Australian shares ended marginally lower in subdued trading on Tuesday, dragged down by consumer and mining stocks, while local investors waited for crucial growth data.

The S&P/ASX 200 index fell 0.1% to 8,103.5 points.

The Australian consumer staples index closed 2.1% in the red, marking its worst trading session since early August as major constituents traded ex-dividend.

Top grocer Woolworths and its smaller-rival Coles ended 2.9% and 2.7% lower respectively. Pub and hotel operator Endeavour Group and country’s biggest conglomerate Wesfarmers fell 3% and 1.4%.

The ex-dividend date is a cut-off by which investors need to be on the register of a company to receive the upcoming dividend payment.

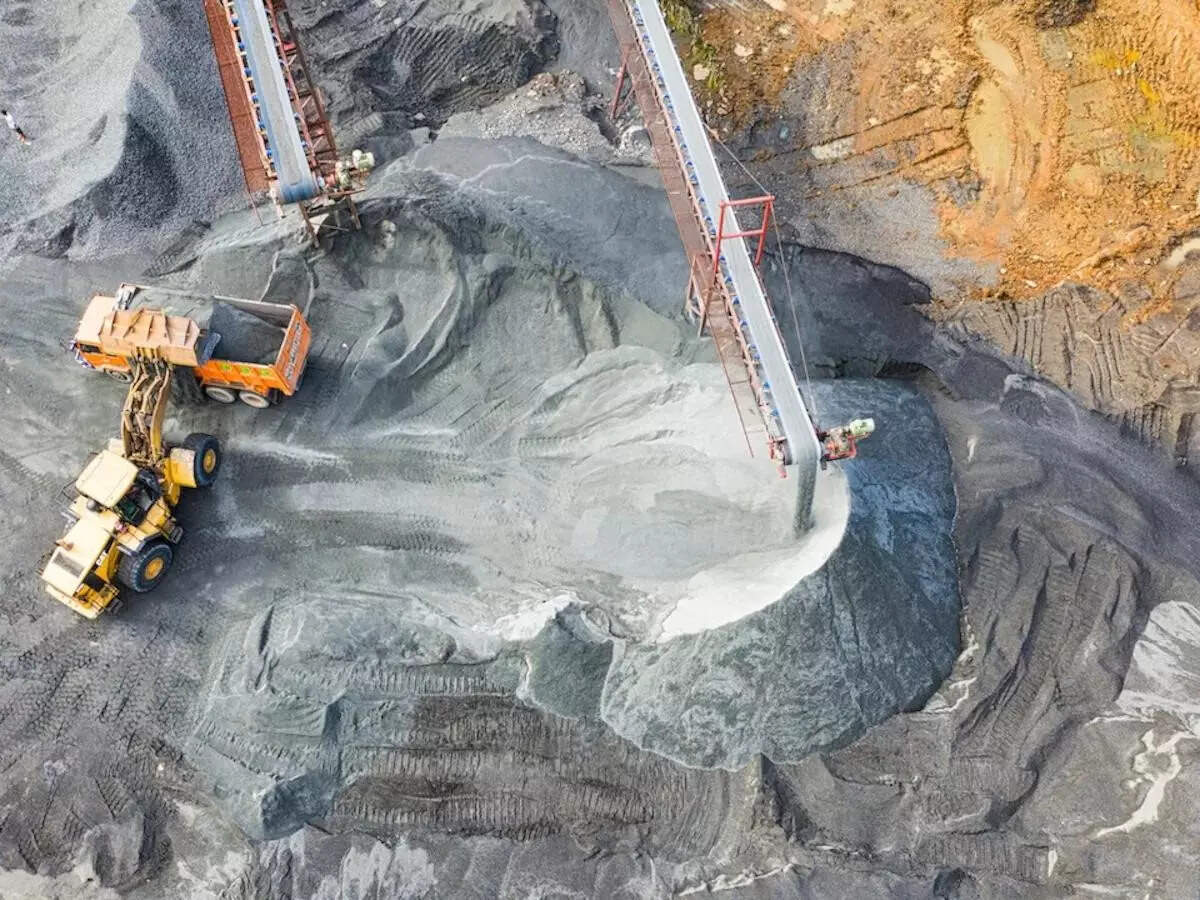

Local mining stocks fell 1.4% to end the day. Iron ore futures were around their lowest level in two weeks on the back of poor economic data from top customer China which clouded outlook.

BHP Group, Rio Tinto and Fortescue ended the day between 1.4% and 2.4% lower.

Prices of lithium carbonate fell as well, impacting miners of the metal used for electric vehicles. Mineral Resources was the top loser on the benchmark whereas Lake Resources and IGO fell 2.4% and 4.3% respectively.

Australian economic data released on Tuesday came in mixed with the country’s current account deficit widening in the June quarter.

Investors are awaiting gross domestic product (GDP) numbers on Wednesday which is expected to show a modest expansion of 0.3% in the June quarter, up for 0.1% percent in the last quarter.

“If we happened to see a growth figure shy of 0.2% for the quarter, this could amplify calls for the central bank to bring forward the rate-cutting timeline,” said Tim Waterer, market analyst at KCM Trade.

Investors bought into financials in the day, with the index reversing earlier booked losses. Commonwealth Bank of Australia hit a record high during the session.

New Zealand’s benchmark S&P/NZX 50 index closed 0.2% lower at 12,534.5 points.