The Hong Kong market has recently seen a notable uptick, with the Hang Seng Index gaining 1.99% amid positive investor sentiment despite weaker-than-expected economic activity in China. This backdrop of cautious optimism sets the stage for identifying promising growth companies with high insider ownership, particularly those expecting significant earnings growth. In such an environment, stocks with strong insider ownership can be appealing as they often indicate confidence from those closest to the company’s operations. Here are three SEHK-listed growth companies that fit this profile and are anticipating up to 31% earnings growth.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

iDreamSky Technology Holdings (SEHK:1119) |

18.8% |

104.1% |

|

Pacific Textiles Holdings (SEHK:1382) |

11.2% |

37.7% |

|

Tian Tu Capital (SEHK:1973) |

34% |

70.5% |

|

Adicon Holdings (SEHK:9860) |

22.4% |

28.3% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

18.7% |

79.3% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

13.9% |

100.1% |

|

Value Partners Group (SEHK:806) |

23.4% |

59.5% |

|

Beijing Airdoc Technology (SEHK:2251) |

28.6% |

83.9% |

|

Beijing Fourth Paradigm Technology (SEHK:6682) |

22.8% |

104.5% |

|

DPC Dash (SEHK:1405) |

38.2% |

91.5% |

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

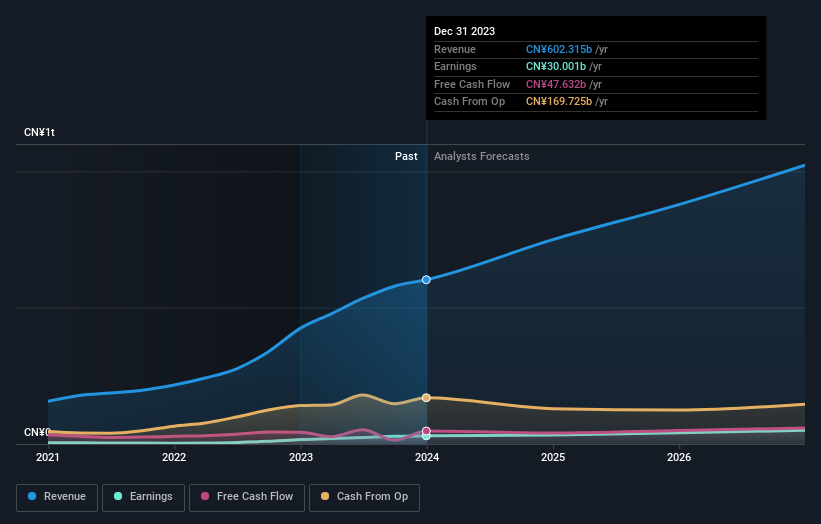

Overview: BYD Company Limited, with a market cap of HK$705.43 billion, operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally through its subsidiaries.

Operations: BYD generates revenue primarily from its automobile and battery sectors, serving markets in China, Hong Kong, Macau, Taiwan, and internationally.

Insider Ownership: 30.1%

Earnings Growth Forecast: 15.2% p.a.

BYD, a significant player in the electric vehicle market, demonstrates strong growth potential with high insider ownership. Recent strategic partnerships, such as the multi-year deal with Uber to deploy 100,000 EVs globally, underscore its expansion efforts. The company’s production and sales volumes have shown substantial year-over-year increases. Analysts forecast BYD’s earnings to grow at 15.22% annually, outpacing the Hong Kong market average of 11%, while its return on equity is expected to reach 22.2% in three years.

Simply Wall St Growth Rating: ★★★★☆☆

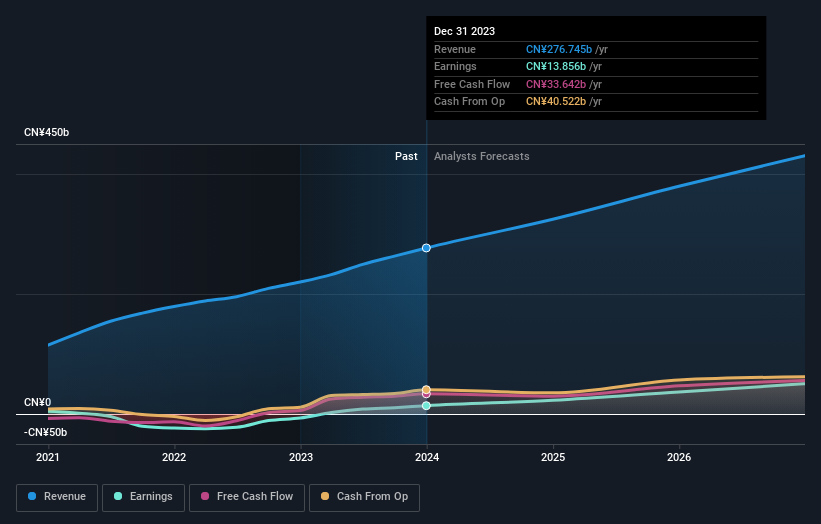

Overview: Meituan operates as a technology retail company in the People’s Republic of China with a market cap of approximately HK$661.07 billion.

Operations: The company’s revenue segments include food delivery, in-store, hotel & travel services, and new initiatives & others.

Insider Ownership: 11.6%

Earnings Growth Forecast: 31.3% p.a.

Meituan, a key player in the Hong Kong market, exhibits strong growth potential with high insider ownership. The company recently announced a $2 billion share repurchase program and reported first-quarter sales of CNY 73.28 billion, up from CNY 58.62 billion last year. Earnings grew by 568.2% over the past year and are forecast to grow at 31.3% annually, significantly outpacing the Hong Kong market’s average earnings growth of 11%.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Techtronic Industries Company Limited designs, manufactures, and markets power tools, outdoor power equipment, and floorcare and cleaning products globally with a market cap of approximately HK$189.48 billion.

Operations: The company generates revenue primarily from its Power Equipment segment ($13.23 billion) and Floorcare & Cleaning segment ($965.09 million).

Insider Ownership: 25.4%

Earnings Growth Forecast: 15.3% p.a.

Techtronic Industries demonstrates solid growth with high insider ownership, evidenced by substantial insider buying in the past three months. Earnings grew 7.8% last year and are forecast to grow 15.27% annually, outpacing the Hong Kong market’s average of 11%. Trading at 29.7% below its estimated fair value, Techtronic recently reported a net income of US$550.37 million for H1 2024, up from US$475.78 million last year, and announced an interim dividend of HKD 1.08 per share.

Summing It All Up

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:3690 and SEHK:669.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com