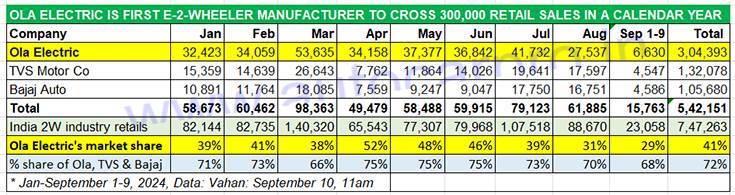

Ola Electric, the electric two-wheeler market leader in India, has become the first EV maker in India to achieve retail sales of 300,000 units in a single calendar year. Fittingly enough, the company recorded the milestone on September 9 – World EV Day. As per the latest Vahan retail sales data, Ola Electric has delivered a total of 304,393 units (September 10, 2024 11am). With four months left to go in the current calendar year, expect Ola to cross sales of 400,000 units.

Ola Electric, which has averaged monthly sales of 37,220 units between January-August 2024, currently has a 41% market share in the year to date.

Ola Electric, which has averaged monthly sales of 37,220 units between January-August 2024, currently has a 41% market share in the year to date.

Ola Electric entered the Indian EV market in July 2021 and created a buzz immediately when bookings opened for its e-scooter on July 15 for a minimal amount of Rs 499. Within the first 24 hours, the company received a record-breaking 100,000 reservations, making it the most pre-booked scooter in the world. The S1 and S1 Pro electric scooters went on sales, priced at Rs 99,999 and Rs 129,999, respectively (ex-showroom, including FAME II subsidy, but excluding state subsidy) on September 15.

In terms of cumulative sales, Ola with 681,394 units has a massive lead of 330,064 units over its immediate rival, TVS Motor Co.

In terms of cumulative sales, Ola with 681,394 units has a massive lead of 330,064 units over its immediate rival, TVS Motor Co.

Ola has been the first e-two-wheeler OEM to hit the 100,000, 200,000 and 300,000 sales milestones in India. While its retails in the last few months of CY2021 were just 240, CY2022 saw Ola register sales of 109,396 units – which was more than the combined sales of Ather Energy (51,808 units), which was the then No. 2 OEM, and TVS Motor Co (47,812 units). In CY2023, Ola sold 267,365 units, which constitutes handsome 144% year-on-year growth, which gave it a huge lead of 100,786 units over its immediate rival, TVS Motor Co which sold 166,579 iQubes. Now, in the first eight months (January-August 2024 and nine days of September 2024, Ola with 304,393 units is already 37,028 units ahead of its CY2023 sales. This gives Ola an overall 41% share of the e-two-wheeler market, well ahead of TVS Motor Co (132,078 iQubes and 18% market share), Bajaj Auto (105,680 Chetaks and 14% market share) and Ather Energy (76,834 units and 10% market share).

TVS and Bajaj Auto cross 100,000 sales in current year

TVS and Bajaj Auto cross 100,000 sales in current year

The e-two-wheeler industry is the largest contributor to EV sales in India and accounts for a 57% share. The segment, at present, is well set to surpass the 1-million sales milestone for the first time in CY2024 and is currently 201,181 units shy of CY2023’s record 948,444 units. The e2W industry will need to record strong double-digit growth in the September-December period if India EV Inc is to hit the 2-million milestone for the first time in CY2024.

Along with Ola, TVS Motor Co and Bajaj Auto are the two other OEMs to have recorded six-figure sales numbers. While TVS has sold 132,078 iQubes in the January 1-September 9, 2024 period, Bajaj Auto has sold 105,680 Chetaks. And the battle between the two legacy players, both of whom launched their e-scooters in the same month (January 2020), has turned intense. The sales gap between TVS and Bajaj, which was 94,642 units in CY2023, is currently 26,398 units in the current year, with four months to go for CY2024 to end.

ALSO READ:

World EV Day Special: Will EV sales in India hit 2 million units in FY2025?

TVS iQube and Bajaj Chetak battle revs up, sales gap less than 10,000 units in April-July