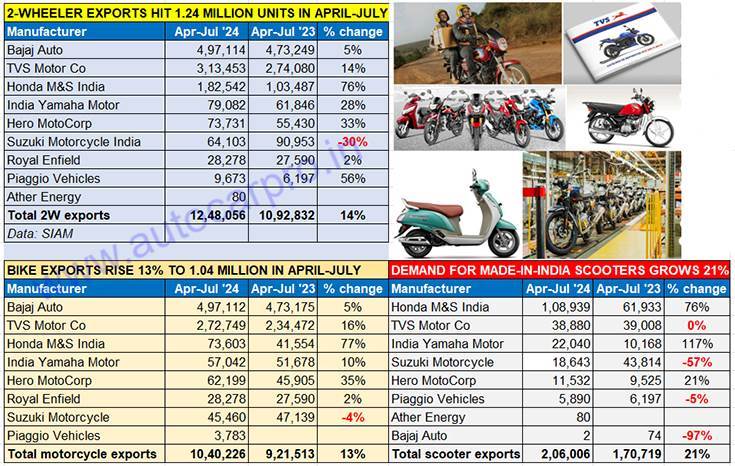

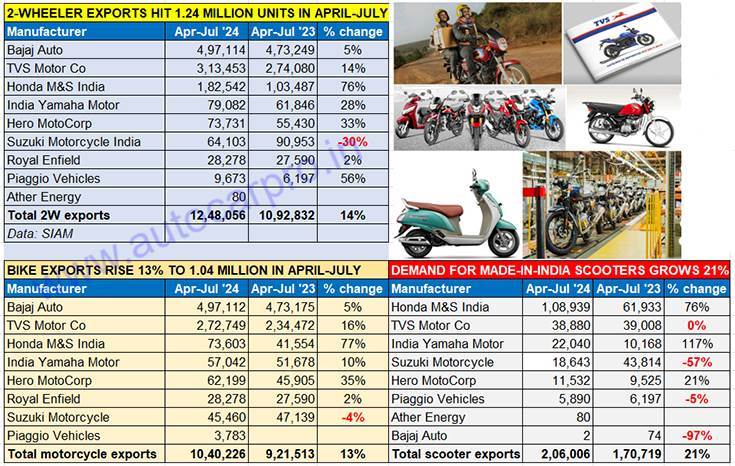

One of the indicators of a maturing automotive market is its automobile exports which, often also act as a buffer to slowing domestic market sales. In the current fiscal year’s first four months, the two-wheeler industry has shipped a total of 1.24 million units, up 14% YoY (April-July 2023: 1.09 million units). While motorcycle exports at 10,40,226 units and up 13% account for 83% of total exports till end-July 2024, scooter shipments at 206,006 units are up 21% YoY (April-July 2023: 170,719 units).

Bajaj Auto remains the No.1 two-wheeler exporter, with overseas dispatches of nearly half-a-million units. The 497,114 units Bajaj exported are up 5% YoY and comprise 497,112 motorcycles (up 5%) and two Chetaks (down 97%). This gives Bajaj Auto an export market share of 40 percent.

In the entry-level up to 110cc fuel-efficient motorcycle category, the company’s exports were down 32% to 145,959 units, reflecting the distress in some key African markets. Export demand for Bajaj bikes though improves as the cubic capacity grows higher. The 110-125cc category fared much better – 129,952 units, up 51% YoY. The 125-150cc category saw exports of 71,690 units, up 50 percent. Dispatches in the 150-200cc category (Husqvarna, KTM, Pulsar) at were up 15% at 87,055 units. Next up is the 200-250cc segment where 30,517 units were exported, up 21 percent. And, with exports of made-in-Inda Triumph motorcycles kicking off in Q1, demand in the 350-500cc category in April-July 2025 rose 35% to 31,939 units.

The company remains optimistic about exports. In an investor call last month, Rakesh Sharma, executive director, Bajaj Auto had said: “There is a small but steady revival in the overseas market and the number of countries which remain in stress conditions is also slowly reducing. Largely, it is Africa, which continues to underperform across almost all major markets, led by Nigeria. Our benchmark motorcycle sales in Nigeria of 50,000 per month has dropped down to under 5,000 in April, but has now recovered to 15,000 levels, still far from the 50,000 benchmark. Compared to Q1 of previous year, we are down by about 40% in Africa, but up by 20% in Middle East and North Africa, up by 70% in Asia, led by Philippines and Nepal, and LATAM has delivered an outstanding performance with a 26% growth and reaching or crossing the benchmark of FY2023 levels. While in stressed markets, we continue to grow with the market, which is largely Africa. But in the recovering and growing market, we are significantly outperforming the industry and gaining share. The new plant in Brazil commenced production in June, it has a single-shift capacity of 20,000 units per annum, but that is scalable to 50,000 units per annum. This will make a quantum change to our capability to introduce new models and widen distribution. Traction for our Dominar brand has been excellent and in the medium term, we expect Brazil to be amongst our top 3 international markets.”

TVS Motor Co, the firm No. 2 exporter, clocked export dispatches of 313,453 units, up 14% YoY, and an export market share of 25% in April-July 2024. The growth is mainly due to strong demand for its motorcycles – 272,749 units, up 16% – because scooter exports were flat at 38,880 units.

TVS two-wheelers are currently sold in over 80 countries in key markets across Asia, Africa and Latin America. In the past 10 months, the company has strategically entered new markets like Nepal, Vietnam, and France. And it has also begun exporting the made-in-Hosur BMW CE 02 electric scooter – 2,652 units were exported between April and June 2024. In the last four months, EV exports are 3,150 units comprising the CE 02 and the TVS iQube.

