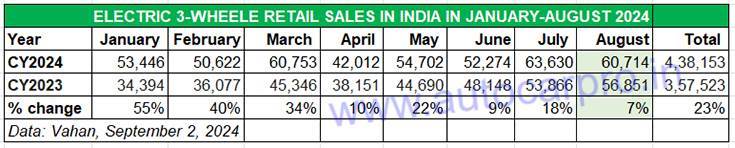

The electric three-wheeler segment, which hit a monthly retail sales high of 63,630 units (up 18%) in July 2024, has recorded sales of 60,714 units in August 2024, up 7% year on year, as per Vahan retail sales data. August was the mid-month of the ongoing three-month Electric Mobility Promotion Scheme 2024 (EMPS) scheme valid from July 1 through to September 30, 2024. This means September could just see the e-three-wheeler industry record a new monthly sales record.

Though the e-two-wheeler segment is the largest in terms of volumes, e-three-wheelers are witnessing the fastest shift to electric mobility. A total of 105,478 three-wheelers spanning CNG, LPG, petrol and electric powertrains were sold last month. At 60,714 units, e-three-wheelers comprised 57% of that total, which means every second unit was an EV.

In terms of EV segment share and total EV industry sales of 156,227 units in August 2024, e-three-wheelers accounted for 39%. Two-wheelers (88,451 units) accounted for 56% and passenger vehicles’ (6,335 units) share was 4 percent.

If the same growth momentum is maintained over the next four months, the electric 3W industry could achieve annual sales of 650,000 units in CY2024.

If the same growth momentum is maintained over the next four months, the electric 3W industry could achieve annual sales of 650,000 units in CY2024.

Like the two-wheeler segment, this one too is headed for record sales in CY2024. Cumulative eight-month retails at 438,153 units (up 23% YoY) are already 75% of CY2023’s record sales of 583,601 units. Given the same momentum, one can expect the sector to clock annual sales of around 650,000 units this year.

Mahindra Last Mile Mobility’s newest dealership was inaugurated on August 27 at Turanga, Angul in Odisha.

Mahindra Last Mile Mobility’s newest dealership was inaugurated on August 27 at Turanga, Angul in Odisha.

Market leader Mahindra Last Mile Mobility registered sales of 5,163 units in August, down 1.67% YoY (August 2023: 5,163 units) albeit this total is its third-highest monthly sale in the year to date after March (7,492 units) and July (6,972 units). The company had an 8.50% market share in August 2024.

Cumulative eight-month January-August retails for MLMM at 41,789 units are up 24% YoY (January-August 2023: 33,802 units). This number is already 76% of the company’s total CY2023 retails of 54,599 units and gives it a cumulative market share of 10% for the first eight months of CY2024.

In the first seven months of CY2024, MLMM has sold a total of 36,632 units, which makes for average monthly sales of 5,194 units. Last month saw MLMM sign an MoU with Ecofy to offer ease of finance for 10,000 units through leasing and subscription schemes.

MLMM’s EV portfolio comprises the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Super and e-Alfa Cargo which cater to multiple mobility operations in the passenger and cargo domains. To ensure sustained supplies to meet growing demand, MLMM has tripled its production capacity, leveraging its manufacturing plants in Bengaluru, Haridwar, and Zaheerabad.

Bajaj Auto, which gained the No. 3 position for the first time in July with 3,691 units, has moved up to No. 2 position for the first time since it entered the e-three-wheeler market in June 2023. In August, the company sold 4,027 units – its highest monthly sales yet – to mark near-1700% YoY growth albeit on a very low base of 224 units in August 2023.

Bajaj Auto, which is the IC engine three-wheeler market leader, has two products – the RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0. While its January-August 2024 total of 20,209 units remains below YC Electric (27,773 units), Bajaj Auto is clearly making its presence felt. Since its e3W market entry in June 2023, Bajaj Auto has seen demand rising month on month, which is reflected in 6.63% market share in August, up from the 5.80% in July. In CY2023 (six months since market entry in June 2023), Bajaj Auto was ranked 28th. In FY2024, in just 10 months after its EV rollout, Bajaj grabbed a 2% market share and was ranked No. 13. Fifteen months later, it is positioned behind the market leader. With growing demand for both its products, ramped-up production and an expanded EV sales network, expect the Pune-based auto major to achieve higher numbers in the coming months.

The longstanding No. 2 player is the No. 3 for August, as a result of Bajaj Auto moving up one rank. YC Electric Vehicles, with 3,794 units, recorded its second-best monthly sales after the 3,857 units in July and takes its January-August 2024 total to 27,773 units, 68% of its total CY2023 sales of 40,789 units. Like MLMM, YC Electric has five products – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations. Low initial cost, from Rs 125,000 to 170,000 for passenger EVs, and Rs 130,000 to Rs 165,000, is what is driving demand for this EV OEM.

At No. 4 is Saera Electric Auto which clocked retails of 2,806 units in August 2024. The company, which currently has over 700 dealerships, has outlined an ambitious network expansion plan to add another 500 outlets across India by end-March 2025. This aggressive expansion plan for Mayuri e-Ricksaws, its flagship brand, comes into play to assist Saera’s ambitious target to achieve 50,000 retail units by the end of the fiscal year. Between April and August 2024, it has registered sales of 14,479 units, up 22% (April-August 2023: 11,857 units), and 49% of its CY2023 retails of 29,321 units.

Dilli Electric Auto maintains its fifth position on the OEM ladder-board with 2,206 units in August. Its cumulative eight-month retails of 16,441 units gives it a 4% share for the January-August 2024 period.

Italian major Piaggio Vehicles has clocked retail sales of 1,557 units in August, which takes its eight-month total to 14,310 units, which is an increase of 15% YoY (Jan-Aug 2023: 12,462 units) and gives it a market share of 3 percent. The company’s Apé E-City FX Max passenger model (with 145km range) and Apé E-Xtra FX Max cargo carrier (115km range) are fully assembled by an all-women team at its Baramati factory in Maharashtra. On May 1, Piaggio launched a battery subscription model for its Apé Elektrik three-wheeler in 30 cities across India in an effort to simplify ownership and eliminate upfront battery costs.

Murugappa Group company TI Green Mobility’s Montra Electric, another recent entrant into the e-three-wheeler market like Bajaj Auto, is slowly climbing up the ranks. On August 21, Montra Electric announced delivery of its 5,000th three-wheeler Passenger Auto (L5M category) within one year of launch and entry into the electric three-wheeler market. Over 12 months, Montra Electric has delivered its Super Autos to customers across 74 markets spanning 17 states. In August 2024, Montra Electric saw retail sales of 597units, taking its January-August 2024 total to 3,655 units. This gives it No. 23 position, which is a creditable performance given that this sub-segment of the EV industry has the highest number of players – 530 companies – vying for a slice of the zero-emission action.

ALSO READ:

ALSO READ:

Electric 2W sales at 88,471 units in August up 41% but down 17% in July

Electric car and SUV retails in August lowest in the past 8 months: 6,335 units