Fundraising headwinds caught up with Southeast Asian venture capital (VC) firms in the first half of this year, resulting in a decline in both the number of fund closes and the total capital raised, finds the latest report from DealStreetAsia – DATA VANTAGE.

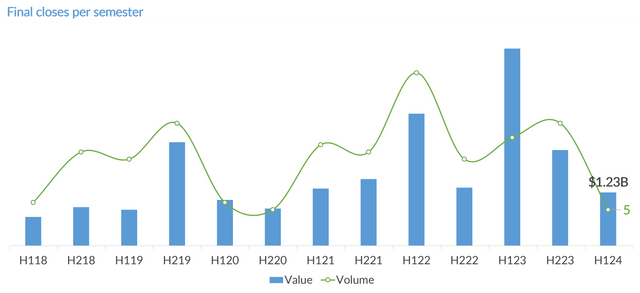

Five venture funds reached a final close in the first semester of 2024, a sharp drop from 17 in H2 2023 and just a third of the H1 2023 tally, according to SE Asia’s VC Funds: H1 2024 Review. At $1.23 billion, the total capital raised in H1 2024 was less than half the amount raised in the previous semester and down 73% year over year.

The data indicates that venture fundraising for the full year 2024 could fall significantly short of 2023, when regional firms closed 32 funds to raise an aggregate of $6.77 billion—the highest on record.

Limited partners (LPs), such as pension funds, endowments and sovereign wealth funds that commit capital to venture funds, have put the brakes on as they seek returns from existing relationships in what remain challenging exit conditions. They are also prioritising existing relationships with established fund managers who have longer track records, making fundraising more arduous for first-time funds. It is no surprise that only two Southeast Asia-focused funds reached a final close in the first half of the year.

On a downward trajectory

VC fundraising in Southeast Asia has cooled since its peak in H2 2021, when 42 fund milestones were achieved. The report categorises interim and final closes as separate milestones to provide a comprehensive view of capital raised within specific periods.

In the first half of this year, regional VCs recorded 11 fundraising milestones, down from 22 in H2 2023 and 25 in the same period last year. Similarly, the fresh capital raised in H1 2024 declined 58% year on year to $1.35 billion.

Southeast Asia’s performance in 2023 – 47 fundraising milestones and $5.02 billion in new capital – was already a correction from 2022 levels. Going by the H1 data, we can expect 2024 to continue the downward trajectory.

The decline in fundraising milestones underscores the broader economic challenges facing the region, including high capital costs and intensifying macroeconomic headwinds. The report argues that a slowdown in fundraising is warranted as startup funding has continued to deteriorate.

Navigating the slowdown

Fund managers interviewed for the report point to strategic initiatives that have helped them tide over the slowdown in a challenging fundraising landscape.

Kamet Capital, which closed its debut closed-end fund in March at $70 million, short of a $100 million target set in early 2022, has leaned on Founders Club, its network of entrepreneurs who built their wealth in tech, consumer and healthcare industries in mainland China.

“As the participants of the Founders Club add their unique perspective given their industry vertical, having a sufficiently broad base of LPs is of the greatest value in adding more insights and access to new segments of the tech, consumer and healthcare industries,” said Kamet Capital CEO Kerry Goh.

Singapore-based ACA Investments is also focusing more on high-net-worth individuals and family offices to achieve the first close of its latest fund, whose target has been reduced to $20 million from $40 million.

“We are focusing on those individual investors with whom we have good existing relationships and who are particularly sympathetic to the social and environmental impact of what we do,” ACA Investments director Kim Jung Kyu said. The company has also stopped looking at new deals to prioritise the survival of existing portfolio companies.

Mars Growth Capital managing director Navas Ebin said private credit could significantly accelerate exit opportunities, revitalising the market while addressing the gap in growth funding.

Although NAV financing has not gained much traction in the region, according to Ebin, it can provide liquidity to LPs and fund managers with additional capital to support top-performing portfolio companies.

“In terms of the market for the next six to 12 months, I believe things should look better from next year onwards, although there are a lot of factors at play, including geopolitical factors,” he added.

More foreign funds line up

On a more encouraging note, the report found signs of foreign venture firms, or those not headquartered in Southeast Asia, ramping up their allocations for the region.

In the first half of this year, six foreign funds reached a final close after raising $2.07 billion in total. This marks a significant improvement from the previous semester, which saw only two fund closes worth $160 million. This upward trajectory suggests that this year’s fundraising could exceed last year’s (10 fund closes).

London-based HSBC launched two credit funds in the first semester: the $1 billion ASEAN Growth Fund and a $150 million venture debt fund aimed at Singaporean startups.

On the equity front, US-based VC firm SOSV, known for investments in Southeast Asian companies like Green Li-ion and Allozymes, secured $306 million for its fifth fund. Additionally, Accion International raised $152.5 million for its Accion Digital Transformation Fund.

Currently, at least 33 foreign funds are in the market with plans to allocate capital to Southeast Asia, collectively targeting $5 billion. Of this, at least $1.52 billion has already been secured, indicating a strong interest in the region.

SE Asia VC Funds: H1 2024 Review covers fundraising by VC firms based in Southeast Asia and their regional and global counterparts with a mandate to invest in the region. It offers:

- Fundraising data for SE Asian VC firms since 2018

- Fundraising data for Asian, APAC and global funds with SE Asia allocations since 2018

- List of funds currently in the market

- Insights from prominent investors in the region’s VC landscape