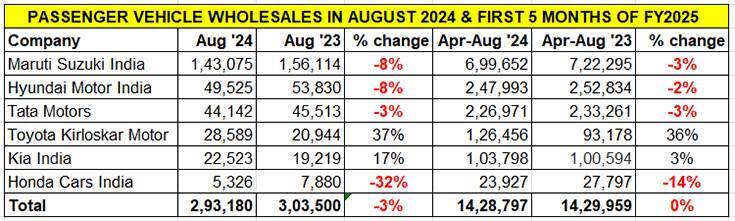

The heady days of high single-digit growth may just be behind for the Indian passenger vehicle industry. If the wholesales numbers for August 2024 released by a few OEMs are any indication, then the month may not be as august as the year-ago August: the 359,228 units in August 2023 were an increase of 9% YoY (August 2022: 328,376 units). In August 2024, the combined dispatches of six car and SUV manufacturers at 293,180 units are down 3% YoY while their cumulative five-month performance at 1.42 million reflects flat sales.

While the remaining 11 OEMs have yet to release their wholesale numbers, other than Mahindra & Mahindra, which should easily maintain its strong double-digit growth with dispatches of over 40,000 units for the eighth month in a row this calendar year, there is unlikely to be any other major spike. The PV industry’s overall performance in August can be attributed to a combination of tepid consumer demand and high levels of inventory at dealers, which OEMs are rationalising.

In July as well as August, the Federation of Automobile Dealers Association (FADA) had stated that its dealer feedback highlighted challenges such as low customer inquiries and postponed purchase decisions, and had cautioned OEMs about the high levels of inventory, which had hit a new high of 62-67 days, and urged them to “implement prudent inventory control”.

A glance at the five-OEM data table above reveals plenty of red ink and when the top three PV OEMs register such YoY declines, it is but natural that overall industry growth will be impacted. Let’s dive into each of these OEMs’ sales numbers for last month.

From the look of the five OEM’s sales in August, it looks that prudent inventory control has been in place, which is reflected in the plenty of red ink.

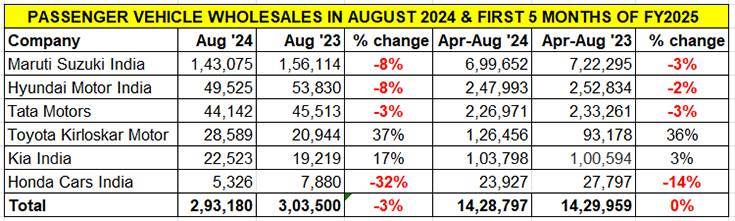

MARUTI SUZUKI INDIA

August 2024: 143,075 units, down 8%

April-August 2024: 699,652 units, down 3%

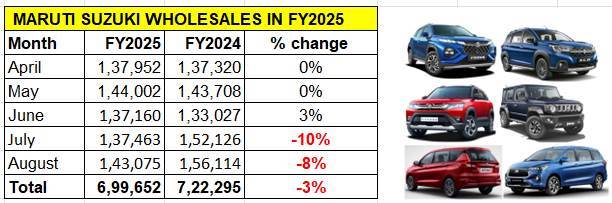

August 2024 marks the second straight month of decline for PV market leader and industry bellwether Maruti Suzuki India. At 143,075 units, August 2024 dispatches were down 8% on year-ago 156,114 units. The rate of decline would have been higher if it weren’t for the sustained demand for its pack of utility vehicles. Both in August as well as in April-August, the UVs are the sole sub-segment that are in positive territory for Maruti Suzuki.

Despite the slashing of prices for the entry level Alto and S-Presso budget hatchbacks, demand continues to be lukewarm. August sales for these two models at 10,648 units was down 13% and in April-August by 17% at 51,424 units.

Things are not very different in the six-hatchback portfolio of the Baleno, Wagon R, Swift, Celerio, Dzire, Tour S and Ignis. August dispatches at 58,051 units are down 20% YoY. This is the lowest for this lot in the past four months, after the 64,049 units in June, 68,206 units in May 2024 and 58,682 units in July 2024. The April 2024 tally was 56,953 units. Combined five-month sales at 305,941 units are down 13% YoY. Demand for the company’s sole sedan – the premium Ciaz – as well as the Eeco van is down.

HYUNDAI MOTOR INDIA

August 2024: 49,525 units, down 8%

April-August 2024: 247,993 units, down 2% YoY

Hyundai Motor India’s August 2024 dispatches have the same rate of decline as Maruti Suzuki: down 8% YoY. The Korean car and SUV manufacturer has reported dispatches of 49,525 units compared to 53,830 in August 2023. This is the third month in the ongoing fiscal year that monthly sales have dipped below the 50,000 mark.

