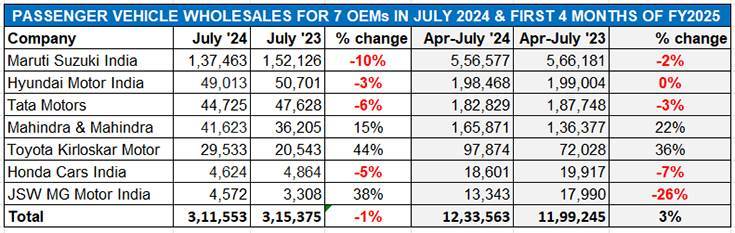

The Indian passenger vehicle (PV) industry, which crossed the million-units mark (10,26,006 units, up 3%) in the first quarter of FY2024, seems to have begun the second quarter on a similar slower note. As per the compay-wise releases for seven PV manufacturers, combined wholesale dispatches add up to 311,553 units, which makes for a 1% year-on-year decline (April-July 2023: 315,375 units). As the data table below reveals, four of the seven OEMs have registered a YoY downturn in their wholesales.

Four of the seven passenger vehicle OEMs, including the top three, have registered a YoY downturn in their wholesales for July 2024.

Four of the seven passenger vehicle OEMs, including the top three, have registered a YoY downturn in their wholesales for July 2024.

On the cumulative four-months front (April-July 2024), total dispatches of these seven OEMs are 1.23 million units, up 3% on the 1.19 million units in April-July 2023. Let’s take a quick look at how each of these OEMs fared.

The tepid numbers in July 2024 could be put down to the SUV and car makers rationalising high inventory levels. In June 2024, PV retail sales of 281,566 units had witnessed a high level of decline – down YoY by 6.77% YoY (June 2023: 3,02,000 units) and 7.18% month on month (May 2024: 303,358 units). In early July, FADA president Manish Raj Singhania said that inventory levels had hit an all-time high, ranging from 62 to 67 days despite improved product availability and substantial discounts aimed at stimulating demand. He had said at the time, “Dealer feedback highlights challenges such as low customer inquiries and postponed purchase decisions. With the festive season still some time away, it is crucial for passenger vehicle OEMs to exercise caution. Effective inventory management strategies are essential to mitigate financial strain from high interest costs. FADA strongly urges PV OEMs to implement prudent inventory control and engage proactively with the market.”

From the look of the seven OEM’s July numbers, it looks that prudent inventory control has been in place, which is reflected in the plenty of red ink.

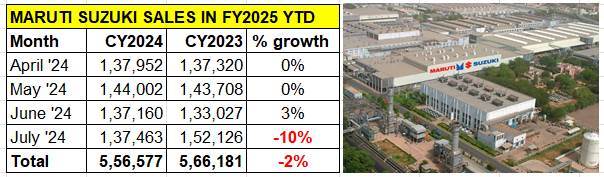

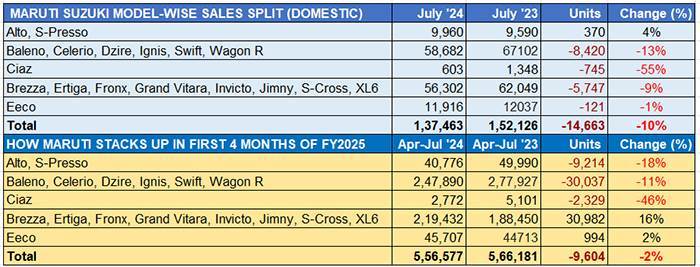

MARUTI SUZUKI INDIA

July 2024: 137,463 units, down 10%

April-July 2024: 556,577 units, down 2%

Market leader and PV industry bellwether Maruti Suzuki India has reported a 10% sales decline in July 2024 – 137,463 units, which are just 303 units more than in June 2024. This performance comes on the back of tepid sales in the first quarter of FY2025 as seen in the four-month wholesales data table below. As it has been for quite some time now, sustained demand for most of its SUVs and MPVs has saved the blushes for the company. However, in July, dispatches of its seven-model utility vehicle portfolio were also down.

