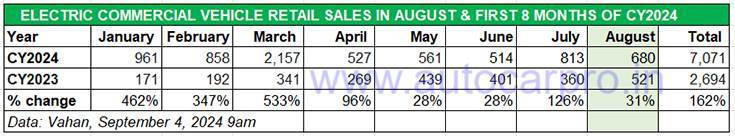

Demand for zero-emission commercial vehicles continues to rise in the Indian automobile market. As per the latest retail sales data sourced from Vahan, a total of 680 e-CVs were sold in August 2024, up 31% year on year (August 2023: 521 units), albeit this number is 16% down on July 2024’s 813 units.

The news for the domestic e-CV industry is better when seen on the cumulative sales front. Between January and August 2024, a total of 7,071 e-CVs have been sold, which constitutes 162% YoY growth (January-August 2023: 2,694 units) and average monthly sales of eCVs of 883 units compared to 336 units a year ago. What’s more, the e-CV industry has surpassed its entire CY2023’s deliveries of 5,011 units and could be headed towards hitting a new record of over 10,000 units in CY2024.

The CV sector essentially comprises light-, medium- and heavy-duty goods carriers and passenger-transporting buses. As compared to personal electric mobility in the form of e-two-wheelers and passenger vehicles, the CV industry is where electric mobility makes wallet-friendly TCO sense given the much larger number of kilometres driven.

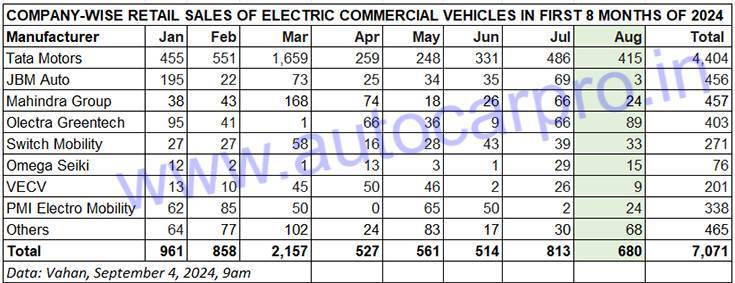

As the monthly sales numbers (see retail sales tata table below) shows, the FY2024-ending month of March 2024 witnessed the highest demand – 2,157 e-CVs, followed by January (961 units). Combined retails for the first five months of FY2025 at 3,095 units are up 55% YoY (April-August 2023: 1,990 units).

In terms of e-CV model-wise share for the January-August 2024 period, demand is tilted towards light goods carriers – an estimated 4,252 units and 60% share – while electric buses account for 2,663 units (38% share) and heavy goods 152 units (2% share). Let’s take a look at how the main players have fared in August and for the year to date.

New Ace EV 100 gives Tata Motors’ eCV sales a fresh charge

In terms of OEM sales which constitutes combined sales tally of goods carriers and passenger-transporting buses, Tata Motors is the strong eCV market leader with 415 units – 300 light e-goods carriers and 115 buses – in August (61% market share) and 4,404 units –3,346 e-LCVs SCVs and 1,058 buses – in January-August 2024 (62% share).

These strong numbers for e-LCVs/SCVs can be attributed to the launch of the new Ace EV 1000 small mini-truck in May this year. This zero-emission SCV offers a higher rated payload of one tonne and a certified range of 161km on a single charge. Targeted at last-mile mobility providers, the newest variant of the Ace EV has been developed to address evolving needs of sectors like FMCG, beverages, paints and lubricants, and dairy.

The electric bus-only JBM Auto is the No. 2 OEM with a total of 456 units in the first eight months of 2024, which gives it a current market share of 6 percent. In August, the company sold 3 buses with the best monthly sales coming in January (195 units).

Olectra Greentech has sold a total of 403 e-CVs including 387 buses (89 in August) in the Janaury-August 2024 period.

Switch Mobility, the electric commercial vehicle arm of Ashok Leyland has sold 33 eCVs in August (5% market share) and a total of 271 in January-August (market share: 4%)