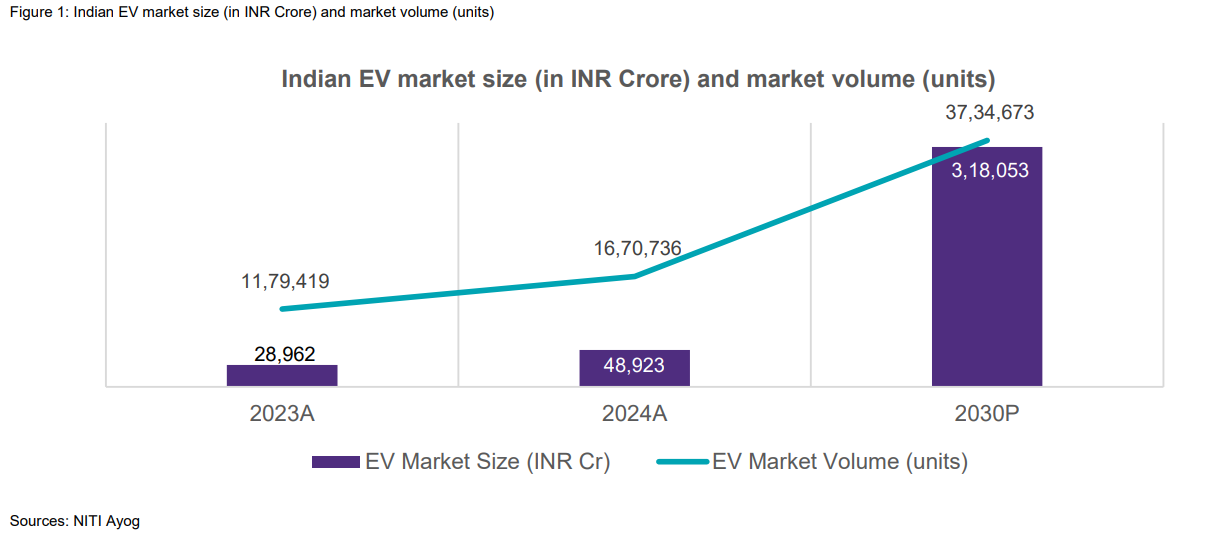

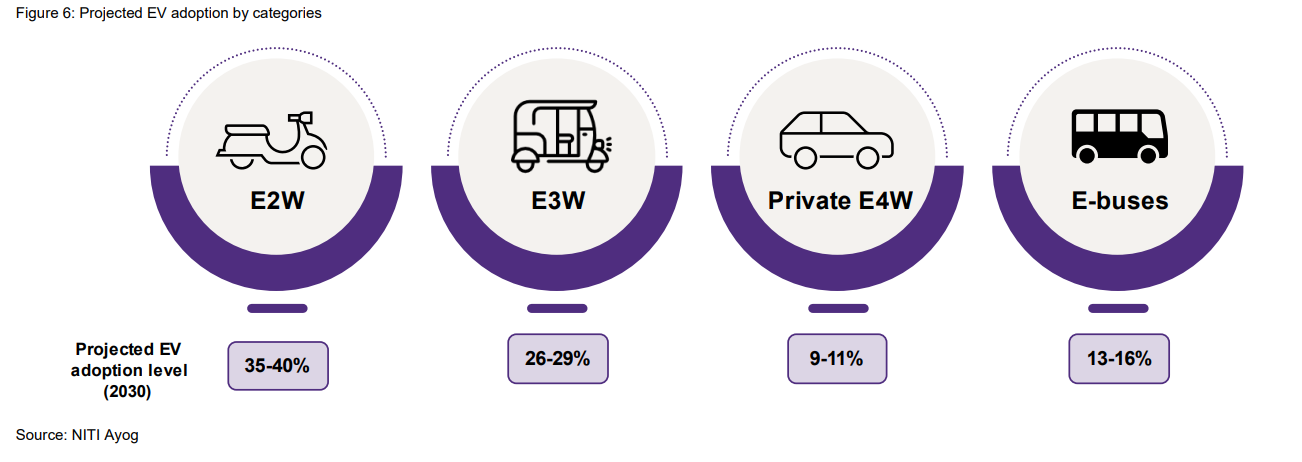

On the back of rising acceptance of electric vehicles (EVs), the Indian EV market, which is valued at Rs 49,000 crore in 2024, is expected to reach Rs 3,18,000 crore by 2030 with a CAGR of 37%, reflecting significant growth and investment opportunities, as per a joint survey by ACMA and Grant Thornton Bharat.