SUVs continue to provide the bulk of the sales for the Korean car and SUV manufacturer. Hyundai Motor India retails 10 models in India — two hatchbacks (Grand i10 Nios, i20), two sedans (Aura, Verna) and six SUVs (Creta, Venue, Alcazar, Exter, and Tucson along with the all-electric Ioniq 5). The company has, a few months ago, pulled out the all-electric Kona from the market.

The new Creta, which is India’s best-selling midsize SUV, and the Venue and Exter compact SUVs continue to be the growth drivers. The rapid pace of demand for the new Creta, launched in January 2024, has meant that the new Creta cruised to 100,000-unit sales in just six months. This makes it the fastest in its segment to hit the 100,000 milestone and in half the time the Maruti Grand Vitara took.

Commenting on the sales, Tarun Garg, wholetime director and Chief Operating Officer, HMIL said: “SUVs, led by models like the Creta, Venue and Exter remain a key growth driver for HMIL in 2024 with 66.8% contribution to domestic sales. We are soon going to launch the new 6- and 7-seater SUV, Hyundai Alcazar and are confident of strong festive season response to this new launch.”

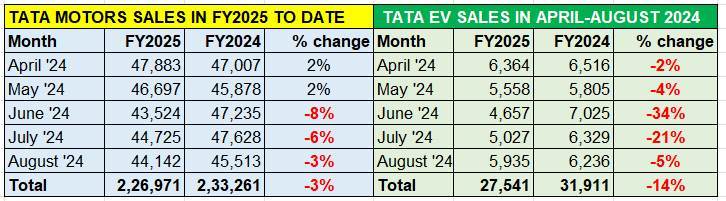

TATA MOTORS

August 2024: 44,142 PVs – down 3% / 5,935 EVs, down 5%

April-August 2024: 226,971 PVs – down 3% / 27,541 EVs, down 14%

Tata Motors has reported total PV dispatches of 44,142 units including 5,935 EVs, in August 2024, down 3% YoY. This is the third straight month of sales decline for the company and reflects the current dampened market sentiment. Like Maruti Suzuki and Hyundai Motor Inda, India’s No. 3 car and SUV manufacturer is feeling the heat but the company hopes the recently launched Tata Curvv SUV-coupe will add some fizz to sales in the coming months.

The Tata Punch compact SUV continues to make waves and as in July, expect this model to also have done well in August.

Meanwhile, with the expanding CNG filling infrastructure across the country, Tata Motors, like Maruti Suzuki, is benefiting from growing demand for its CNG models. While the specific launch date remains unknown, Tata Motors has confirmed that it will introduce the Nexon iCNG model this fiscal year. On the new variant front, June 6 saw the company launch the new Altroz Racer, the sporty avatar of the snazzy premium hatchback and its answer to the Hyundai i20 N Line.

On the cumulative five-month sales front, Tata Motors’ dispatches in the April-August 2024 period at 226,971 units are down 3% YoY.

One of the market advantages that Tata Motors has is that its ‘New Forever’ portfolio spans petrol, diesel, CNG and electric powertrains, thereby considerably expanding its reach compared to most of its rivals.

August 2024 saw the company dispatch 5,935 EVs, down 5% YoY but up 18% on July 2024’s 5,935 units. Last month, Tata Motors’ EV penetration level was 13 percent. The cumulative April-August 2024 total of 27,541 units is down 14% on year-ago sales of 31,911 units and accounts for a 12% share of Tata Motors’ overall PV sales of 226,971 units.

Tata Motors, which has the largest portfolio comprising the Nexon EV, Tigor EV, Tiago EV, Xpres-T (for fleet buyers), Punch EV, and now the Curvv EV.

The company’s share of the ePV market, which was not too long ago upwards of 75%, has been continually reducing, reflecting the growing competition from rival EV OEMs and increased product choice for buyers. Nevertheless, there continues to be a big difference in numbers between Tata Motors and the rest of the competition.

TOYOTA KIRLOSKAR MOTOR

August 2024: 28,589 units, up 37%

April-August 2024: 126,456 units, 36% growth

Toyota Kirloskar Motor is maintaining the strong growth trajectory it has shown since the beginning of the year. In August, the company dispatched 28,589 units – its second-best monthly performance in FY2025 to date – which makes for strong 37% YoY growth.

Toyota Kirloskar Motor is maintaining the strong growth trajectory it has shown since the beginning of the year. In August, the company dispatched 28,589 units – its second-best monthly performance in FY2025 to date – which makes for strong 37% YoY growth.

TKM’s rapid growth trajectory is reflected in its cumulative dispatches in the first five months of FY2025 – the 126,456 units are a 36% YoY increase and constitute 51% of FY2024’s record 244,940 sales. With seven months left to go in FY2025, Toyota is well placed to achieve the 300,000 sales milestone for the first time in a fiscal year.