If there is some relief then it could be the revival of rural market sales, reflected in the improving fortunes of the entry level duo of the Alto and S-Presso – 9,960 units, which are a 4% YoY increase albeit the four-month combined total of 40,776 units is down 18% YoY. The recent move to rev up demand for its budget cars, when the company slashed prices of the Alto, S-Presso and Celerio to Rs 499,000, has paid off and the coming months should see improved demand for these models.

Maruti Suzuki dispatched a total of 58,682 units of the six-model hatchback range comprising the Baleno, Wagon R, Swift, Celerio, Dzire, Tour S and Ignis, down 13% YoY. This is the lowest for this quintet in the past three months, after the 64,049 units in June and 68,206 units in May 2024. The April 2024 tally was 56,953 units. Four-month sales at 247,890 units are down 11% YoY. The company’s sole sedan – the premium Ciaz – wholesales were down by 55% to 603 units, and even the Eeco van has felt the heat with 11,916 units, down 1 percent in July.

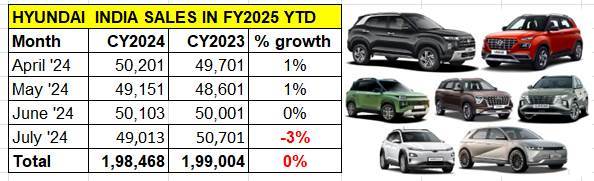

HYUNDAI MOTOR INDIA

July 2024: 49,013 units, down 3%

April-July 2024: 198,468 units, 0% growth

Hyundai Motor India has reported dispatches of 49,013 units in July 2024, which constitutes a YoY decline of 3% (June 2023: 50,701 units). This is the second month in the ongoing fiscal year that monthly sales have gone a tad below the 50,000 mark.

SUVs continue to provide the bulk of the sales for the Korean car and SUV manufacturer. Hyundai Motor India retails 10 models in India — two hatchbacks (Grand i10 Nios, i20), two sedans (Aura, Verna) and six SUVs (Creta, Venue, Alcazar, Exter, and Tucson along with the all-electric Ioniq 5). The company has, a couple of months ago, pulled the all-electric Kona out from the market.

The new Creta, which is India’s best-selling midsize SUV, and the Venue and Exter compact SUVs continue to be the growth drivers. The new Creta, launched in mid-January 2024, clocked its highest-ever monthly dispatches yet in July – 17,350 units – and accounted for 35% of Hyundai’s July wholesales. The rapid pace of demand for the model has meant that the new Creta cruised to 100,000-unit sales in just six months. This makes it the fastest in its segment to hit the 100,000 milestone and in half the time the Maruti Grand Vitara took.

While the sales stats for the other SUVs have not been released, suffice it to say that the two compact SUVs – Venue and Exter – would have also registered high numbers.

TATA MOTORS

July 2024: 44,725 PVs – down 6% / 5,207 EVs, down 21%

April-July 2024: 182,829 PVs – down 3% / 21,606 EVs, down 16%

Growth is slowing down for Tata Motors, which had registered record passenger vehicle sales in FY2024 and CY2023. The car and SUV maker dispatched 44,725 PVs in July, down 3% YoY. The decline in its EV wholesales at 5,027 units, down 21% YoY, has dragged overall numbers down. While the July numbers have stalled the month-on-month sales decline since February, they have nevertheless contributed to the cumulative four-month wholesales decline of 3% – 182,829 units (April-July 2023: 198,748 units).

Tata Motors, which is the third-ranked passenger vehicle OEM after Maruti Suzuki and Hyundai Motor India, is to some extent feeling the heat of the strong SUV competition from Maruti Suzuki, Mahindra & Mahindra and Hyundai Motor India.