According to the report key drivers behind this massive push are government support, improved affordability, infrastructure development, high market penetration potential, manufacturing incentives, and localization requirements. Last year, private equity and venture capital firms made an investment of around USD 1 billion (Rs 8395.86 crore), the report added.

In the last fiscal year, around 16.7 lakh EVs were sold in the country, making a significant jump of 42% from 11.8 lakh vehicles sold in FY23.

As per the report, the rapid growth highlights the accelerating adoption of EV technology in India, driven by advancements in key components and comprehensive strategy to enhance EV accessibility, reliability, and efficiency.

EV component surge

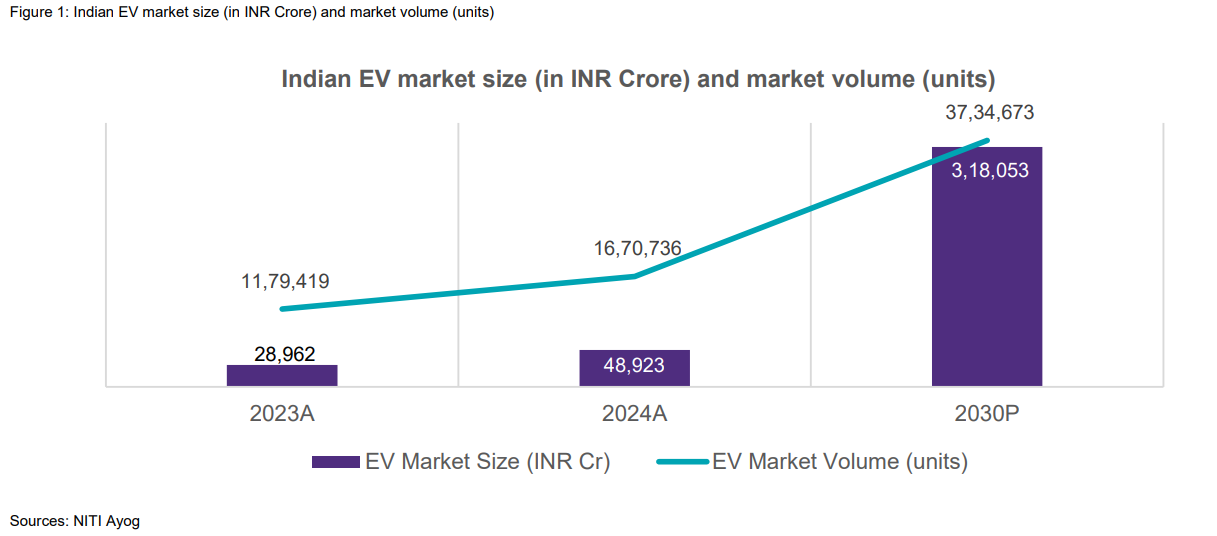

This report also delves deeper into the transformative potential that the global shift towards EVs holds for India’s automotive and component industry. The Indian EV components market is set for significant growth from 2023 to 2030. It underscores the importance of 11 key components that are unique to EVs, such as batteries, power trains, and power electronic components. These components necessitate significant changes in manufacturing processes compared to those used for internal combustion engine (ICE) vehicles.

Battery and related components are expected to increase from Rs 13,000 crore in 2023 to Rs 140,000 crore by 2030, the report noted. “The powertrain and power electronics segment is projected to grow from Rs 10,000 crore in 2023 to Rs 88,000 crore by 2030. Other EV components (which include connectivity and control systems and chassis and other body parts) will also expand, rising from Rs 5,000 crore in 2023 to Rs 90,000 crore by 2030,” the report added.

Furthermore, the report also categorized 11 key components and their child parts based on their domestic dependency and investment/skills needed for assembly. “Components like wiring harnesses and connectors have low domestic dependency and require minimal investment or skills, while components like electric motor assemblies have high import dependency but also competitive domestic capabilities, requiring higher investment or skills,” it mentioned.

