In the world’s largest two-wheeler market, the world’s largest two-wheeler manufacturer Hero MotoCorp and its arch rival, Honda Motorcycle & Scooter India, are engaged in a riveting battle for supremacy in the domestic market.

Hero MotoCorp, which is the unrivalled boss of the volume game since years thanks to the sustained demand for its fuel-sipping 100cc commuter motorcycles, seems to be under pressure for the first time in decades. As per the latest retail sales data available on government of India’s Vahan website (September 1, 2024, 7am), the difference between the two top motorcycle and scooter manufacturers has shrunk to just a little over 6,000 units. In August 2024, Hero MotoCorp sold a total of 358,586 units, 6,028 units more than HMSI (352,558 units). Incidentally, August retails are the lowest for both OEMs in the eight months of this calendar year.

Honda dispatched 17,10,594 units in April-July 2024, 6,009 wholesale units more than Hero MotoCorp’s 17,04,585 units.

While HMSI has gone ahead of Hero MotoCorp on the wholesales front in the April-July 2024 period with 17,10,594 units, 6,009 units more than Hero’s 17,04,585 units, going ahead of the longstanding No. 1 will take some effort and sales growth consistency. A deep dive into the last 32 months’ retail sales reveals that Honda had last beaten Hero in retail sales in September 2022 with 298,399 units to Hero’s 269,486 units.

The retail sales differential between the top two motorcycle and scooter manufacturers in India is shrinking in CY2024.

The retail sales differential between the top two motorcycle and scooter manufacturers in India is shrinking in CY2024.

A look at the data table above reveals that the retail sales differential between the two OEMs is shrinking rather rapidly. In CY2022, the difference in favour of Hero MotoCorp was 1.16 million units, increasing to 1.38 million units in CY2023. Now, in the first eight months of CY2024, the difference is down to 459,534 units – this was 862,454 units in January-August 2022 and 953,980 units in January-August 2023.

HERO’S WHOLESALES SHARE DOWN FROM 40% IN FY2015 to 30% IN FY2024

Wholesales essentially are vehicle manufacturers’ dispatches to their dealers across the country and a function of forecasting demand and supply patterns, as compared to retail sales which constitute the real-world consumer demand scenario.

In an apple-to-apple comparison between the two OEMS, decadal SIAM industry wholesales data reveals that in an expanding market, Hero MotoCorp’s market share has reduced from 40% in FY2015 to 30% in FY2024. The same 10-year period sees HMSI’s market share drop marginally from 26% to 25% in FY2024. And, in the April-July 2024 period, both OEMs’ market shares have levelled out – at 28% – most likely as a result of Hero MotoCorp optimizing its dealer inventory. At 18,31,697 units, Hero MotoCorp dispatched 21,653 fewer two-wheelers than HMSI (18,53,350 units).

MOTORCYCLE BOSS VERSUS THE SCOOTER KING

While Hero MotoCorp is the boss of the motorcycle world, HMSI rules the scooter market like no other. In the ongoing fiscal’s first four months, Hero MotoCorp dispatched a total of 17,19,145 motorcycles, up 9% YoY (April-July 2023: 15,77,327), which constitute an overwhelming 94% of its overall two-wheeler dispatches of 18,31,697. Hero’s scooter dispatches were 112,552 units, up 1% (April-July 2023: 111,127). The bulk of Hero MotoCorp’s wholesales belong to the fuel-sipping entry-level commuter motorcycle 100-110cc segment – 14,62,953 units, up 7% YoY – comprising the 97.2cc-engined HF Deluxe, Splendor+, Splencor+ XTEC and Passion Plus.

The next highest volume driver for Hero is the 110-125 segment with 284,353 units, down 3% (April-July 2023: 292,680), where it has the 113cc Passion XTEC and the 124cc Super Splendor and the Glamour.

Honda, the unassailable king of the scooter world in India since the launch of the Activa, hit the headlines for having gone past Hero MotoCorp in the wholesales market in the first four months of FY2025. HMSI has dispatched a total of 1.85 million two-wheelers of which scooters account for 55% or 10,23,911 units, up 36% YoY (April-July 2023: 753,572 units). Of this, the Activa 110 and 125 siblings account for 905,632 units or 88% of the scooter total.

The share of motorcycles in HMSI’s April-July 2024 wholesales is 45% – 829,439 units. Like scooters, Honda bike dispatches have also seen strong growth of 63% YoY (April-July 2023: 509,490 units). The bulk of the motorcycle sales (64%) have come from the 125cc CB Shine – 528,422 units, up 48% YoY.

EXCITING BATTLE TO CONTINUE IN THE COMING MONTHS

While Honda’s retail numbers closed in on Hero in August, Hero MotoCorp still remains the No. 1 in the cumulative numbers analysis, on a calendar year- and fiscal-year basis – both in terms of retail sales and wholesale dispatches to showrooms across India.

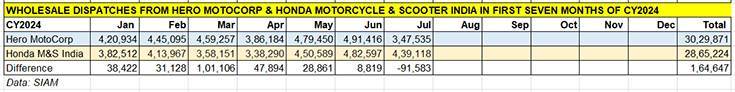

In retails, Hero has a lead of over 450,000 units over Honda in the January-August 2024 period and, on the wholesales front Hero MotoCorp has dispatched 164,647 more two-wheelers than HMSI. If Honda consistently improves its rate of growth in the coming months, then maybe the gap could be bridged. Nevertheless, given the upcoming festival season when typically OEMs stretch their marketing muscle to achieve maximum sales traction, expect the no-handlebars-barred battle underway between the top two two-wheeler players to continue even as motorcycle and scooter buyers make their preference felt. Stay tuned in for more sales updates.