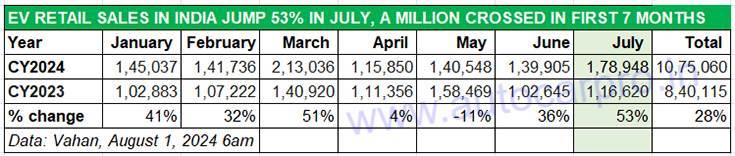

India’s electric vehicle industry has had a good July 2024 on the retail sales front. At 178,948 units, the year-on-year increase was a strong 53%, with an additional 62,328 EVs being sold (July 2023: 116,620 units) or 5,772 EVs being sold each day.

This strong growth was expected as the now-extended Electric Mobility Promotion Scheme 2024 (EMPS) was to have ended on July 31, with e-scooter and bike buyers advancing their purchase decisions ahead of that date. However, on July 26, the government extended the EMPS subsidy scheme by another two months till the end of September.

The EMPS now targets to support 560,789 EVs, comprising 500,080 e-two-wheelers and 60,709 ethree-wheelers (e-3Ws). This includes 13,590 rickshaws and e-carts, as well as 47,119 e-3Ws in the L5 category.

Seven months into CY2024, India EV Inc is now 457,258 units away from the record annual sales of 10,75,060 units it achieved in CY2023.

Seven months into CY2024, India EV Inc is now 457,258 units away from the record annual sales of 10,75,060 units it achieved in CY2023.

At 178,948 units, July is the second-best month for India Auto Inc in the calendar year to date, after the FY2024-ending March (213,036 EVs) when the 200,000-unit milestone was surpassed for the first time as a result of the FAME III subsidy scheme ending. Although EMPS, initially valid for four months from April-July 2024, had already been announced in end-March, customer offtake was slow in April (115,850 units, up 4%). Demand picked up in May (140,548 units, down 11%) and June (139,905 units, up 36%) but revved up to target the 180,000 mark in July.

That’s thanks to the two key growth drivers and the biggest volume creators for the sector as also the most affordable ones – the electric two- and three-wheeler sub-segments. Between the two, they accounted for 170,577 units or 95% of total EV sales in July.

OLA SELLS OVER 41,000 E-SCOOTERS, TVS-BAJAJ BATTLE TURNS INTENSE

The e-two-wheeler sub-segment maintained its strong ratio for India EV Inc with 60% share of the total 1,78,948 EVs sold in India in July 2024, and helped drive overall industry numbers.

Led by Ola Electric, two-wheeler OEMs are well set to hit the million-units milestone for the first time in 2024. Seven-month retails at 634,770 units are already 74% of 2023’s record sales.

Led by Ola Electric, two-wheeler OEMs are well set to hit the million-units milestone for the first time in 2024. Seven-month retails at 634,770 units are already 74% of 2023’s record sales.

The e-two-wheeler segment registered sales of 106,949 units, up 34% YoY, surpassing the 100,000-unit mark after four months. Market leader Ola Electric led the charge with 41,597 units in July 2024, up 114% YoY, and a 39% market share. Ola is followed by TVS Motor Co (19,471 iQube e-scooters), improving 87% on year-ago sales and a 18% share. Third-ranked Bajaj Auto seems to have cemented its position as the No. 3 e-two-wheeler OEM – the company retailed 17,642 Chetaks, a 375% YoY increase on a low year-ago base (July 2023: 4,128 units). This was the seventh month in a row that Bajaj has outsold Ather Energy. What’s more, it is now hard on the heels of TVS Motor Co, and currently has a 16.49% market share.

Mahindra Last Mile Mobility with 6,975 units was over 3,000 units ahead of the No. 2 OEM, YC Electric. Bajaj Auto (3,691 units) takes No. 3 rank for a month for the first time since its market entry in June 2023.

Mahindra Last Mile Mobility with 6,975 units was over 3,000 units ahead of the No. 2 OEM, YC Electric. Bajaj Auto (3,691 units) takes No. 3 rank for a month for the first time since its market entry in June 2023.

