The past couple of months have seen plenty of action on the CNG-powered passenger vehicle front, what with Hyundai Motor India launching the dual-cylinder Grand i10 Nios CNG and the base variant of the Aura Hy-CNG E sedan in August and the dual-cylinder Exter CNG in mid-July. And, Maruti Suzuki is to launch the CNG variant of the snazzy Swift hatchback on September 12. Reason enough to take a quick look at the retail sales performance of the CNG PV segment for the first five months of FY2025.

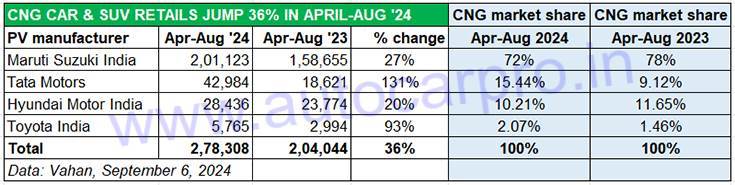

As per Vahan retail sales data (as of September 6, 2024), India’s four CNG car and SUV manufacturers sold a total of 278,308 units in the April-August 2024 period, 73,864 units more than they did in April-August 2023 (204,044 units) and registered strong 36% year-on-year growth. July 2024 with 58,046 units is the month with the highest sales, followed by April (57,097), August (56,672), May (55,675) and June (50,818).

At 278,308 units in the first five months of FY2025, retail sales of CNG-powered passenger vehicles are already 47% of FY2024’s 590,071 units.

At 278,308 units in the first five months of FY2025, retail sales of CNG-powered passenger vehicles are already 47% of FY2024’s 590,071 units.

These four OEMs – Maruti Suzuki India, Tata Motors, Hyundai Motor India and Toyota Kirloskar Motor – together sold a total of 590,071 units in FY2024, up 45% (FY2023: 407,334 units). This effectively means that CNG PV sales in the first five months of FY2025 are already 47% of the FY2024 total, with seven months still to go in the ongoing fiscal. If the same rate of growth in maintained between September 2024 and March 2025, one can expect the CNG PV industry to scale a new fiscal year high of over 700,000 units.

Maruti Suzuki has an order book of nearly 165,000 units spanning all its CNG models. The most popular models are the Ertiga, Brezza and the Dzire.

Maruti Suzuki has an order book of nearly 165,000 units spanning all its CNG models. The most popular models are the Ertiga, Brezza and the Dzire.

Maruti’s CNG market share at 72%, targets 600,000 sales in FY2025

Passenger vehicle market leader Maruti Suzuki, the pioneer in the factory-fitted CNG PV segment in India since 2010, has the largest portfolio of 12 CNG models comprising the Alto K10, Baleno, Brezza, Celerio, Dzire, Eeco, Ertiga, Grand Vitara, S-Presso, Wagon R, XL6, and the Fronx. Understandably, with such a wide model spread, the company has a vice-like grip on the market.

Maruti Suzuki, which completely pulled out of the diesel car market in April 2020, has seen the vacuum being filled by the consumer demand for its CNG models. As per Vahan data, Maruti Suzuki India has sold and delivered a total of 636,777 passenger vehicles in the April-August 2024 period, of which 201,123 are CNG-powered variants and constitute 31% of total sales. These 201,123 CNG PV sales are a 27% YoY increase (April-August 2023: 158,655 units) and 46% of the company’s CY2023 CNG PV sales of 434,177 units. At present, the company has a vice-like 72% share of the CNG PV market.

Maruti Suzuki currently has a strong order book of nearly 165,000 units spanning all its CNG models, with the most popular ones being the Ertiga MPV, Brezza compact SUV and the Dzire sedan. The company has outlined an ambitious sales target over 600,000 CNG PVs in FY2025, which translates into 38% YoY growth over its FY2024’s 434,122 units, and around 11,000 units more than the entire PV industry’s retails of 589,996 CNG cars and SUVs last fiscal.

Tata Motors has standardised its innovative twin-CNG-cylinder technology across its CNG line-up that comprises the Tigor, Tiago, Altroz and Punch.

Tata Motors has standardised its innovative twin-CNG-cylinder technology across its CNG line-up that comprises the Tigor, Tiago, Altroz and Punch.