Commenting on the export performance in an analyst call on August 6, following the company’s Q1 FY2025 earnings, K N Radhakrishnan, director and CEO, TVS Motor Co, said: “There were some challenges in Red Sea that is affecting the transit times and increased also timely availability of vessels containers is a concern. We had some challenges in our dispatches in Q1. We have taken enough countermeasures to mitigate these challenges and situation is likely to improve in Q2. During this quarter, we added HLX 125 5 gear to our portfolio. The new motorcycle offers features that are powerful and efficient. It has best-in-class durability, requires minimal maintenance as a superior engine, provides excellent mileage and performs across terrain. This will definitely further strengthen our international product portfolio. Certain select African markets are facing challenges due to currency devaluation and persistent inflation. However, considering the base effect in our assessment, the possibility of further decline in Africa is low. We feel that we will be doing better in Africa this year. LATAM gives us a huge opportunity. We have started exporting to LATAM. Asia, we are seeing some challenges in Bangladesh, but we are hopeful that things will settle down soon. Middle East also a huge opportunity for TVS and we are strengthening this area.”

“We have a well-planned product lineup for electric mobility and you will be witnessing some of the launches soon. Last year, we started TVS iQube to ASEAN and Asian markets. We will expand EV product sales to both developing and developed markets. We strongly believe that India will emerge as a major export hub for two-wheelers EV,” added Radhakrishnan.

Honda Motorcycle & Scooter India, the longstanding No. 2 player, which saw its domestic market dispatches go ahead of market leader Hero MotoCorp in the April-July 2024 period, shipped 182,542 two-wheelers, improving 14% on its year-ago exports. They comprised 108,939 scooters, which is a big jump of 76% YoY, and 73,603 bikes, which is a similar 77% YoY increase. Clearly, demand is back for HMSI products in its key markets.

The company has outlined a strategic export growth programme. On April 18, HMSI inaugurated a new state-of-the-art engine assembly line at its Global Resource Factory in Manesar, Gurugram (Haryana), with a focus on CKD (Completely Knocked Down) exports. The new assembly line has a manufacturing managing of 600 engines a day and can produce engines for models ranging from 110cc to 300cc, catering to diverse needs and preferences of Honda customers globally.

Hero MotoCorp, the world’s largest two-wheeler manufacturer and the domestic market leader, is upping the ante on its global manufacturing footprint. The company, which entered the growing Southeast Asian market by commencing operations in the Philippines on August 1, 2024, plans to now bring Brazil into its ambit.

In an investor presentation earlier this month, Hero MotoCorp has confirmed that operations will start in Brazil in Q4 FY2024 (January-March 2025). In May this year, the company had said it had plans to set up a new wholly owned subsidiary in Brazil, to manufacture and distribute two-wheelers, including parts and accessories. The Brazilian operations is most likely to be named ‘Hero MotoCorp do Brasil Ltd’, with investment in phases

The company is witnessing demand rise for its exports – the 73,731 units in April-July represent a 33% YoY increase and comprises 62,199 bikes (up 35%) and 11,532 scooters (up 21%). The company now has three overseas assembly plants – in Bangladesh (150,000 units per annum), Colombia (80,000 per annum), Nepal (75,000 units per annum) and the Philippines (150,000 units per annum).

With two-wheeler exports to key African markets coming under pressure due to challenging inflationary conditions which impact two-wheeler purchases, Indian OEMs are looking to diversify into other global markets and Latin America is a promising business opportunity. Brazil, the largest in the region, is one such market. In June 2024, Bajaj Auto commenced operations at its new plant in Manaus, Brazil. The plant has a single-shift capacity of 20,000 units per annum, scalable to 50,000 units. Royal Enfield has five CKD assembly plants worldwide – Thailand, Argentina, Colombia, Brazil and Argentina.

The No. 5 exporter is India Yamaha Motor, with 79,082 units (up 28%). The bulk of its exports comprised bikes – 57,042 units, up 10 percent. The key volume contributors were the FZ and SZ (29,800) Crux (16,688). Scooters contributed 22,040 units, up 117%, including 21,944 Fascino and Ray, 6,714 Aerox, to total exports.

Suzuki Motorcycle India is the sole OEM from among the top players to see a decline – 47,991 units, down 24%, with its performance dragged down by the 60% YoY decline in scooter dispatches (13,069 units) while bike exports were up 8% at 22,221 units.

Royal Enfield, whose FY2024 exports of 100,055 units were down 22% on FY2023’s 77,937 units, has dispatched a total of 28,278 bikes in the first four months of FY2025, up 2% YoY. RE’s line-up includes the Hunter 350 roadster, Meteor 350, Super Meteor 650 cruiser, Interceptor 650 and Continental GT 650 twins, Shotgun 650, the all-new Himalayan adventure tourer, the Scram 411 ADV Crossover, and the Bullet 350 and Classic 350. Along with its two production facilities at Oragadam and Vallam Vadagal, near Chennai. Royal Enfield also has five modern CKD assembly facilities in Nepal, Brazil, Thailand, Argentina and Colombia.

FY2025 EXPORT GROWTH OUTLOOK: OPTIMISTIC

What is heartening is that the reviving two-wheeler export growth story is benefiting all the major OEMs, which augurs well for India Two-Wheeler Inc. Strong domestic sales can only add tailwind to that growth trajectory.

Judicious management of both domestic and export market sales help inventory management as well as capacity utilisation. Bajaj Auto, TVS and Honda have each recorded smart export growth in the first quarter of FY2025 and with demand picking up in key global markets, it is expected things can only get better in the months to come. The icing on the export ‘cake’ is that the profit margins are often better on the made-in-India products.