With the drop registered in the eighth month, only a growth of 4.5% is accumulated in the total for the year

Sales of electric and plug-in hybrid passenger cars fell 18% in August, placing the total for the year 1.7% below the same month in 2023

Registrations of light commercial vehicles continue to grow by 0.1%, with 8,943 sales

Sales of commercial vehicles, buses, coaches and minibuses decreased by 33.1%, with 1,783 units

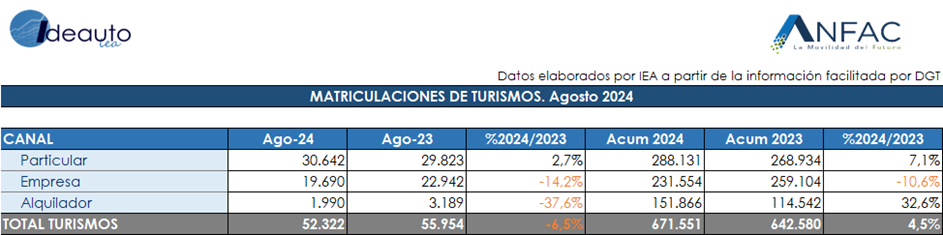

Madrid, September 2, 2024. The passenger car market suffers a significant decline in the month of August, with a drop of 6.5% and a total of 52,322 units. The eighth month is always marked by the summer vacation period, which causes sales to decline. However, this August it obtained a worse figure than the previous year, slowing annual growth, which with 671,551 new registrations is only 4.5% higher than in 2023. Likewise, the market is still 30% smaller prior to the pandemic.

For its part, the electrified passenger car market also suffers a drop, with a 17.8% reduction in sales in August, with 5,706 units sold. A figure that represents 10.91% of the total market and is very far from the 12.4% share that was registered in August 2023. Likewise, in the total for the year there is already a decline of 1.7 % of sales, with 69,833 units and only 10% of sales over the total market.

The average CO2 emissions of passenger cars sold in August remain at 117.4 grams of CO2 per kilometer traveled, 1.2% higher than the average emissions of new passenger cars sold in the same month of 2023. In total of the year, an average of 117.8 grams of CO2 per kilometer traveled is recorded, 0.48% lower.

Regarding sales by channels, only those aimed at individuals manage to grow. Specifically, they increased 2.7% in August, with 30,642 units. On the contrary, both the corporate and rental markets registered notable declines in the eighth month, with falls of -14.2% and -37.6%, respectively.

LIGHT COMMERCIAL VEHICLES

Registrations of light commercial vehicles remained stable in August, with a slight increase of 0.1% and 8,943 units sold. Until the eighth month, a total of 109,301 vehicles have been sold, which represents an increase of 16.6% compared to the same period of the previous year. Regarding sales by channels, both self-employed (+7%) and companies (+0.5%) registered growth, while renters decreased by 16.2% in August.

INDUSTRIAL AND BUSES

In August, registrations of commercial vehicles, buses, coaches and minibuses suffered a notable decrease of 33.1%, with 1,783 units. In the total for the year, 23,239 units are accumulated, which represents an increase of 12.2%. By type of vehicle, industrial sales are where the greatest drop is recorded, with a decrease of 35.7% and 1,630 units. While the bus and coach market managed to grow by 19.5%, up to 153 sales in the month.

Félix García, director of communication and marketing at ANFAC, explained that “August closes the month in a negative way, something that has not happened since March of this year. It is true that it is the month par excellence for vacations and that it has never been a good month. What is worrying is the downward trend that the market has been dragging on in recent months, with a stagnation in sales that slows down the progression that we had in 2023. With this trend, if at the beginning of the year we were convinced of surpassing, after five years, the million passenger cars sold, we are now closer to remaining even below 980,000 units, which would mean a growth of 3.2% compared to the previous year. The noise against the use of private cars continues to be very high, which confuses customers and paralyzes their desire to buy a new car, safer, cleaner and more profitable than their old vehicle. It would be better and more effective to develop incentive policies for citizens and companies to acquire or renew their cars and fleets for more sustainable and new ones, since the vehicle that emits the most is the one that is not renewed.”

Raúl Morales, communication director of FACONAUTO, indicated that “if we analyze the evolution of vehicle registrations so far this year, we have to talk about atony, a lack of strength and vigor that has been seen again in the month’s sales.” August, with practically flat registrations compared to August of last year, which forces us to rethink our objective of exceeding one million units by the end of 2024. Last month we highlight the contribution of the individual channel, that sale one to one that the dealership makes in families, and which accounted for 60% of all sales to the detriment of the other marketing channels (business channel and rental company channel which, on this occasion, have contributed less to the market). And once again we have to talk about the stoppage in the registrations of electrified vehicles, which occurred again in the month of August, and which is a wake-up call for buyers to advance measures that help accelerate the implementation of the electric vehicle. in our country.

GANVAM’s communications director, Tania Puche, pointed out that “the market is showing a negative sign, something that we have not seen in the month of August since 2021, when we were experiencing the effects derived from the pandemic and the chip crisis. In general terms, August is usually a month of lower sales due to the holiday period and rental companies – which have been stocking up on vehicles in recent months to respond to the tourist campaign – slow down their purchases in summer. Added to these circumstances is that companies are cooling investment in fleet renewal, at a time when the speed of change to electric cars is lower than expected. Thus, we are facing a market that, with volumes almost 30% below pre-pandemic levels, is going to remain below one million units at this rate for the fifth year in a row.”