MAHINDRA STRENGTHENS ITS GRIP ON E-3W MARKET, BAJAJ AUTO IS NO. 3 FOR THE FIRST TIME

This segment of the EV market is the one which is witnessing the fastest transition to e-mobility and at present each second three-wheeler sold in India is a zero-emission model. This is also the segment which has the highest number of players – 512 – as per Vahan company-wise data. Despite this big number, 10 players dominate the market and in July, they accounted for 42% of total sales.

Like the e-two-wheeler industry, e-three-wheeler OEMs have been impacted by the now-reduced subsidy which has seen most OEMs increase their product prices. While this can somewhat dampen demand, the wallet-friendly long-term USP of an EV remains a draw in the electric three-wheeler segment, which has a high percentage of single-owners as well as last-mile logistics operators.

At over 63,000 units sold, July 2024 was the best-ever month for e3W OEMs.

At over 63,000 units sold, July 2024 was the best-ever month for e3W OEMs.

In July 2024, the zero-emission e-three-wheeler industry hit its best-ever monthly sales – 63,628 units, up 18% YoY (July 2023: 53,864 units), beating the previous best of 60,752 units in March 2024.

Electric three-wheeler market leader Mahindra Last Mile Mobility maintains its strong grip and was over 3,000 units ahead of the No. 2 player. MLMM sold a total of 6,975 units, which gives it an 11% market share. In July, ahead of the government extending the EMPS subsidy, the company had aggressively pushed its five models comprising the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Super and e-Alfa Cargo which cater to multiple mobility operations in the passenger and cargo domains. To ensure sustained supplies to meet growing demand, MLMM has tripled its production capacity, leveraging its manufacturing plants in Bengaluru, Haridwar, and Zaheerabad.

The firm No. 2 player is YC Electric Vehicles, which sold 3,857 units in July – this is its best monthly sales yet. Like MLMM, YC Electric has five products – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations.

Bajaj Auto, which is the IC engine three-wheeler market leader, has two products on sale – the Bajaj RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0. July 2024, with 3,691 units sold, marks the first time that Bajaj Auto has taken the No. 3 rank for a month. July retails are also Bajaj’s best monthly figures yet. Bajaj Auto is clearly making its presence felt in this segment of the industry. Since its e3W market entry in June 2023, Bajaj Auto has seen demand rising month on month, which is reflected in the company’s 5.80% market share in July.

In CY2023 (six months since market entry in June 2023), Bajaj Auto was ranked 28th. In FY2024, in just 10 months after its EV rollout, Bajaj grabbed a 2% market share and was ranked No. 13. Fourteen months down the line, it is now No. 3 and a 6% market share. With growing demand for both its products, ramped-up production and an expanded EV sales network, expect the Pune-based auto major to achieve higher numbers.

Saera Electric Auto is ranked fourth with 2,573 units in July, followed by Dilli Electric Auto (2,268 units) and Piaggio Vehicles (1,953 units).

ELECTRIC CAR & SUV MAKERS SELL 7,500 EVs, TATA SHARE AT 63%

Retail sales of electric passenger cars, SUVs and MPVs crossed the 7,500-unit mark for the third month in a row in July 2024. While the 7,517 units sold in July 2024 are down 3% on year-ago sales (July 2023: 7,768 units), they are a 4% month-on-month increase (June 2024: 7,211 units).

While the 7,517 units sold in July 2024 are down 3% YoY (July 2023: 7,768 units), they are a 4% month-on-month increase (June 2024: 7,211 units).

While the 7,517 units sold in July 2024 are down 3% YoY (July 2023: 7,768 units), they are a 4% month-on-month increase (June 2024: 7,211 units).

Electric passenger vehicle market leader Tata Motors, which has the largest portfolio comprising the Nexon EV, Tigor EV, Tiago EV, Xpres-T (for fleet buyers) and the Punch EV, sold 4,752 EVs in July 2024. This constitutes a YoY decline of 13% YoY (July 2023: 5,470 EVs), reflecting the increased competition in the marketplace. In July 2024, Tata Motors share of the ePV market was 63%, down from the 70% it had in July 2023.

MG Motor India, which has two EVs on sale (the ZS EV and Comet EV), sold 1,520 units in July – its best monthly performance in the year to date. This gives it a market share of 20%, improving upon its year-ago share of 16% in July 2023.