Tata Motors’ sales jump 131% and CNG PV share rises to 15%

Tata Motors, the No. 3 PV OEM in overall sales after Maruti Suzuki and Hyundai Motor India, is the No. 2 in CNG-powered car and SUV sales. The company, which had first introduced its innovative twin-CNG-cylinder technology in the Tata Altroz hatchback, has now standardised the technology in its entire CNG line-up which comprises the Tiago CNG, Punch CNG, Altroz CNG and Tigor CNG.

The placement of the twin CNG cylinders under the luggage areas ensures that boot space similar to that in the ICE models.

The placement of the twin CNG cylinders under the luggage areas ensures that boot space similar to that in the ICE models.

One of the Tata CNG models’ USPs is the seamless shift between CNG and petrol mode as a result of a single ECU while maintaining higher fuel efficiency. What’s more, they enable vehicle start directly in the CNG mode.

Tata Motors, which had sold a total of 83,482 CNG cars and SUVs in FY2024, has already achieved 51% of that in the first five months of FY2025. Its April-August 2024 retails of 42,984 units (up 131%) make it well placed at this stage of the fiscal to cross the 100,000 CNG PV sales milestone for the first time in FY2025.

For the first five months of FY2025, Tata’s CNG penetration level has risen to 41% – 83,482 units out of total 204,110 cars and SUVs retailed across petrol, diesel, CNG and electric powertrains.

Tata Motors, which entered the CNG market with the Tiago hatchback and Tigor sedan in January 2022, has gone on to hugely benefit from the rollout of new CNG models like the Tata Punch CNG compact SUV , which was Tata Motors’ response to the introduction of the Hyundai Exter CNG compact SUV. In early February 2024, Tata Motors launched the Tiago and Tigor CNG AMT which has added more ‘ammo’ to the CNG portfolio. Having confirmed plans to introduce the Nexon CNG, showcased at the Bharat Mobility Expo in January, it is set to launch the greener Nexon anytime soon.

That’s not all. Tata Motors could also be looking to introduce a CNG variant of the recently launched Curvv SUV-coupe, adding to the petrol, diesel and electric powertrains. Speaking to Autocar India at the launch of the electric Curvv on August 7, Shailesh Chandra, Managing Director, Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility, said that a CNG version is under active consideration. “While designing the car, we have ensured that the design is protected for CNG and while it’s premature to confirm a launch I can say it’s under active consideration,” affirmed Chandra.

In July, the Exter compact SUV became the first Hyundai CNG model to get dual-cylinder technology. The Aura CNG and Grand i10 Nios CNG are have a similar layout.

In July, the Exter compact SUV became the first Hyundai CNG model to get dual-cylinder technology. The Aura CNG and Grand i10 Nios CNG are have a similar layout.

Hyundai looks to up the ante with new launches

Hyundai Motor India is ranked third in the CNG PV OEM listing with 28,436 units, an increase of 20% YoY (April-August 2023: 23,774 units). This total is 44% of its FY2024’s sales of 64,465 units but the advance of Tata Motors and Toyota seems to have eaten into its market share, which is now 10.21% compared to 11.65% in April-August 2023.

Hyundai Motor India, which currently has three CNG models – Aura, Grand i10 Nios and Exter – is looking to rev up sales and has recently launched the base variant of the Aura – Hy-CNG E – at Rs 748,600, powered by a 1.2-litre Bi-Fuel engine, advanced safety features and fuel efficiency of 28.4 km/kg.

Having introduced a dual-cylinder CNG setup in the Exter compact SUV, in July, Hyundai launched the Grand i10 Nios hatchback with the same layout. The Hyundai Nios CNG dual-cylinder version is available in the two mid-spec Magna and Sportz variants and priced between Rs 775,000 lakh and Rs 830,000. The coming months will show whether demand accelerates for these models.

Demand picks up for Toyota’s CNG models

Demand picks up for Toyota’s CNG models

Toyota Kirloskar Motor, which is currently witnessing strong demand for its range of cars, SUVs and MPVs and registered wholesales of 126,456 units in April-August 2024, is also faring very well on the CNG PV retail front.

The company, which has recently expanded its CNG passenger vehicle portfolio to four models with the Taisor joining the Glanza hatchback, Urban Cruiser Hyryder and the Rumion MPV, sold 5,765 units in the past five months, up 93% YoY (April-August 2023: 2,994 units). This makes for a CNG penetration level of 5.53% of total retails of 104,149 PVs across all powertrains in the April-August 2024 period.

ALSO READ:

Maruti, Hyundai, Tata, Toyota: CNG strategies explained