models with the Grand Vitara being the latest to join the export portfolio. UVs – 31,977 units and up 183% – accounted for 46% of Maruti exports, while hatchback and sedan shipments, at 36,201 units comprised 52% with the remaining 2% coming from the Eeco van. At present, the Maruti Suzuki models with the highest export demand are the Dzire sedan, the Swift, S-Presso and Baleno hatchbacks, and the Brezza SUV.

Hyundai Motor India, with exports of 42,600 units, sees a YoY increase of 21 percent. The company, which lost the top exporter title to Maruti Suzuki in FY2022, has been stretched for manufacturing capacity and has focused on catering to demand in the domestic market. But with additional capacity coming its way with the acquisition of GM India’s Talegaon plant, it will be better placed to cater to exports in the coming years. Hyundai’s top PV exports included i10 and i20 hatchbacks an d Aura sedan (20,919 units), the new sixth-generation Verna sedan (13,962 units, up 45%), Venue and Exter SUVs (3,763 units, up 6%), flagship Alcazar SUV (3,763 units, up 41%) and the Creta SUV (782 units, down 24%).

Honda is the second-highest UV exporter – the 10,659 Elevates/WR-Vs in Q1 FY2025 give it an export share of 14% of total UV exports of 76,281 units.

Honda is the second-highest UV exporter – the 10,659 Elevates/WR-Vs in Q1 FY2025 give it an export share of 14% of total UV exports of 76,281 units.

The big news is Honda Cars India jumping into third place with 18,009 units, up 256% on a low-year ago base of 5,508 units. The Japanese carmaker, which is back in the SUV game with the Elevate, has received a huge boost with exports of the made-in-India WR-V (the rebadged Elevate SUV). Honda is the second-highest UV exporter – the 10,659 Elevates/WR-Vs in Q1 FY2025 give it a UV export share of 14% of total exports of 76,281 units by India UV Inc. Since August 2023, when Elevate exports to Japan began, HCIL has shipped a total of 61,863 units. The Elevate has also eclipsed City sedan exports (7,080 units) in Q1 FY2025.

Volkswagen India, which witnessed strong export demand in FY2024 (44,180 units), has shipped 17,313 cars and SUVs in April-June 2024, up 133 percent and maintains its fourth rank. Leading the charge for the German carmaker is the made-in-India Virtus global sedan with 9,166 units, up 88% and the Taigun midsize SUV with 5,466 units, up 329%. Both the models are built on VW’s MQB-AO-IN platform (as are Skoda Auto India’s Slavia sedan and Kushaq SUV).

Nissan Motor India, with 12,809 units, up 116%, is ranked fifth on the PV export ladder-board. The Sunny sedan continues to be its top export model with 9,166 units, followed by the Magnite SUV. On June 29, the company crossed the cumulative export milestone of 1.1 million units, with a Magnite being the milestone SUV shipped from the Ennore Kamarajar Port.

Kia India, which is the No. 3 PV exporter in FY2024 (52,105 units, down 39%) is now down to No. 6 position in Q1 FY2025. The 7,713 units are a sharp 66% YoY decline (Q1 FY2024: 22,511 units). Numbers have been dragged down by the big decline in exports of its biggest export model, the Seltos (1,764 units, down 78% YoY) as well as the Sonet (3,153 units, down 74%). The Carens MPV is the sole product to see growth (2,796 units, up 28%).

Toyota Kirloskar Motor, which increased production capacity at its plants in Bidadi, Karnataka, retains its seventh ranking (as of FY2024) in Q1 FY2025 with 4,830 units, all of them UVs comprising the Rumion MPV and the Urban Cruiser Hyryder).

In April, Citroen India dispatched its first shipment of e-C3s to Indonesia from the Kamarajar Port to become the multinational carmaker to export EVs.

In April, Citroen India dispatched its first shipment of e-C3s to Indonesia from the Kamarajar Port to become the multinational carmaker to export EVs.

PCA Motors, the maker of Citroen cars in India, which had dispatched 3,278 units abroad in FY2024, has exported 1,388 units in Q1 FY2025. On April 11, 2024, Citroen India dispatched the inaugural shipment of 500 units of the made-in-India Citroen e-C3 hatchbacks to Indonesia from Kamarajar Port, thereby becoming the first multinational carmaker to export EVs.

Q1 EXPORTS AUGUR WELL FOR FY2025

Given that FY2024 exports at 672,105 units were up just 1.4% YoY, India Passenger Vehicle Inc’s total overseas shipments of 180,483 units, which are a 19% YoY increase, constitute a good opening quarter for FY2025 and augur well for the ongoing fiscal.

India PV Inc’s best-ever export year was FY2017 when a total of 758,830 units were shipped overseas (with Hyundai Motor India, Maruti Suzuki and Nissan Motor India leading the charge). PV exports had slid to their lowest level – 404,400 units – in the past 10 years in FY2021.

Demand in the domestic market is slowing down and passenger vehicle inventories are at a record high. With ample manufacturing capacity at hand, car and SUV manufacturers will be looking to aggressively ship their products to overseas markets. Will FY2025 transform into a record-breaking fiscal for exports. Well, we will have to wait for three more quarters to find out.

ALSO READ:

Two-wheeler exports rise 17% to 923,000 units in Q1 FY2025