EV Adoption Outlook

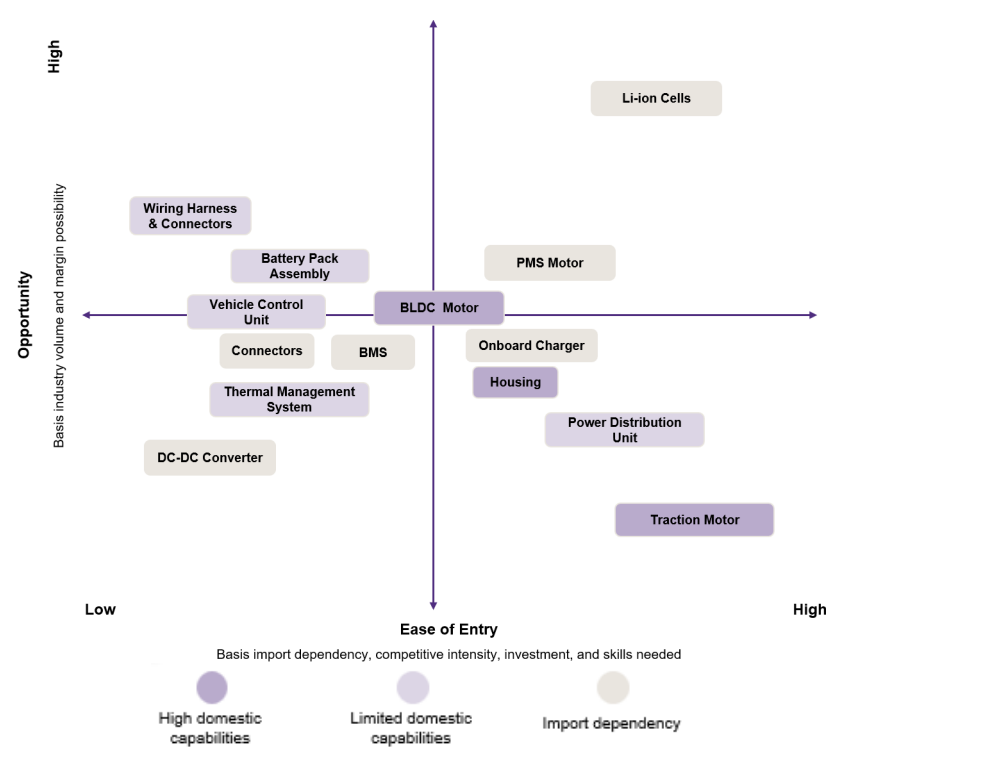

EV adoption in India as of FY23 stands at 6.3%. The multinational corporate advisory and accounting firm expects EV penetration in the country to reach 30–35% by 2030 on account of new government policies, a reduction in the cost of vehicles, and the development of charging infrastructure, with more charging stations being set up across cities.

“The electric two- and three-wheelers are predicted to do the chunk of the EV volumes in the short term, while it is predicted that the electric four-wheeler will grow in the long term,” the report said.

According to Vivek Vikram Singh, Chairperson, Electric Mobility & Telematics, ACMA the two-wheeler (E2W) segment is expected to lead the charge, with scooters comprising 40% of this category, driven by new product launches from established players. He also noted that the three-wheeler segment will see substantial adoption in urban markets due to restricted ICE permits and high demand for new EVs, despite challenges from CNG competition and rural charging infrastructure.

“The four-wheeler segment’s growth will be led by the shared mobility sector, supported by government incentives and lower operating costs, with the shared category projected to grow 20-25% and the private category 9-11%. Lastly, the e-bus segment will be driven by strong government initiatives for 100% electrification of public buses by 2030, with adoption rates expected to reach 13-16%,” he added.

Focus on exports and tech partnerships

In this latest report, Grant Thornton Bharat lists out two critical recommendations to strengthen the domestic EV ecosystem. Firstly, the firm emphasizes adopting country-wise export strategy for Indian EV auto component companies.

“By leveraging India’s strengths in software and electronics integration, and maintaining a balance between cost efficiency and quality, Indian companies can position themselves as key players in the global EV supply chain. This approach will not only enhance their market share but also elevate their role from suppliers of basic components to providers of sophisticated systems,” the report highlighted.

Secondly, the report also pointed out that it is crucial to establish partnerships with leading and upcoming global EV technology providers to accelerate the localisation of critical EV components. A strategic decision must be made on whether to invest in or co-develop with emerging start-ups or collaborate with global players planning to set up assembly operations in India. “To facilitate this, a dedicated technology scouting team should be established to identify and adopt cutting-edge technologies,” the report said.