The big rebound year for rental was 2022 to 2023, when sales increased by 58%.

This is an AI-generated image for informational purposes only. Refer to our Terms of Use.

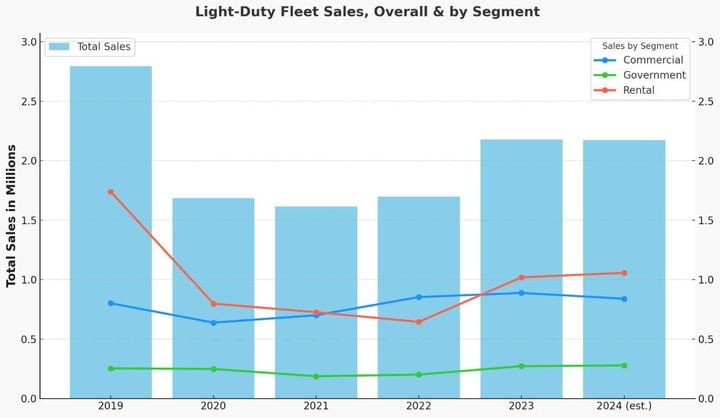

Light-duty fleet sales from the last “normal” year before the COVID-19 pandemic and through projected sales for 2024 show overall sales in three fleet segments — rental, commercial, and government — staying on a path toward more normal sales levels, according to data from Bobit Research.

Rental Fleet Sales Drop the Most Since 2019

Rental — which commands nearly half of all fleet sales that are dominated by passenger cars — suffered the largest pandemic drop from 2019 through 2022 as manufacturers prioritized more profitable retail sales.

Rental companies adjusted to smaller fleet sizes with longer lengths of service for rental vehicles. The big rebound year for rental was 2022 to 2023, when sales increased by 58%.

Annual totals show the rental car industry bought 1,738,993 fleet vehicles in 2019, compared to 1,019,225 vehicles in 2023 and a projected 1,057,073 vehicles for the full calendar year of 2024.

Ironically, though market watchers have recently labeled the rental market as “over-fleeted,” yearly sales figures for rental in 2024 will be at least 40% lower than those for 2019.

Overall Fleet Trends Ahead

While 2023 could be called the “recovery year” for fleets, sales have been on par or trending slightly down month to month in 2024 to date.

Based on 2024 sales through July, Automotive Fleet, a sister media brand to Auto Rental News, predicts that overall fleet sales will equal or fall slightly shy of 2023 sales, although will still lag 22% behind total sales in 2019.

This moderation of sales roughly reflects the overall market, as NADA data shows that new light-vehicle sales in July 2024 had a SAAR (seasonally adjusted annual rate) of 15.8 million units, down 0.8% year-over-year.

One of the best approaches for rental car operators is to focus more sharply on forecasting demand, and then make fleeting decisions as flexible as possible, said John Healy, the managing director and equity research analyst covering the business services sector for Northcoast Research, during a rental car market economic overview on April 15 at the International Car Rental Show in Las Vegas. A nimble remarketing strategy should avoid shedding too many vehicles at once but also avoid having to make payments on depreciating cars while waiting for demand to improve, he said.