Demand for Tata Motors’ CNG models is growing. While the specific launch date remains unknown, Tata Motors has confirmed that it will introduce the Nexon iCNG model this fiscal year. On the new variant front, June 6 saw the company launch the new Altroz Racer, the sporty avatar of the snazzy premium hatchback and its answer to the Hyundai i20 N Line.

Tata maintains leadership in EVs but competition’s growing

Tata maintains leadership in EVs but competition’s growing

One of the market advantages that Tata Motors has is that its ‘New Forever’ portfolio spans petrol, diesel, CNG and electric powertrains, thereby considerably expanding its reach compared to most of its rivals.

July saw dispatches of 5,027 EVs (down 21% YoY), which makes for an EV penetration level of 11 percent. The combined April-July 2024 total of 21,606 units is down 16% on year-ago sales of 25,675 units and account for a 12% share of Tata Motors’ overall PV sales of 182,829 units.

Tata Motors, which has the largest portfolio comprising the Nexon EV, Tigor EV, Tiago EV, Xpres-T (for fleet buyers) and the Punch EV, retailed 4,752 EVs in July 2024, down 13% (July 2023: 5,470 units). This is indicative of the increased competition in the marketplace. In July 2024, Tata Motors’ share of India’s ePV market was 63%, down from the 70% it had in July 2023. The company is all set to launch the Curvv EV, the first variant of the SUV-coupe on August 7, with prices starting around Rs 20 lakh. This will position it above the Nexon EV and below the upcoming Harrier EV. The Curvv EV will rival the upcoming Hyundai Creta EV, Maruti eVX and even the MG ZS EV, while the ICE (petrol and diesel) variants will take on midsize SUVs such as the Hyundai Creta, Maruti Grand Vitara and Kia Seltos.

The company’s share of the ePV market, which was not too long ago upwards of 75%, has been continually reducing, reflecting the growing competition from rival EV OEMs and increased product choice for buyers. Nevertheless, there continues to be a big difference in numbers between Tata Motors and the rest of the competition.

MAHINDRA & MAHINDRA

July 2024: 41,623 units, up 15%

April-July 2024: 165,871 units, 22% growth

Mahindra & Mahindra, with its SUV-laden portfolio, continues to fire on all cylinders. The company has reported domestic market wholesales of 41,623 units in July 2024, which is a 15% YoY increase (July 2023: 36,205 units) and marks the seventh month in a row that M&M has surpassed the 40,000-unit dispatches mark.

Sales in the first four months of FY2025 (April-July 2024) at 167,871 units are up 22% YoY and 36% of M&M’s record FY2024 sales of 459,877 units. In the highly competitive UV market, M&M, which has eight SUVs (Bolero, Bolero Neo, Scorpio, Scorpio N, Scorpio Classic, Thar, XUV3XO, XUV400 and XUV700), is extremely well placed to capitalise on the surging demand for this vehicle type.

Demand continues to be strong and as of August 1, 2024 (and May 15 for the recently launched XUV 3XO), M&M had total open bookings of 220,000 units. These comprise the flagship XUV700, Scorpio N and Scorpio Classic, Bolero, Thar and the XUV 3XO. The youngest Mahindra in town has been priced aggressively from Rs 749,000 – the XUV 3XO is targeted to be new disrupter in the compact SUV market, which saw sales of over a million units in FY2024 and accounted for 25% of the record 2.52 million UV dispatches in India.

Like it does every year, Mahindra & Mahindra will take the covers off its latest product – the Thar Roxx – on August 15. The five-door SUV is to be positioned above the three-door Thar in Mahindra’s portfolio and will rival the Force Gurkha 5-door and the Maruti Jimny. Pricing is likely to be from around Rs 15 lakh (ex-showroom) upwards. The Thar Roxx will also compete with midsize SUVs like the Hyundai Creta and Kia Seltos, among others.

M&M is benefiting from its substantially ramped-up production at its factories. Given the strong demand for its SUVs, it has outlined plans to further increase output. On June 14, M&M confirmed that it plans to further increase production capacity to 64,000 units per annum or 768,000 units per annum by end-FY2025 and 72,000 units a month / 864,000 units per annum by end-2026.