Commenting on the strong sales performance, Sabari Manohar, Vice-President, Sales-Service-Used Car Business, Toyota Kirloskar Motor said: “As we approach the festive season, demand for our products remain buoyant, and we are already witnessing increased consumer interest and higher footfall across all our dealerships. SUVs and MPVs continue to significantly contribute to our sales numbers, reflecting a growing preference for these segment vehicles. Interestingly, this trend is not limited to major urban centres but extends to Tier 2 and Tier 3 markets as well, demonstrating widespread customer acceptance for our offerings.”

He added, “As a response to the market needs, we reopened the bookings in August for the Innova Hycross ZX & ZX (O) models, available in both self-charging strong hybrid electric (SHEV) and gasoline variants. With streamlined production and an enhanced supply chain, we’ve successfully reduced the waiting period, allowing us to commence bookings for the top-end grades. Additionally, increased supply of Urban Cruiser Hyryder has also enabled us to meet the market demand leading to reduced waiting period.”

Along with strong demand for its Toyota models, the company is also benefiting from sustained demand for the clutch of rebadged models – the Glanza, Urban Cruiser Hyryder, Urban Cruiser Taisor and the Rumion. In the April-July 2024 period, these Maruti Suzuki-rebadged models accounted for 52% of the company’s sales. What has also given Toyota a new charge in the competitive marketplace is its ramped-up production and customer-friendly initiatives.

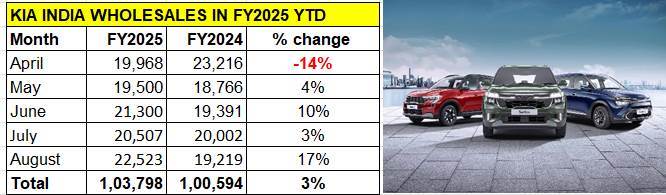

KIA INDIA

KIA INDIA

August 2024: 22,253 units, up 17%

April-August 2024: 103,798 units, up 3%

Kia India has registered its best monthly performance in the current fiscal in August 2024: 22,523 units, up 17% YoY (August 2023: 19,219 units). What is giving Kia strong sales momentum is the continuing demand for the feature-laden and ADAS-equipped new Sonet compact SUV launched in January 2024.

As it has done right since its January launch, the Sonet was the best-selling product for Kia in August with 10,073 units, going past the five-figure mark for the second time this year, after January’s 11,530 units. The Seltos with 6,536 was next, followed by the Carens MPV (5,881 units) and the all-electric EV6 (33 units).

Kia India’s cumulative April-August 2024 sales at 103,798 units are up 3% YoY. The Sonet, which has outsold the Seltos for eight straight months this year, accounts for 44,682 units or a 43% share. The Seltos, with 31,659 units, has a 30% share while the Carens MPV (27,358 units) has a 26% share of Kia India’s dispatches in the first five months of FY2025. The EV6 has sold 99 units in the same period.

HONDA CARS INDIA

August 2024: 5,326 units, down 32%

April-August 2024: 23,927 units, down 14%

Honda Cars India, which retails the Amaze and City sedans along with the Elevate midsize SUV, dispatched 5,326 units in August, down a substantial 32% YoY (August 2023: 7,880 units). The April-August 2024 count at 23,927 units is also down – by 14 percent.

Honda Cars India, which retails the Amaze and City sedans along with the Elevate midsize SUV, dispatched 5,326 units in August, down a substantial 32% YoY (August 2023: 7,880 units). The April-August 2024 count at 23,927 units is also down – by 14 percent.

While the Elevate midsize SUV has been instrumental in bringing Honda Cars India ‘back in the game’, particularly in the booming SUV segment where it was missing on the action big time, sales have slowed down in the past few months.

GROWTH OUTLOOK FOR THE PASSENGER VEHICLE INDUSTRY

While most OEMs continue to rationalise inventory levels at their dealers across the country, they will also be ensuring that there is ready availability of popular models – read SUVs. In fact, given the plethora of mouth-watering deals and discounts currently available, this is possibly the best time to buy a new passenger vehicle.

Passenger vehicle OEMs, like the two-, three-wheeler and commercial vehicle brethren, will be counting on the upcoming festive season to up the sales momentum. While the first half of September with Ganesh Chaturthi in the first week and Onam on September 15 should deliver some momentum, the second fortnight is likely to be tepid, given that ‘Pitru Paksh’ is from September 17 through to October 2. But with Dussehra in the second half of October and Diwali kicking off the month of November, OEMs will be looking forward to some much-needed sales-number fireworks in the marketplace.