As global markets experience heightened volatility, the Hong Kong market has not been immune to these pressures, with the Hang Seng Index recently retreating amid weak corporate earnings and economic data. In such uncertain times, investors often seek companies that demonstrate both growth potential and significant insider ownership, as these factors can indicate strong management confidence and alignment with shareholder interests. In this article, we explore three growth companies listed on the SEHK that boast high levels of insider ownership.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

Laopu Gold (SEHK:6181) |

36.4% |

34.7% |

|

Akeso (SEHK:9926) |

20.5% |

54.7% |

|

Fenbi (SEHK:2469) |

31.2% |

22.4% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

18.7% |

69.8% |

|

Pacific Textiles Holdings (SEHK:1382) |

11.2% |

37.7% |

|

Zhejiang Leapmotor Technology (SEHK:9863) |

14.7% |

78.9% |

|

DPC Dash (SEHK:1405) |

38.2% |

104.2% |

|

Kindstar Globalgene Technology (SEHK:9960) |

16.5% |

88% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

13.9% |

109.2% |

|

Beijing Airdoc Technology (SEHK:2251) |

28.6% |

93.4% |

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited, with a market cap of HK$771.01 billion, operates in the automobiles and batteries sectors across China, Hong Kong, Macau, Taiwan, and internationally.

Operations: The company’s revenue segments include CN¥507.52 billion from Automobiles and Related Products and Other Products, and CN¥154.49 billion from Mobile Handset Components, Assembly Service, and Other Products.

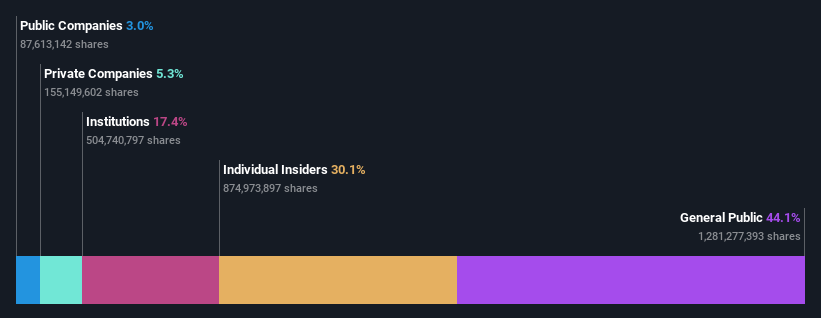

Insider Ownership: 30.1%

BYD has demonstrated substantial growth, with earnings increasing by 36.2% over the past year and revenue forecasted to grow at 14% annually, outpacing the Hong Kong market. The company’s high insider ownership aligns management interests with shareholders. Recent production and sales numbers show significant year-over-year increases, reflecting robust operational performance. Additionally, BYD’s strategic partnership with Uber aims to expand its electric vehicle footprint globally, potentially driving further growth and market penetration.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meituan is a technology retail company in the People’s Republic of China with a market cap of approximately HK$741.67 billion.

Operations: The company’s revenue segments include Core Local Commerce, generating CN¥228.13 billion, and New Initiatives, contributing CN¥77.56 billion.

Insider Ownership: 11.6%

Meituan’s earnings surged by 175.5% in the past year, with revenue rising to CNY 155.53 billion for H1 2024. The company has actively repurchased shares, completing buybacks worth HKD 7.17 billion and $2 billion this year, reflecting strong insider confidence despite some recent insider selling. Analysts forecast annual profit growth of 25.8%, outpacing the Hong Kong market’s average, though revenue growth is expected to be slower at 12.9% per year.

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc., a biopharmaceutical company, researches, develops, manufactures, and commercializes antibody drugs and has a market cap of approximately HK$48.75 billion.

Operations: The company’s revenue primarily comes from the research, development, production, and sale of biopharmaceutical products, amounting to CN¥1.87 billion.

Insider Ownership: 20.5%

Akeso has demonstrated significant growth potential, supported by its high insider ownership. Despite a challenging H1 2024 with revenue dropping to CNY 1.02 billion and a net loss of CNY 238.59 million, the company is advancing its innovative pipeline. Notably, Akeso’s PD-1/VEGF bispecific antibody ivonescimab received priority review for new indications and showed promising clinical results against pembrolizumab in NSCLC trials. Analysts anticipate robust annual revenue growth of 32.9%, outpacing the Hong Kong market average.

Next Steps

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:3690 and SEHK:9926.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com