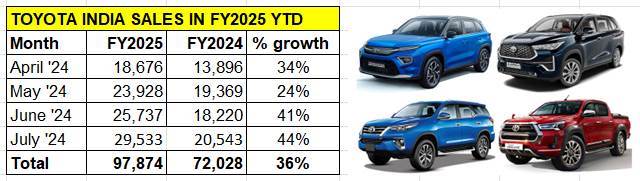

TOYOTA KIRLOSKAR MOTOR

July 2024: 29,533 units, up 44%

April-July 2024: 97,874 units, 36% growth

Toyota Kirloskar Motor is on a roll. Sustained demand for Toyota-made MPVs and SUVs as also the clutch of rebadged models along with ramped-up production and customer-friendly initiatives is paying dividends in the competitive marketplace. So much so, that TKM’s dispatches of 29,533 units, up 36% YoY, are its best monthly numbers in the year to date.

TKM’s rapid growth trajectory is reflected in its cumulative dispatches in the first four months of FY2025 – the 97,874 units are a 36% YoY increase and constitute 40% of FY2024’s record 244,940 sales

Commenting on the strong performance, Sabari Manohar – vice-president, Sales-Service-Used Car Business, Toyota Kirloskar Motor said, “Demand for all our models remains at an all-time high, especially in the SUV and MPV segments. Our formidable presence in these categories, with models like the Innova Crysta, Innova Hycross, Urban Cruiser Hyryder, Rumion, Taisor, Fortuner, Legender, Hilux, and the LC 300, offers robust choices to customers.”

He added, “Our operational enhancement strategy, including the addition of a third shift, is supporting strong demand. For certain models, especially in the case of Urban Cruiser Hyryder, a streamlined supply situation has also led to a reduction in waiting periods.”

On August 1, TKM signed an MOU with the government of Maharashtra to explore the potential of setting up of a greenfield manufacturing facility that will further strengthen the company’s focus on advanced green technologies. In addition, work on the third plant in Bidadi near Bangalore which was announced in 2023, at an investment of Rs. 3,300 crores has already begun with work expected to complete in 2026.

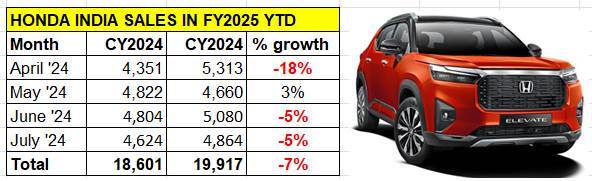

HONDA CARS INDIA

July 2024: 4,624 units, down 5%

April-July 2024: 18,601 units, down 7%

Honda Cars India, which retails the Amaze and City sedans along with the Elevate midsize SUV, dispatched 4,624 units in July, down 5% YoY, while its April-July 2024 tally at 18,601 units is also down, by 7 percent. In fact, the Japanese carmaker has exported 20,719 units in the first four months of FY2024, 2,118 units more than its domestic market wholesales.

While the Elevate midsize SUV has been instrumental in bringing Honda Cars India ‘back in the game’, particularly in the booming SUV segment where it was missing on the action big time, sales have slowed down in the past few months.

GROWTH OUTLOOK FOR THE PASSENGER VEHICLE INDUSTRY

With rationalised inventory and demand for popular SUVs and MPVs remaining as strident as ever, Indian passenger vehicle manufacturers would be gearing up to capitalise on the festive season. There’s Raksha Bandhan coming up on August 19, followed by Janmashtami on August 26. Onam, the festival of Kerala, begins in early September and Ganesh Chaturthi is on September 7. Dussehra is on October 12 and Diwali opens the month of November. These festive occasions are when typically new vehicle buyers prefer to make their purchases and the PV industry, as also other vehicle segments, would be looking to capitalise on.