Mahindra & Mahindra is ranked third on the e-PV ladder-board with sale of 485 XUV 400s, its sole EV, in July 2024, up 27% (July 2023: 380 units). This gives the company a 6.45% EV market share for the month.

BYD India, which sells the Atto 3 SUV, e6 MPV and launched the Seal sedan on March 5, is ranked fourth in July with 342 units (4.54% market share). This is the EV OEM’s best monthly sales in the year to date and improving upon June 2024’s 238 units. BYD was behind Hyundai for the first three months of this year but has surged ahead of the Korean carmaker since April for four straight months. June sales (000 units) are BYD India’s best monthly numbers YTD.

Meanwhile, PCA Motors (Citroen India) has gone ahead of Hyundai in the numbers game. In July, PCA sold 155 units, albeit this is down 35% on June’s 238 units. The company, which retails the e-C3, the electric avatar of the C3 hatchback, is seeing growing demand particularly from EV fleet operators. The Citroen eC3, which has a 29.2kWh battery pack and an ARAI-claimed range of 320km, should see increased sales momentum later this year. Between March and June 2024, the e-C3 has received bulk orders for over 7,000 units from Blusmart, OHM E Logistics and Cab-E.

Having discontinued the Kona in India, five years after launching it in July 2019, Hyundai Motor India sold 55 Ioniq 5 EVs in July.

Meanwhile, demand for luxury electric cars, sedans and SUVs was slow in July compared to previous months this year. As per Vahan data, combined retail sales of seven OEMs in July 2024 were 165 units, down 14.50% (July 2023: 193 EVs). However, they have logged a 28% YoY increase when it comes to cumulative seven-month sales: 1,525 units in January-July 2024 versus the 1,191 units sold in January-July 2023.

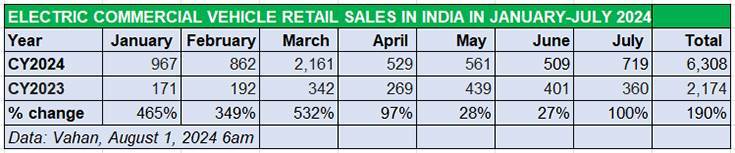

ELECTRIC CV MAKERS SELL 719 UNITS IN JULY

Even as the buzz about hydrogen as an alternative fuel to drive sales of commercial vehicles (CVs), particularly long-haul trucks, gets louder, demand for electric CVs has risen smartly. The CV sector essentially comprises light-, medium- and heavy-duty goods carriers and passenger-transporting buses.

As per the latest Vahan retail sales data, the CV industry, where electric mobility makes wallet-friendly TCO sense given the much larger number of kilometres driven, compared to personal EVs, clocked retail sales of 719 units in July, up 100% on a low year-ago total of 360 units.

As the monthly sales numbers (see retail sales tata table above) shows, the FY2024-ending month of March 2024 witnessed the highest demand – 2,161 eCVs, followed by January (967 units). The average monthly sales of 935 eCVs in H1 2024 is a marked increase over the 308 units in H1 2023.

INDIA EV INC WELL SET TO RECORD SALES OF OVER 1.5 MILLION UNITS IN 2024

With the EMPS subsidy policy extended for another two months till end-September, expect demand to sustain in the volume-generating two- and three-wheeler segments. What’s more, with Ganesh Chaturthi coming up in early September, it can be surmised that next month should see a strong bump up in the retail sales of these two segments, which together account for over 95% of India EV Inc’s sales.

Meanwhile, the action in the electric passenger car, SUV and MPV market is also growing with new models and variants being introduced. On the commercial vehicle industry front, demand for intra-city and last-mile logistics should see an uptick.

With five months to go in 2024, EV OEMs in India are now 457,258 units away from the industry’s record annual sales of 10,75,060 units achieved in CY2023. Given the 153,000-odd monthly average sales of the past three months, that should be surpassed by around November this year. Stay tuned for further insights and analyses of the EV industry.

ALSO READ:

Electric two-wheeler sales in July cross 100,000 units after four months

Electric 3Ws clock best-ever monthly sales in July: over 63,000 units

Electric car & SUV OEMs sell 7,500 units in July, 56,000 EVs in first 7 months of 2024