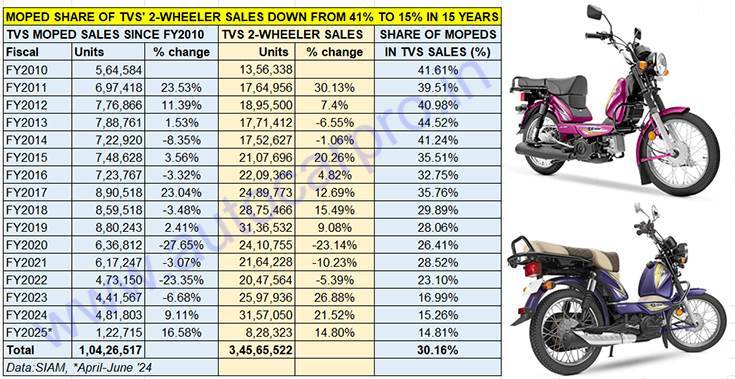

Even as the Indian two-wheeler industry registered wholesales of 4.98 million units, up 20% YoY, in April-June 2025, what comes to light is the continuing and strong contribution of the humble moped, the product at the lowest end of the two-wheeler pyramid, to overall industry numbers. TVS Motor Co, the sole IC engine moped manufacturer in India, continues to see demand albeit a lot less than it did 15 years ago.

As per SIAM wholesales data for Q1 FY2025 (April-June 2024), the company dispatched 122,715 XL100s, up 16.58% year on year (Q1 FY2024: 105,261 units). Do the math – that’s 1,348 mopeds sold every day for the 91-day period between April and June 2024.

What keeps the moped mantra ticking for TVS is the small two-wheeler’s affordability quotient, good mileage, and high level of reliability as a carrier of household goods, dairy and agricultural produce for small traders, particularly in rural India. Most of the moped demand is understood to generate from South India, Gujarat and regions of Madhya Pradesh.

The XL100 is currently sold in five variants, from the base Heavy-Duty (Rs 44,999) through to the top-end Comfort i-Touchstart (Rs 60,905).

TVS Motor Co currently has only one model on sale – the TVS XL100. Available in five variants (as shown above), the XL100’s pricing starts at Rs 44,999 for the base ‘Heavy-Duty’ XL100 through to Rs 60,905 (ex-showroom Delhi) for the top-end Comfort i-Touchstart variant. Powered by a BS VI-compliant four-stroke, single-cylinder 99.7cc petrol engine which develops 4.3hp at 6000rpm and torque of 6.5 Nm at 3500rpm, the TVS XL has a kerb weight of 89kg.

Amidst the multitude of scooters and motorcycles of varying cubic capacity, the TVS XL100 continues to soldier on and maintains a sizeable contribution to the company’s overall two-wheeler volumes. A deep dive into 15-year wholesales data reveals that from a 41% share (546,584 mopeds) of TVS two-wheelers (1.35 million units) in FY2010, mopeds currently (122,715 units in Q1 FY2025) account for 15% of total TVS volumes of 828,323 two-wheelers.

Cumulative sales of 122,715 XL100s in April-June 2024 were a 16% YoY increase and translate into 1,348 mopeds sold every day in Q1 FY2025.

Cumulative sales of 122,715 XL100s in April-June 2024 were a 16% YoY increase and translate into 1,348 mopeds sold every day in Q1 FY2025.

TRADING PLACES DUE TO CHANGED MARKET DYNAMICS

The moped story is one of trading places. In FY2010, TVS sold a total of 13,56,338 two-wheelers comprising 299,396 scooters, 492,358 motorcycles and 564,584 mopeds. At the time, mopeds were the highest selling vehicles for TVS and accounted for the largest share of its two-wheeler sales – 41.62%, followed by motorcycles (36.30%) and scooters (22.07%).

Fast forward 15 fiscals to FY2024 and the market dynamics have changed completely. Of TVS’ total 31,57,050 two-wheelers sold in FY2024, scooters accounted for 14,51,409 units and a 46% share, motorcycles (12,23,838 units / 39% share) and mopeds (481,803 units / 15% share).

