As rising inflation and subsequent monetary tightening continue to restrict liquidity worldwide, private equity funds that primarily invest in Southeast Asia are finding it hard to raise capital.

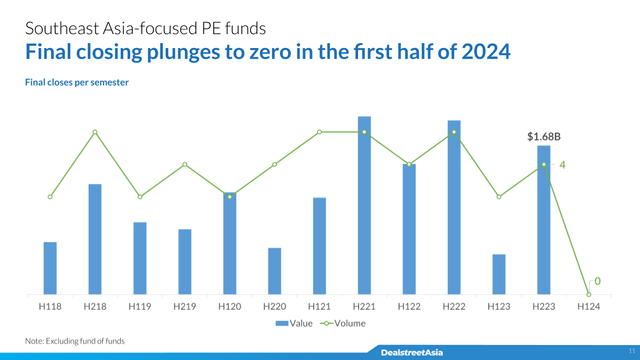

No PE fund, which has the majority of its capital allocated to the region, secured a final close in Jan-June (H1) 2024, according to the Private Equity in SE Asia: H1 2024 Review by DealStreetAsia DATA VANTAGE. In August, Thailand’s 9Basil Group became the first, and so far only, PE firm to secure a final close for a Southeast Asia-focussed vehicle this year.

In comparison, in H2 and H1 of 2023, the tally of final closes had stood at four and three, respectively.

The first signs of the capital crunch were visible in 2023 itself. Five of the six PE funds that closed last year did not meet their targets.

Growtheum Capital, which aimed to raise $600-800 million for its debut fund, closed at $567 million in August 2023. Singapore-based Asia Partners fell short of its $600 million target for its second fund, securing only $474 million in December. Similarly, the Asia Energy Transition Fund, managed by Switzerland’s SUSI Partners, closed at $120 million in June 2023, well below its $250 million goal.

“These outcomes highlight the increasingly difficult conditions for fundraising [from limited partners, or LPs], which have only become more challenging this year [2024],” read the report.

“The key concern for the global LP community is DPI and exits… This phenomenon is global and not limited to emerging markets,” said Alexander Krefft, co-founder and partner, Triple P Capital.

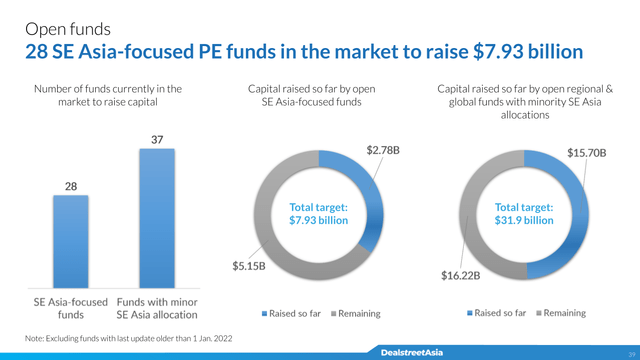

On a more positive note, at least seven new funds with majority allocations for Southeast Asia have been launched in 2024, according to the report.

Meanwhile, in terms of interim closes, there was good news and bad news. The silver lining was that, in July, Creador secured a $700 million first close for its sixth flagship fund. The Malaysian PE giant’s fund is now within touching distance of its $800 million target.

However, as of mid-September 2024, only four funds had secured interim closes, just half of what was reported in the entire 2023.

Global funds with minority allocations to SE Asia

In contrast, there is a more optimistic trend in the global market as funds are increasingly including Southeast Asia to diversify their target markets.

In the first half of this year, at least 11 global funds with minority allocations to Southeast Asia secured final closes, raising a total of $37.65 billion. Still, this is short of last year’s tally. Thirteen such funds had closed in H2 2023 and 11 in H1 2023, raising $43.8 billion and $31.9 billion, respectively.

US-based CVC Capital Partners closed the largest global fund with minority allocations to Southeast Asia this year raising $6.8 billion for its sixth Asia fund. Meanwhile, TPG secured $5.3 billion for its eighth buyout fund, TPG Capital Asia VIII, becoming the second biggest fund on the list.

“From a private equity standpoint, Southeast Asian companies will benefit when US rates fall. This, coupled with governments’ growth-oriented policies, a rapidly expanding middle class, and an alternative manufacturing centre outside of China, will eventually lead to greater consumption demand and higher asset prices,” said Eddie Ong, Deputy CIO and managing director of private investments at SeaTown Holdings.

Currently, there are at least 37 open global and pan-regional funds in the market with minority allocations to Southeast Asia. This is more than the 28 Southeast Asia-focused PE funds that are currently raising capital.

Capital pours for SE Asian climate funds

The report further suggests that the rise in the number of global funds allocating capital to Southeast Asia is “driven by growing investor interest in climate and impact investments”.

Of the 14 global funds with minority allocations to the region that reported interim closings this year, half are climate-focused funds looking to raise $3.4 billion, according to the report. Moreover, eight climate funds with minority allocations to the region secured their final closes in the past five years.

Among Southeast Asia-focused funds, four climate vehicles achieved final closes in the past five years, including the 8F Aquaculture Fund, KV Asia Capital Fund II, SUSI Partners Asia Energy Transition Fund, and Tropical Asia Forest Fund 2.

Stephanie Bilo, Chief Client and Investment Solutions Officer, responsAbility Investments said LP interest in climate-focused funds remains strong, particularly in emerging markets like Southeast Asia, despite higher interest rates and economic volatility. This is driven by the region’s high CO2 impact efficiency and lower emission reduction costs. “Southeast Asia contributes over half of global GHG emissions, and with 85% of its energy coming from fossil fuels, it offers huge potential for high-impact climate solutions,” said Bilo

The Private Equity in SE Asia: H1 2024 Review report has extensive data on:

- SE Asia-focused PE funds that have secured final and interim closes since 2015

- New funds launched by Asian, APAC and global PE firms targeting SE Asia

- List of open funds currently raising capital

- Perspectives from industry experts

The report is available exclusively to DealStreetAsia–DATA VANTAGE subscribers. Subscribe/upgrade your subscription now to access our entire set of reports. Still not sure? Opt for a one-month trial or reach out to subs@dealstreetasia.com for a demo.