In FY2010, TVS had a two-wheeler stable of around a dozen products comprising five scooters (Teenz, Pep, Pep+, Streak, Wego), 11 motorcycles (Max/Max 4R, Victor GX/GLX, Jive, Star City/ Star City 125, Sport, Flame, Phoenix and Apache) and 75cc mopeds. At present, TVS has a similar-sized product portfolio comprising five scooters (Scooty Pep+, Scooty Zest, Jupiter, NTorq, iQube electric), six motorcycles (Sport, Star City Plus, Radeon, Raider, Ronin and Apache) and one moped (XL100) but consumer preference has shifted firmly in favour of scooters and bikes.

Moped sales hit their highest in FY2017 when 890,518 units were sold and accounted for 5% of India Auto Inc’s two-wheeler sales of 17.58 million units.

Moped sales hit their highest in FY2017 when 890,518 units were sold and accounted for 5% of India Auto Inc’s two-wheeler sales of 17.58 million units.

Moped sales in India and for TVS hit their highest level in FY2017 (890,518 units, up 23% YoY) and in FY2019 (880,234 units, up 2%). However, with consumers shifting loyalty to gearless scooters (like the TVS Jupiter launched in FY2014 and the company’s first 125cc scooter (NTorq) in FY2018 as also a clutch of rider-friendly bikes, the decline in moped sales had begun.

While the moped per se did witness an evolution in getting a four-stroke engine, 100cc power and also an electric-start option, the real sales breaker came in April 2020 when India Auto Inc made the mandatory upgrade from BS IV to BS VI. As a ratio of a moped’s retail price, which was then in the Rs 29,000 to Rs 38,000 range, the BS VI-compliant product price hike was a significant one.

April 2020 was also when the pandemic struck and brought the country and manufacturing to a standstill. Moped sales fell sharply by 27% in FY2020 to 636,812 units, dropped by 3% in FY2021 and then again by 23% to 473,150 units in FY2022. FY2024 though with 481,803 units (up 9%) and Q1 FY2025 (122,715 units, up 16% YoY) have seen moped demand stage a recovery but the numbers are a far cry from the heady FY2019.

Coming after the iconic Kinetic Luna, which was launched in 1972, the TVS moped is 45 years old and is estimated to have clocked cumulative sales of over 3.5 million sales over four-and-a-half decades. It was in 1979 that Sundaram Clayton, a TVS Group company, set up a moped factory at Hosur to manufacture the TVS 50 moped which is known to have a top speed of 105kph.

Price differential between the TVS XL100 (left) at Rs 45,000 and the latest moped in town – the Kinetic E-Luna – priced at Rs 79,990 remains large.

Over the years, there were other mopeds like the Hero Puch, Mopeds India’s Suvega and the BSA Bond but they all bit the dust and the TVS XL100 has proved to the last moped standing. That is until the e-Luna, the electric avatar of the Kinetic Luna, was launched in February 2024 at an introductory price of Rs 69,990 and currently has an ex-showroom price of Rs 79,990. That’s Rs 34,991 costlier than the base Heavy Duty TVS XL (Rs 44,999) and Rs 19,085 more than the top-end variant, the Comfort i-Touchstart (Rs 60,905). The sizeable price difference between the Kinetic e-Luna and the TVS XL100 means India’s sole petrol-engined moped will continue to ride the demand which comes its way.

TVS MOPED TO GO ELECTRIC?

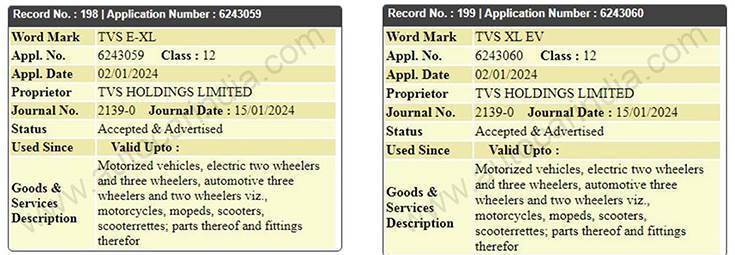

Will the TVS moped go electric? There’s no confirmation on that front yet but given the company’s strong success with its first electric scooter, the iQube, which has sold over 350,000 units since launch in January 2020, it would not be wrong to surmise that TVS could expand its two-wheeled EV portfolio.

Earlier this year, Autocar India reported that TVS has trademarked two names bearing the ‘XL’ moniker. Are these clues to a new battery-powered XL moped? We’ll have to wait to know more.